Global Eco-Friendly Low VOC Automotive Wiring Harness Tape Market - Key Trends & Drivers Summarized

Why Is the Push for Cleaner Cabins and Greener Cars Accelerating Demand for Eco-Friendly Automotive Tapes?

As the automotive industry navigates an era of electrification, sustainability, and evolving consumer safety expectations, eco-friendly low VOC (volatile organic compound) automotive wiring harness tapes have emerged as a critical component in vehicle design. These specialized tapes are used extensively in securing, insulating, and protecting wiring systems within vehicles, and now must comply with increasingly stringent indoor air quality standards. In traditional vehicles, VOC emissions from interior components, including tapes, adhesives, and insulation materials, have long been linked to off-gassing and air quality concerns within vehicle cabins. However, with rising global awareness about the health impacts of such emissions - especially among sensitive groups like children and the elderly - OEMs are prioritizing materials with reduced chemical emissions. Low VOC tapes, often made using solvent-free, water-based adhesives and eco-friendly substrates, are being rapidly adopted to support green manufacturing goals, improve occupant health, and ensure compliance with regulatory benchmarks such as Japan’ s JAMA guidelines or Europe’ s REACH legislation. Additionally, the global transition to electric vehicles (EVs) is amplifying the need for high-performance, thermally stable, and environmentally compliant wiring solutions. As car interiors become more sophisticated - with more sensors, electronics, and data transmission lines - there is an urgent need for tapes that perform reliably while contributing to sustainability targets. In this context, low VOC wiring harness tapes are becoming both a technical necessity and a brand differentiator.How Are Technological Innovations Reinventing the Capabilities of Eco-Friendly Harness Tapes?

The eco-friendly automotive wiring harness tape segment is being significantly advanced by innovations in materials science, adhesive chemistry, and thermal performance engineering. Manufacturers are moving beyond basic tape solutions to develop high-performance products that deliver on multiple fronts: electrical insulation, vibration dampening, abrasion resistance, and heat tolerance - all while adhering to low-emission profiles. The shift toward solvent-free and water-based adhesives has been a game-changer, enabling low VOC compliance without compromising adhesion strength or thermal endurance. Many of today’ s eco tapes are constructed using PET, cotton, or nonwoven fabrics sourced from recycled or renewable feedstocks, aligning with circular economy principles. Additionally, advancements in flame retardancy, corrosion resistance, and long-term aging performance have expanded the applications of eco-friendly tapes into high-stress zones within both ICE and EV platforms. The growing use of multilayer construction also allows for customization of performance characteristics, such as noise reduction or EMI shielding, tailored to specific areas within a vehicle. Smart labeling technologies and QR-coded reels now help OEMs and Tier 1 suppliers track material sourcing and VOC certification, reinforcing supply chain transparency. Furthermore, the development of tapes with improved conformability and tool-free application supports automation in wiring harness assembly lines, improving efficiency and reducing waste. These technological strides are not only making eco-friendly tapes more functional but are also aligning them with evolving automotive design trends and production practices.Are Regulatory Pressures and OEM Sustainability Goals Reshaping Material Procurement Strategies?

Global regulatory bodies and automakers are increasingly aligning around a shared goal: reducing the environmental footprint of vehicle production and enhancing in-cabin air quality. This convergence is pushing Tier 1 and Tier 2 suppliers to reassess their procurement strategies for every component - including wiring harness tapes. In Europe, directives such as REACH and the ELV (End-of-Life Vehicles) directive are pressuring manufacturers to eliminate harmful substances from vehicle interiors. In parallel, automakers are responding to consumer and investor expectations with aggressive ESG (Environmental, Social, Governance) targets, demanding that every material used - right down to the smallest adhesive tape - meets sustainability benchmarks. OEMs like Toyota, Volkswagen, and BMW have implemented internal VOC limits and require certification for materials used within the cabin, driving demand for suppliers that offer tested and validated low-emission solutions. Additionally, with the global spotlight on electrification, automakers are increasingly seeking materials that not only reduce VOCs but are also thermally stable, lightweight, and recyclable. These factors are transforming wiring harness tapes from commodity items into strategic procurement priorities. Suppliers that can offer certified eco-friendly tapes with proven performance benefits are being favored in RFQs, while those failing to adapt risk losing market share. Furthermore, fleet operators, especially in electric and shared mobility segments, are showing increased interest in vehicle sustainability, further amplifying demand for compliant, low-emission interior materials. The result is a fast-shifting supply chain ecosystem where eco-friendly wiring harness tapes are central to environmental compliance and product innovation.What Factors Are Driving the Rapid Growth of the Eco-Friendly Low VOC Automotive Wiring Harness Tape Market?

The growth in the eco-friendly low VOC automotive wiring harness tape market is driven by several interrelated factors rooted in material innovation, vehicle electrification trends, regulatory shifts, and evolving procurement standards. First, advancements in water-based adhesive chemistry and recyclable substrates have enabled the development of high-performance tapes that meet both emission reduction goals and durability requirements. The rapid expansion of electric vehicles - characterized by higher thermal loads and dense wiring configurations - is creating new demand for flame-retardant, heat-resistant, and vibration-tolerant tapes that are also environmentally compliant. End-use sectors, including passenger vehicles, commercial fleets, and autonomous mobility platforms, are all prioritizing materials that contribute to both performance and sustainability. Regulatory agencies across Asia, Europe, and North America are enforcing stricter limits on interior air pollutants, accelerating the phase-out of traditional solvent-based tapes. Simultaneously, major OEMs are embedding sustainability into product lifecycle assessments, prompting sourcing teams to favor suppliers offering validated low-VOC alternatives. Consumer preference for green, healthy, and ethically produced vehicles is further pressuring automakers to ensure every material, including tapes, aligns with broader environmental commitments. Lastly, the rise of green rating systems, such as LEED for automotive manufacturing facilities and carbon labeling for components, is boosting market visibility and adoption. Together, these drivers are shaping a robust growth trajectory for eco-friendly wiring harness tapes, firmly positioning them as a vital enabler of next-generation, low-emission automotive design.Report Scope

The report analyzes the Eco Friendly Low VOC Automotive Wiring Harness Tape market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Material (PVC Material, Polyester Material, Polyethylene Material, Bio-based Material, Other Materials); Adhesive (Acrylic Adhesive, Rubber Adhesive, Silicone Adhesive, Other Adhesives); Vehicle (Passenger Cars, Commercial Vehicles, Two Wheelers); Distribution Channel (Direct Sales, Distributors & Wholesalers, Online Retailers); Application (Engine Compartment Application, Cabin Application, Chassis Application, Battery & Powertrain Application, Interior & Exterior Wiring Harness Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the PVC Material segment, which is expected to reach US$287.3 Million by 2030 with a CAGR of a 4%. The Polyester Material segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $141.0 Million in 2024, and China, forecasted to grow at an impressive 4.9% CAGR to reach $116.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Eco Friendly Low VOC Automotive Wiring Harness Tape Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Eco Friendly Low VOC Automotive Wiring Harness Tape Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Eco Friendly Low VOC Automotive Wiring Harness Tape Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

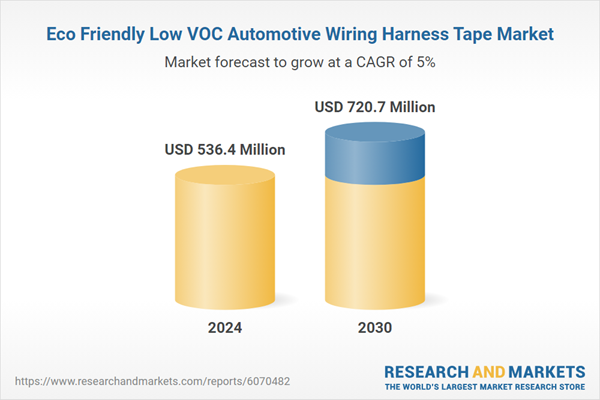

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aspel SA, BTL Industries, Cardioline SpA, Contec Medical Systems Co., Ltd., COSMED Srl and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Eco Friendly Low VOC Automotive Wiring Harness Tape market report include:

- 3M India Ltd.

- AVATACK Co., Ltd.

- Avery Dennison Corporation

- Brite-Line (Shanghai) Technology Company Limited

- Coroplast Tape Corporation

- Denka Co., Ltd.

- HellermannTyton Corporation

- Shanghai Yongguan Adhesive Products Co.

- Teraoka Seisakusho Co., Ltd.

- Tesa Tapes (India) Private Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M India Ltd.

- AVATACK Co., Ltd.

- Avery Dennison Corporation

- Brite-Line (Shanghai) Technology Company Limited

- Coroplast Tape Corporation

- Denka Co., Ltd.

- HellermannTyton Corporation

- Shanghai Yongguan Adhesive Products Co.

- Teraoka Seisakusho Co., Ltd.

- Tesa Tapes (India) Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 242 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 536.4 Million |

| Forecasted Market Value ( USD | $ 720.7 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |