Global Commercial Radars Market - Key Trends & Drivers Summarized

Why Are Commercial Radars Becoming More Essential? Understanding Their Expanding Applications

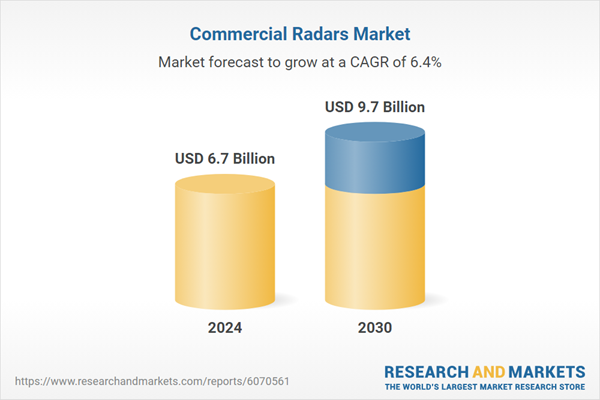

The increasing adoption of commercial radars across various industries has propelled market growth, driven by advancements in radar technology and the rising need for precise monitoring, surveillance, and navigation solutions. Traditionally used in aviation and maritime sectors, commercial radars are now widely deployed in industries such as automotive, meteorology, security, and industrial automation. These systems play a crucial role in air traffic control, weather monitoring, perimeter security, and autonomous vehicle navigation, offering real-time situational awareness and threat detection. The expansion of smart cities and intelligent transportation systems has further fueled demand for high-performance radar solutions, enabling improved traffic management, collision avoidance, and enhanced safety measures. Additionally, the growing reliance on radar technology for disaster prevention and climate monitoring has highlighted its importance in mitigating the risks associated with extreme weather conditions. As industries continue to integrate radar-based solutions into their operations, the commercial radar market is poised for substantial growth, driven by increasing technological advancements and expanding end-use applications.How Are Technological Advancements Enhancing Commercial Radar Systems? Exploring Innovations in Radar Performance

The evolution of radar technology has significantly improved the capabilities of commercial radar systems, making them more accurate, reliable, and adaptable to diverse operational requirements. The introduction of solid-state radar systems has enhanced performance by eliminating mechanical components, reducing maintenance costs, and improving longevity. Additionally, advancements in synthetic aperture radar (SAR) technology have enabled high-resolution imaging and terrain mapping, expanding applications in environmental monitoring and geospatial analysis. The integration of artificial intelligence (AI) and machine learning (ML) algorithms has further optimized radar signal processing, allowing for real-time object classification and enhanced detection capabilities. In the automotive sector, the development of millimeter-wave radar has revolutionized advanced driver assistance systems (ADAS), enabling autonomous vehicles to detect obstacles, pedestrians, and road conditions with greater precision. The adoption of 5G-enabled radar technology has also improved communication between radar systems and connected devices, enhancing operational efficiency in industries such as logistics, manufacturing, and public safety. With continuous advancements in miniaturization, power efficiency, and multi-function radar systems, commercial radars are becoming increasingly sophisticated, offering improved performance across various applications.What Are the Challenges Limiting Commercial Radar Market Growth? Addressing Industry Constraints

Despite the significant progress in commercial radar technology, several challenges continue to hinder market expansion, including high costs, regulatory restrictions, and concerns regarding frequency interference. The development and deployment of advanced radar systems require substantial investment in research, testing, and manufacturing, making them expensive for small and mid-sized businesses. Additionally, strict regulatory frameworks governing radar frequency bands and electromagnetic spectrum usage vary across regions, posing compliance challenges for manufacturers and service providers. The issue of frequency congestion, particularly in urban environments, has raised concerns about potential interference between radar systems and other wireless communication technologies, necessitating the development of adaptive signal processing techniques. Furthermore, cybersecurity threats targeting radar-based infrastructure have become a growing concern, as malicious actors seek to disrupt critical radar-dependent operations, such as air traffic control and border surveillance. To overcome these challenges, industry stakeholders must focus on cost-effective production strategies, regulatory harmonization, and enhanced cybersecurity measures to ensure the seamless adoption of commercial radar solutions.What’ s Driving the Growth of the Commercial Radar Market? Identifying Key Expansion Factors

The growth in the commercial radar market is driven by several factors, including the rising demand for autonomous systems, increasing investment in smart infrastructure, and advancements in sensor fusion technology. The expansion of the autonomous vehicle industry has significantly contributed to the adoption of radar-based sensing solutions, as manufacturers prioritize safety and real-time environmental perception. The development of smart cities and intelligent transportation networks has also fueled demand for radar-based traffic monitoring and accident prevention systems. Additionally, the aviation and maritime sectors continue to invest in next-generation radar technologies to enhance navigation accuracy and security. The increasing deployment of radar systems in weather monitoring and disaster preparedness has further strengthened market demand, as climate change concerns drive the need for accurate forecasting and early warning systems. With ongoing innovations in AI-driven radar analytics, compact radar modules, and enhanced connectivity, the commercial radar market is expected to witness sustained growth, offering new opportunities for technology providers and end-users across multiple industries.Report Scope

The report analyzes the Commercial Radars market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Antenna Component, Transmitter Component, Duplexer Component, Receiver Component, Signal and Data Processors Component, Phased Array Component, Other Components); Platform (Land Platform, Naval Platform, Space Platform, Airborne Platform); Dimension (2D Dimension, 3D Dimension, 4D Dimension); Application (Air Traffic Control and Navigation Application, Airspace Monitoring Application, Sea Traffic Control and Navigation Application, Automotive Application, Remote Sensing and Weather Observation Application, Ground Traffic Control Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Antenna Component segment, which is expected to reach US$3.0 Billion by 2030 with a CAGR of a 7.6%. The Transmitter Component segment is also set to grow at 6.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 10.3% CAGR to reach $2.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Radars Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Radars Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Radars Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACME Printing, American Litho, Inc., Bertelsmann Printing Group, Canon Inc., Cenveo Publisher Services and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Commercial Radars market report include:

- Aselsan A.S.

- BAE Systems Plc

- Bharat Electronics Ltd.

- Elbit Systems Ltd.

- General Dynamics Mission Systems, Inc.

- HENSOLDT AG

- Indra Sistemas SA

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo SpA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aselsan A.S.

- BAE Systems Plc

- Bharat Electronics Ltd.

- Elbit Systems Ltd.

- General Dynamics Mission Systems, Inc.

- HENSOLDT AG

- Indra Sistemas SA

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo SpA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 500 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.7 Billion |

| Forecasted Market Value ( USD | $ 9.7 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |