Global Automotive E/E Architecture Market - Key Trends & Drivers Summarized

Why Is Automotive E/E Architecture Redefining Vehicle Design?

Automotive E/E (Electrical/Electronic) architecture has become a cornerstone of modern vehicle design, enabling the seamless integration of advanced features, enhanced performance, and greater safety. E/E architecture serves as the backbone for all electronic systems in a vehicle, managing everything from power distribution to communication between sensors, control units, and actuators. With the rise of connected, autonomous, and electric vehicles, E/E architecture has transitioned from a distributed model to centralized and zonal systems, offering improved scalability and efficiency. The shift toward electric and autonomous vehicles has significantly accelerated the adoption of advanced E/E architectures. These vehicles rely heavily on sophisticated electronic systems to manage electric powertrains, ADAS (Advanced Driver Assistance Systems), infotainment, and over-the-air (OTA) updates. The complexity of modern vehicles has made traditional distributed architectures less viable, paving the way for centralized systems that offer higher computing power, streamlined wiring, and improved data processing capabilities.How Are Emerging Trends Shaping the E/E Architecture Market?

The automotive industry is undergoing a technological revolution, and emerging trends are reshaping the role of E/E architecture in vehicle development. The most prominent trend is the shift toward zonal E/E architecture, which organizes vehicle electronics into zones rather than individual control units. This reduces the complexity of wiring harnesses, lowers vehicle weight, and simplifies manufacturing processes. Zonal architectures are particularly advantageous for electric vehicles (EVs) and autonomous cars, which require robust communication networks and real-time data processing. Another transformative trend is the rise of software-defined vehicles (SDVs). With SDVs, much of a vehicle's functionality is determined by software, making E/E architecture a critical enabler. Automakers are increasingly integrating domain controllers, high-performance computers, and Ethernet-based communication networks into their vehicles to support SDVs. These systems facilitate features like OTA updates, real-time diagnostics, and customizable vehicle settings, creating a more dynamic and adaptable driving experience. Additionally, the proliferation of connected vehicles has driven the adoption of advanced E/E architecture. With vehicles generating vast amounts of data, automakers are relying on centralized computing platforms to process and analyze this information efficiently. The integration of 5G connectivity and V2X (Vehicle-to-Everything) communication has further elevated the importance of robust E/E systems capable of handling high-speed data transfer and ensuring cybersecurity.What Role Does Technology Play in Advancing E/E Architecture?

Technological advancements are at the core of modern E/E architecture, enabling greater functionality, efficiency, and integration. One of the most significant innovations is the development of high-speed in-vehicle communication protocols, such as Ethernet and CAN-FD (Controller Area Network-Flexible Data Rate). These protocols ensure faster and more reliable communication between electronic control units (ECUs) and sensors, which is critical for the operation of ADAS and autonomous systems. The introduction of domain controllers and centralized computing units has also transformed E/E architecture. These high-performance computers consolidate the functions of multiple ECUs, reducing hardware redundancy and enabling software-driven customization. For example, centralized E/E architecture allows automakers to deploy new features via OTA updates, eliminating the need for hardware modifications and enhancing vehicle lifecycle management. Advancements in semiconductor technology have further revolutionized E/E systems. High-performance processors, GPUs, and AI accelerators are now integrated into vehicles to handle the demands of autonomous driving and complex data analytics. Additionally, the development of zonal control units (ZCUs) has streamlined wiring harness design, reducing weight and cost while improving vehicle assembly efficiency. Cybersecurity technologies have also become a focal point in E/E architecture development. With connected vehicles increasingly targeted by cyber threats, automakers are integrating secure communication protocols, firewalls, and intrusion detection systems into their E/E platforms to protect sensitive data and ensure system integrity.What Factors Are Driving Growth in This Market?

The growth in the automotive E/E architecture market is driven by several factors rooted in technology, regulatory requirements, and consumer preferences. One of the primary drivers is the rapid adoption of electric vehicles (EVs) and hybrid vehicles. These vehicles require advanced E/E systems to manage their high-voltage powertrains, battery management systems, and regenerative braking, making sophisticated architectures indispensable. The rise of autonomous vehicles and ADAS is another critical growth driver. These systems rely on a vast network of sensors, cameras, and LiDAR to operate effectively, requiring E/E architectures with high computing power and real-time communication capabilities. As automakers strive to achieve higher levels of autonomy, the demand for centralized and zonal E/E architectures continues to grow. Consumer expectations for connected and software-defined vehicles have also fueled market growth. Features such as OTA updates, personalized driving profiles, and advanced infotainment systems are now standard in many vehicles, necessitating robust E/E platforms. The integration of 5G and V2X communication further expands the scope of E/E architecture, enabling vehicles to interact seamlessly with their surroundings and other road users. Stringent safety and emissions regulations have also played a significant role in driving E/E architecture advancements. Governments worldwide are mandating the inclusion of safety features like automated emergency braking, lane-keeping assistance, and driver monitoring systems, all of which require sophisticated E/E systems. Additionally, the push for lightweight and energy-efficient vehicle designs has led automakers to adopt zonal and centralized architectures that reduce wiring complexity and weight. Lastly, advancements in semiconductor and software technologies have made it feasible to develop cost-effective and scalable E/E architectures, enabling widespread adoption across vehicle segments. Combined with increasing investment in R&D by automakers and technology providers, these factors ensure sustained growth and innovation in the automotive E/E architecture market.Report Scope

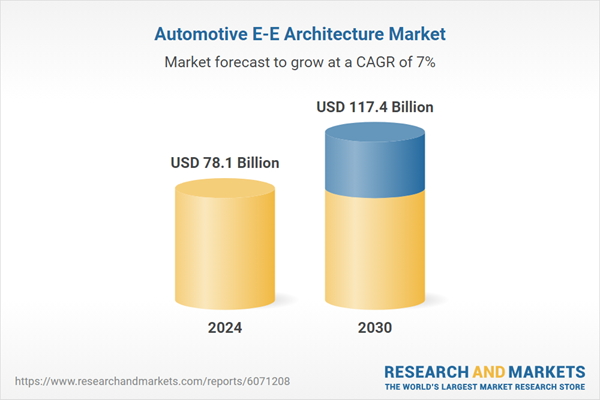

The report analyzes the Automotive E-E Architecture market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Propulsion (ICE Vehicles, Electric Vehicles); Vehicle Type (Passenger Vehicles, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the ICE Vehicles segment, which is expected to reach US$71.4 Billion by 2030 with a CAGR of a 8.4%. The Electric Vehicles segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $21.3 Billion in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $24.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive E-E Architecture Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive E-E Architecture Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive E-E Architecture Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bosch Mobility Solutions, Denso Corporation, Guchen EAC, Hanon Systems, Henan Kingclima Industry Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Automotive E-E Architecture market report include:

- Aptiv Plc

- Bosch Mobility Solutions

- Continental AG

- Denso Corporation

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Lear Corporation

- Magna International, Inc.

- Valeo SA

- Visteon Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aptiv Plc

- Bosch Mobility Solutions

- Continental AG

- Denso Corporation

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Lear Corporation

- Magna International, Inc.

- Valeo SA

- Visteon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 78.1 Billion |

| Forecasted Market Value ( USD | $ 117.4 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |