Global Hedge Fund Market - Key Trends & Drivers Summarized

Why Are Hedge Funds a Critical Component of the Global Investment Landscape?

Hedge funds have long been regarded as one of the most sophisticated and dynamic investment vehicles, attracting institutional investors, high-net-worth individuals, and family offices seeking higher returns and risk diversification. Unlike traditional investment funds, hedge funds employ a variety of strategies, including long-short equity, market-neutral, event-driven, and global macro approaches, allowing them to generate returns in both rising and falling markets. The flexibility of hedge funds in deploying leverage, derivatives, and alternative asset classes has positioned them as a crucial element of modern portfolio management. Despite regulatory challenges and scrutiny, hedge funds continue to play a vital role in capital markets, contributing to liquidity, price discovery, and risk mitigation. As investors seek alternative investment options in a volatile economic landscape, hedge funds remain a preferred choice for those aiming to achieve alpha while managing downside risks.How Is Technology Transforming Hedge Fund Strategies?

The hedge fund industry is witnessing a paradigm shift, driven by the integration of artificial intelligence, big data analytics, and algorithmic trading. Quantitative hedge funds are increasingly leveraging machine learning models to identify market patterns, execute trades with precision, and optimize portfolio allocations. High-frequency trading (HFT) strategies have also become prevalent, allowing funds to capitalize on microsecond market inefficiencies. Additionally, blockchain technology is gaining traction, enhancing transparency and efficiency in hedge fund operations, particularly in fund administration and settlement processes. The use of alternative data sources, such as satellite imagery, social media sentiment analysis, and web scraping, has further revolutionized decision-making, providing fund managers with real-time insights into economic trends. As technology continues to shape investment strategies, hedge funds are becoming more agile and>Why Is the Demand for Hedge Funds Increasing Among Institutional Investors?

Institutional investors, including pension funds, endowments, and sovereign wealth funds, are increasingly allocating capital to hedge funds as a means of achieving portfolio diversification and risk-adjusted returns. With global equity markets experiencing heightened volatility, hedge funds offer investors the ability to hedge against downturns through market-neutral and arbitrage strategies. The low-interest-rate environment has also prompted institutions to seek alternative investment avenues that can generate higher yields compared to traditional fixed-income securities. Additionally, hedge funds have become more transparent in their fee structures and reporting standards, addressing concerns that previously deterred institutional capital. As risk management and alpha generation remain key priorities for investors, hedge funds continue to attract significant capital inflows, reinforcing their role as essential players in the financial ecosystem.What Are the Key Factors Driving the Growth of the Hedge Fund Market?

The growth in the hedge fund market is driven by several factors, including increasing investor demand for diversified, non-correlated asset strategies, the rise of>Report Scope

The report analyzes the Hedge Fund market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Offshore Type, Domestic Type, Fund of Funds Type); Strategy (Long / Short Equity Strategy, Global Macro Strategy, Event Driven Strategy, Multi Strategy, Long / Short Credit Strategy, Managed Futures / CTA Strategy, Other Strategies).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Offshore Hedge Fund segment, which is expected to reach US$3.4 Trillion by 2030 with a CAGR of a 1.9%. The Domestic Hedge Fund segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Trillion in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $1.1 Trillion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hedge Fund Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hedge Fund Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hedge Fund Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aprilia, Benelli, Bimota, BMW Motorrad, Ducati Motor Holding S.p.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Hedge Fund market report include:

- AQR Capital Management

- Avenue Capital Group

- Baupost Group

- BlackRock

- Bridgewater Associates

- Citadel Advisors

- D.E. Shaw & Co.

- Davidson Kempner Capital Management

- Elliott Investment Management

- Farallon Capital Management

- Lansdowne Partners

- Man Group plc

- Marshall Wace

- Millennium Management

- Och-Ziff Capital Management (Sculptor Capital Management)

- Pershing Square Capital Management

- Renaissance Technologies

- Third Point LLC

- Two Sigma Investments

- Winton Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AQR Capital Management

- Avenue Capital Group

- Baupost Group

- BlackRock

- Bridgewater Associates

- Citadel Advisors

- D.E. Shaw & Co.

- Davidson Kempner Capital Management

- Elliott Investment Management

- Farallon Capital Management

- Lansdowne Partners

- Man Group plc

- Marshall Wace

- Millennium Management

- Och-Ziff Capital Management (Sculptor Capital Management)

- Pershing Square Capital Management

- Renaissance Technologies

- Third Point LLC

- Two Sigma Investments

- Winton Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 291 |

| Published | February 2026 |

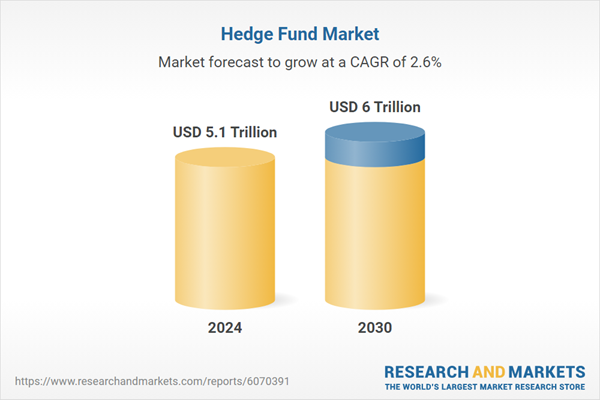

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.1 Trillion |

| Forecasted Market Value ( USD | $ 6 Trillion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |