Global Guaranteed Auto Protection (GAP) Insurance Market - Key Trends & Drivers Summarized

Is Rising Vehicle Depreciation Fueling the Demand for GAP Insurance?

As vehicle prices continue to rise and depreciation rates remain high, consumers are increasingly turning to Guaranteed Auto Protection (GAP) insurance to safeguard their financial investments. GAP insurance bridges the difference between a car’ s market value and the remaining loan or lease balance if the vehicle is totaled or stolen, providing much-needed financial protection. With supply chain disruptions, inflation, and the growing cost of electric vehicles (EVs), the risk of negative equity in auto loans has intensified, making GAP coverage more essential than ever. Additionally, the surge in long-term financing options and high loan-to-value (LTV) ratios is leaving consumers vulnerable to financial shortfalls in case of unforeseen vehicle loss. However, challenges such as limited consumer awareness, regulatory differences across regions, and variations in lender-mandated GAP coverage continue to shape market dynamics. Despite these hurdles, the demand for GAP insurance is rising as auto buyers seek additional financial security in an uncertain economic landscape.How Are Digital Transformation and InsurTech Advancements Enhancing GAP Insurance?

The digitalization of the insurance industry is revolutionizing the way GAP insurance is offered, purchased, and managed. Online auto finance platforms, dealership-integrated insurance services, and embedded GAP coverage options are streamlining policy adoption and simplifying claims processing. InsurTech companies are leveraging artificial intelligence (AI) and big data analytics to assess risk profiles, customize coverage options, and improve fraud detection. Additionally, digital-first insurance providers are offering self-service portals and instant policy issuance, making GAP insurance more accessible to consumers. While these technological advancements enhance efficiency and customer experience, concerns over cybersecurity, data privacy, and potential misrepresentation in automated risk assessments remain key challenges. Nevertheless, the integration of AI-driven underwriting, telematics-based insurance models, and blockchain-backed claims processing is expected to make GAP insurance more transparent and cost-effective, driving broader market adoption.Can GAP Insurance Keep Up with the Growth of Electric Vehicles and Changing Auto Finance Models?

The shift toward electric vehicles (EVs) and evolving auto financing structures are reshaping the GAP insurance market. EVs typically have higher upfront costs and steeper depreciation rates than traditional internal combustion engine (ICE) vehicles, increasing the financial gap between loan balances and market value. As EV adoption accelerates, GAP insurance providers are adapting their policies to cover battery replacement costs and residual value fluctuations. Additionally, the rise of subscription-based vehicle ownership models and leasing services is creating new opportunities for GAP insurance tailored to flexible financing structures. However, uncertainties regarding EV longevity, resale values, and emerging financing models present challenges in risk assessment and policy pricing. Despite these complexities, insurers are innovating to align GAP coverage with the evolving automotive landscape, ensuring relevance in an industry undergoing rapid transformation.What Is Driving the Growth of the GAP Insurance Market?

The growth in the GAP insurance market is driven by several factors, including rising vehicle prices, increasing consumer reliance on long-term auto loans, and the expansion of digital insurance platforms. The growing adoption of electric vehicles, coupled with their high depreciation rates, is further boosting the demand for specialized GAP coverage. InsurTech innovations, such as AI-driven risk assessments, embedded GAP insurance solutions, and digital claims processing, are enhancing accessibility and efficiency in policy management. Additionally, strategic partnerships between auto dealerships, lenders, and insurance providers are making GAP coverage more widely available at the point of vehicle purchase. While regulatory inconsistencies, limited consumer awareness, and fraud risks remain challenges, the ongoing digital transformation of the insurance sector and the evolving nature of auto financing are expected to drive continued growth in the GAP insurance market, reinforcing its importance in the automotive financial protection landscape.Report Scope

The report analyzes the Guaranteed Auto Protection Insurance market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Return-To-Invoice Gap Insurance, Finance GAP Insurance, Vehicle Replacement GAP Insurance, Return-To-Value GAP Insurance, Other Guaranteed Auto Protection Insurances); Application (Passenger Vehicle Application, Commercial Vehicle Application, Other Applications); Distribution Channel (Agents & Brokers Distribution Channel, Direct Response Distribution Channel, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Return-To-Invoice Gap Insurance segment, which is expected to reach US$2.4 Billion by 2030 with a CAGR of a 4.1%. The Finance GAP Insurance segment is also set to grow at 3.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $1.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Guaranteed Auto Protection Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Guaranteed Auto Protection Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Guaranteed Auto Protection Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amba Gums & Feeds Products, Ashapura Proteins Ltd., Ashland Global Holdings Inc., Ashok Industries, Avanscure Lifesciences Pvt. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Guaranteed Auto Protection Insurance market report include:

- Admiral Group plc

- Allianz SE

- Allstate Insurance Company

- American Family Insurance

- Amica Mutual Insurance Company

- Arch Insurance Group Inc.

- Auto-Owners Insurance Group

- AXA S.A.

- Berkshire Hathaway Inc.

- Chubb Limited

- Erie Insurance

- Infinity Auto Insurance

- Kemper Corporation

- Liberty Mutual Insurance Company

- Nationwide Mutual Insurance Company

- Progressive Casualty Insurance Company

- State Farm Mutual Automobile Insurance Company

- The Hartford Financial Services Group, Inc.

- The Travelers Indemnity Company

- Zurich Insurance Group Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Admiral Group plc

- Allianz SE

- Allstate Insurance Company

- American Family Insurance

- Amica Mutual Insurance Company

- Arch Insurance Group Inc.

- Auto-Owners Insurance Group

- AXA S.A.

- Berkshire Hathaway Inc.

- Chubb Limited

- Erie Insurance

- Infinity Auto Insurance

- Kemper Corporation

- Liberty Mutual Insurance Company

- Nationwide Mutual Insurance Company

- Progressive Casualty Insurance Company

- State Farm Mutual Automobile Insurance Company

- The Hartford Financial Services Group, Inc.

- The Travelers Indemnity Company

- Zurich Insurance Group Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 387 |

| Published | January 2026 |

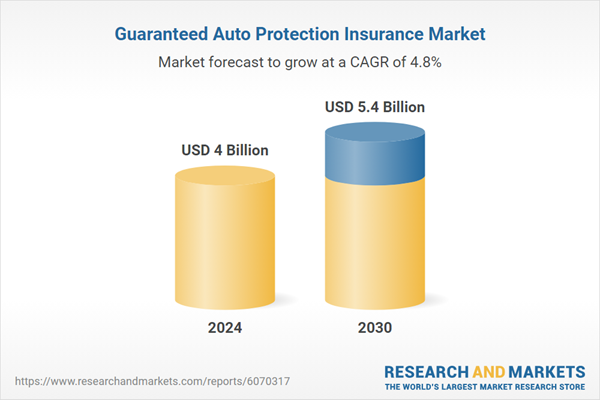

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |