Global Electrolysis Merchant Hydrogen Generation Market - Key Trends & Growth Drivers Summarized

Why Is Merchant Hydrogen Generation via Electrolysis Transforming the Hydrogen Economy?

Merchant hydrogen production via electrolysis refers to large-scale hydrogen generation for sale and distribution rather than on-site industrial consumption. This approach is playing a crucial role in developing the global hydrogen supply chain, enabling businesses and governments to meet clean energy targets while reducing reliance on fossil-fuel-based hydrogen production.With industries such as steel, chemicals, transportation, and power generation increasingly shifting to hydrogen-based solutions, merchant hydrogen is emerging as a key enabler of the transition to a low-carbon economy. Hydrogen refueling stations, industrial plants, and power utilities are investing in electrolysis-based hydrogen procurement to replace conventional hydrogen derived from natural gas. Additionally, renewable energy firms are expanding their capabilities to produce green hydrogen as a standalone commodity.

What Are the Latest Innovations in Merchant Hydrogen Electrolysis?

The introduction of next-generation electrolyzers with improved efficiency, durability, and scalability is driving innovation in merchant hydrogen production. One of the most significant advancements is the commercialization of gigawatt-scale electrolyzer plants, which leverage modular alkaline and PEM technologies to meet growing demand.Another key development is the use of AI-driven load balancing, which optimizes hydrogen production based on electricity price fluctuations and grid stability. Additionally, the integration of hybrid renewable-electrolysis systems is improving cost efficiency by dynamically adjusting hydrogen output in response to energy supply variations.

How Are Market Trends and Regulatory Policies Influencing Merchant Hydrogen Electrolysis?

The growing demand for clean hydrogen in industrial and transport sectors has led to increased investments in merchant electrolysis facilities. Governments worldwide are providing incentives for green hydrogen production, including tax credits, subsidies, and carbon pricing mechanisms. Additionally, new international hydrogen certification programs are emerging to ensure transparency in carbon footprint calculations.Market trends indicate a rise in hydrogen trading hubs, where merchant producers can supply hydrogen to various end-users via pipelines, liquid transport, or compressed gas distribution networks. The expansion of hydrogen storage and distribution infrastructure is further supporting market growth, ensuring reliable supply chains for large-scale industrial applications.

What Is Driving the Growth of the Merchant Hydrogen Electrolysis Market?

The growth in the merchant hydrogen electrolysis market is driven by increasing industrial demand for clean hydrogen, technological advancements in electrolyzer efficiency, and regulatory mandates supporting decarbonization. Large-scale hydrogen projects are emerging across multiple industries, creating new opportunities for hydrogen suppliers and distributors.End-use expansion is another key driver, with merchant hydrogen serving applications in fuel cell transportation, industrial refining, power generation, and hydrogen-based synthetic fuels. The development of international hydrogen trade agreements, expansion of hydrogen refueling networks, and investments in pipeline infrastructure are further accelerating market adoption.

Report Scope

The report analyzes the Electrolysis Merchant Hydrogen Generation market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Petroleum Refinery, Chemical, Metal, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Petroleum Refinery Application segment, which is expected to reach US$2.9 Billion by 2030 with a CAGR of a 8.6%. The Chemical Application segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 11.4% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electrolysis Merchant Hydrogen Generation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electrolysis Merchant Hydrogen Generation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electrolysis Merchant Hydrogen Generation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide SA, Air Products and Chemicals, Inc., Electric Hydrogen, Enapter GmbH, Green Hydrogen Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Electrolysis Merchant Hydrogen Generation market report include:

- Air Liquide SA

- Air Products and Chemicals, Inc.

- Ceres Power Holdings PLC

- Cummins, Inc.

- Electric Hydrogen

- Enapter GmbH

- FuelCell Energy, Inc.

- Green Hydrogen Systems

- H2B2

- Hygreen Energy

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide SA

- Air Products and Chemicals, Inc.

- Ceres Power Holdings PLC

- Cummins, Inc.

- Electric Hydrogen

- Enapter GmbH

- FuelCell Energy, Inc.

- Green Hydrogen Systems

- H2B2

- Hygreen Energy

Table Information

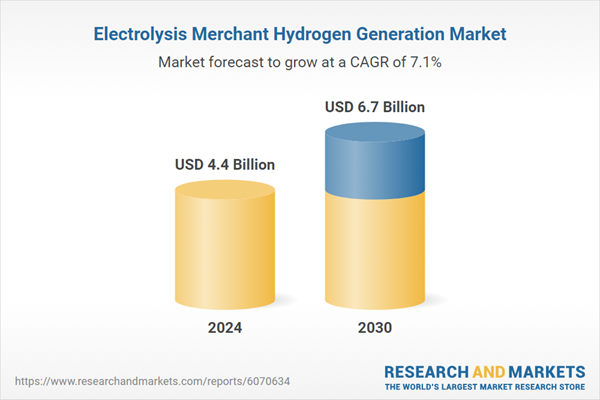

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 6.7 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |