Global Cloud Carbon Management Systems Market - Key Trends & Drivers Summarized

Why is Cloud Carbon Management Gaining Unprecedented Traction?

In an era of stringent environmental regulations and mounting pressure on corporations to achieve net-zero emissions, cloud-based carbon management systems have emerged as a game-changing solution. Governments, enterprises, and industries worldwide are striving to reduce their carbon footprints, fueling the demand for cloud-driven platforms that offer real-time tracking, reporting, and optimization of carbon emissions. Traditional carbon accounting methods, often marred by inefficiencies, lack the agility and precision required for modern sustainability initiatives. Cloud Carbon Management Systems (CCMS) bridge this gap by integrating AI, IoT, and advanced analytics, enabling organizations to set, monitor, and achieve their decarbonization targets efficiently. One of the most critical drivers of this market is regulatory compliance. As governments implement stringent environmental policies like the European Green Deal and the U.S. Securities and Exchange Commission’ s (SEC) proposed climate disclosure rules, businesses must adopt transparent and auditable carbon management solutions. The cloud-based nature of these systems ensures seamless data consolidation across multiple locations, making compliance reporting streamlined and foolproof. Additionally, voluntary sustainability commitments by global corporations are further propelling demand for these intelligent platforms, making CCMS a necessity rather than an option in the corporate sustainability toolkit.How Is Technology Powering the Evolution of Carbon Management?

The rapid advancement in Artificial Intelligence (AI), Internet of Things (IoT), and Blockchain is significantly reshaping the landscape of cloud-based carbon management. AI-powered predictive analytics help businesses anticipate their carbon footprint based on operational trends, allowing them to implement proactive mitigation strategies. IoT devices, on the other hand, provide real-time data acquisition from industrial processes, buildings, and supply chains, feeding into the cloud for instantaneous analysis. This real-time tracking ensures more precise carbon accounting, eliminating human errors and inefficiencies. Blockchain technology is also revolutionizing this space by enhancing data integrity and transparency in carbon offset programs. One of the longstanding challenges in carbon management has been the credibility of carbon credits. Blockchain ensures verifiable and immutable records of carbon offsets, mitigating risks of fraud and double counting. Furthermore, cloud computing’ s scalability allows businesses to integrate carbon tracking tools across diverse operational landscapes, from manufacturing plants to corporate headquarters, without the need for extensive on-premise infrastructure. This technological synergy is creating a robust ecosystem for carbon management, accelerating the adoption of cloud-driven solutions across industries.What Role Do Industries and Enterprises Play in Market Expansion?

Industries such as manufacturing, energy, transportation, and retail are at the forefront of Cloud Carbon Management System adoption, given their high carbon footprint and sustainability mandates. The energy sector is among the most aggressive adopters, leveraging cloud platforms to track emissions across power plants and renewable energy sources. With decarbonization goals set by oil and gas giants, cloud-based systems are increasingly being used to measure, analyze, and report carbon emissions, ensuring compliance with international sustainability standards. In the manufacturing sector, CCMS are instrumental in monitoring emissions from factories, optimizing energy consumption, and implementing low-carbon production methods. The push toward green supply chains is another significant factor driving adoption, as companies seek to provide end-to-end visibility into their carbon impact. Meanwhile, the transportation industry is relying on cloud-based carbon monitoring for fleet optimization, sustainable logistics planning, and regulatory adherence. Even retail and e-commerce giants are leveraging these solutions to track emissions across their supply chains, packaging, and delivery networks, underscoring the widespread applicability of cloud-based carbon management.What Are the Key Growth Drivers for Cloud Carbon Management Systems?

The growth in the Cloud Carbon Management Systems market is driven by several factors, including increasing regulatory pressures, evolving consumer preferences, and technological innovations. The regulatory landscape remains a primary catalyst, as governments worldwide intensify their decarbonization efforts with legally binding emission reduction targets. Compliance requirements such as carbon taxation, emissions trading schemes, and sustainability disclosures are compelling organizations to adopt cloud-based solutions for precise carbon reporting and tracking. Furthermore, corporate sustainability commitments are playing a pivotal role in market expansion. Large multinational corporations are voluntarily committing to carbon neutrality, fueling the demand for advanced cloud-based tracking and mitigation systems. This trend is further reinforced by investor-driven Environmental, Social, and Governance (ESG) mandates, as stakeholders increasingly prioritize sustainable business models. Consumer preferences are also evolving, with green-conscious buyers favoring brands that demonstrate transparency in their carbon footprint. This shift is prompting businesses to integrate cloud carbon management solutions into their sustainability strategies, ensuring traceability from raw material sourcing to end-product delivery. Additionally, the rise of carbon offset markets and the need for real-time emissions data are further propelling demand for cloud-based systems. With these combined factors, Cloud Carbon Management Systems are set to become an indispensable tool for businesses navigating the complex landscape of sustainability and regulatory compliance.Report Scope

The report analyzes the Cloud Carbon Management Systems market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Cloud Carbon Management Solutions, Cloud Carbon Management Services); End-Use (Energy and Utilities End-Use, IT and Telecom End-Use, Transportation and Logistics End-Use, Manufacturing End-Use, Residential and Commercial Building End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cloud Carbon Management Solutions segment, which is expected to reach US$7.3 Billion by 2030 with a CAGR of a 10.1%. The Cloud Carbon Management Services segment is also set to grow at 6.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.0 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cloud Carbon Management Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cloud Carbon Management Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cloud Carbon Management Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Google LLC, Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, Microsoft Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Cloud Carbon Management Systems market report include:

- Accuvio Sustainability Software

- Carbon Analytics

- Carbon Trust

- CO2 AI

- CorityOne

- Ecodesk

- Emitwise

- ENGIE Impact

- Enviance

- IBM Corporation

- Lythouse

- Microsoft Corporation

- Normative

- Persefoni

- Salesforce.com Inc.

- SAP SE

- Schneider Electric (EcoStruxure)

- Sphera Solutions

- Watershed Technology Inc.

- Wolters Kluwer (Enablon Platform)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accuvio Sustainability Software

- Carbon Analytics

- Carbon Trust

- CO2 AI

- CorityOne

- Ecodesk

- Emitwise

- ENGIE Impact

- Enviance

- IBM Corporation

- Lythouse

- Microsoft Corporation

- Normative

- Persefoni

- Salesforce.com Inc.

- SAP SE

- Schneider Electric (EcoStruxure)

- Sphera Solutions

- Watershed Technology Inc.

- Wolters Kluwer (Enablon Platform)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

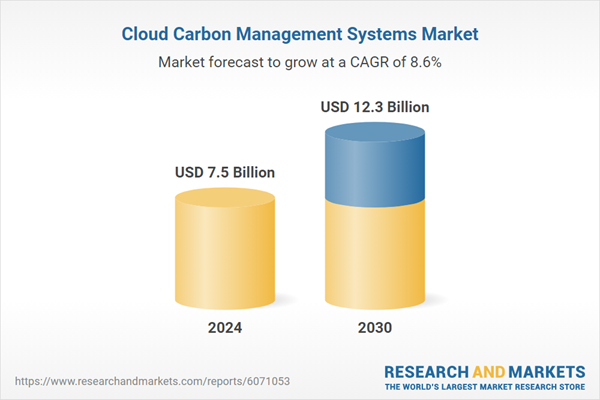

| Estimated Market Value ( USD | $ 7.5 Billion |

| Forecasted Market Value ( USD | $ 12.3 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |