Global Tertiary Water and Wastewater Treatment Equipment Market - Key Trends & Drivers Summarized

Is the World Moving Toward Advanced Water Purification as a Necessity?

With growing concerns around water scarcity, environmental sustainability, and regulatory enforcement, tertiary water and wastewater treatment equipment is increasingly being viewed not as a luxury but a critical infrastructure requirement. Tertiary treatment - often the final and most advanced phase in the treatment cycle - removes residual contaminants, nutrients, pathogens, and micropollutants that primary and secondary treatments cannot adequately address. This stage often employs advanced filtration, disinfection, nutrient removal, and chemical treatment technologies to achieve water quality levels suitable for reuse in agriculture, industry, and even potable applications. As cities expand and industrialization intensifies, the load on existing wastewater systems is increasing, making tertiary treatment essential to prevent ecosystem degradation and public health risks. Global mandates around effluent discharge quality, such as those from the EPA, EU Water Framework Directive, and various national pollution control boards, are pushing municipal bodies and private operators to upgrade or retrofit treatment plants with tertiary systems. Additionally, the global trend toward water reuse and recycling - especially in water-stressed regions like the Middle East, parts of Asia-Pacific, and Western U.S. - is driving robust demand for membrane filtration systems, UV disinfection units, and nutrient removal modules. These systems not only improve compliance but also allow treated water to be safely reintegrated into natural water bodies or industrial cycles, closing the loop on sustainable water management.Why Are Industrial and Municipal Sectors Prioritizing Tertiary Treatment?

Industries and municipalities are rapidly acknowledging the strategic and operational benefits of integrating tertiary treatment into their water management practices. For municipalities, the pressure to deliver high-quality treated water that meets tightening regulatory standards and community expectations is pushing investments in advanced treatment equipment. Tertiary processes such as activated carbon filtration, ozonation, and membrane bioreactors (MBRs) are increasingly being installed in urban wastewater treatment plants to manage contaminants like pharmaceuticals, nitrates, phosphates, and emerging pollutants. In parallel, the industrial sector - especially high-discharge industries such as power generation, food and beverage, petrochemicals, and textiles - is adopting tertiary treatment to ensure compliance and support internal water reuse initiatives. Many companies are investing in zero liquid discharge (ZLD) systems, where tertiary treatment is a key step in achieving complete effluent recycling. Moreover, industries are recognizing that investing in in-house tertiary systems reduces long-term operational costs by minimizing freshwater dependency and wastewater disposal fees. With rising ESG (Environmental, Social, and Governance) commitments, corporations are under pressure to showcase sustainable water practices - further accelerating the deployment of high-performance tertiary systems. Municipal-private partnerships (MPPs) and build-operate-transfer (BOT) models are also emerging to fund and manage tertiary upgrades in developing regions, where infrastructure investment remains a bottleneck. These dynamics reflect a broader trend where tertiary treatment is no longer a regulatory checkbox but a strategic imperative for sustainable growth.Are Innovations in Treatment Technologies Expanding the Potential of Tertiary Systems?

Technological innovation is revolutionizing the capabilities of tertiary water and wastewater treatment equipment, making systems more efficient, modular, and adaptable across a range of settings. Advanced membrane technologies, including reverse osmosis (RO), ultrafiltration (UF), and nanofiltration (NF), are now offering higher contaminant removal rates with reduced energy consumption, supported by innovations in membrane materials and fouling resistance. UV-C LED disinfection systems are gaining traction as a chemical-free alternative to traditional chlorination, offering lower operating costs and environmental impact. Meanwhile, real-time monitoring and IoT-enabled automation are enhancing operational efficiency, allowing plant operators to optimize performance, predict maintenance needs, and ensure regulatory compliance with minimal human intervention. Smart sensors, AI-driven process control, and digital twins are being integrated into tertiary treatment infrastructure to provide predictive analytics, improve water quality monitoring, and reduce downtime. Electrocoagulation, ion exchange systems, and advanced oxidation processes (AOPs) are being deployed for the removal of hard-to-treat substances like endocrine-disrupting chemicals, heavy metals, and persistent organic pollutants. Additionally, containerized and modular tertiary treatment units are enabling decentralized water treatment, ideal for remote facilities, mining operations, and disaster-struck areas. As these technologies become more accessible and cost-effective, the barrier to tertiary treatment adoption continues to fall, expanding its role from centralized urban plants to smaller, localized systems with equal efficacy.What Market Forces Are Driving the Rise of Tertiary Water Treatment Equipment Globally?

The growth in the tertiary water and wastewater treatment equipment market is driven by several factors closely tied to regulatory mandates, technological readiness, and evolving end-user demands. A primary driver is the increasing stringency of global wastewater discharge regulations, which are compelling municipalities and industries to adopt advanced treatment technologies to meet permissible limits for contaminants such as nitrates, phosphates, pathogens, and microplastics. Rising urbanization and population density are intensifying the volume and complexity of wastewater, pushing demand for tertiary systems that can handle high loads and deliver consistently high-quality effluent. Simultaneously, water scarcity in arid and semi-arid regions is prompting large-scale investments in water recycling and reuse infrastructure, with tertiary treatment forming the cornerstone of these projects. Technological innovations - such as low-energy membranes, intelligent SCADA systems, and compact, modular designs - are enhancing the affordability and scalability of tertiary systems. The shift toward circular economy models in water management is also encouraging industries to recycle water internally, reducing dependency on freshwater sources and external effluent disposal. In developing countries, multilateral funding agencies and government programs are increasingly allocating budgets to modernize wastewater infrastructure, with a strong focus on tertiary upgrades. In the private sector, rising sustainability targets and environmental certification requirements are influencing capital allocation toward cleaner, more efficient water treatment technologies. These combined forces are creating a strong, multidimensional growth trajectory for the tertiary treatment equipment market across both developed and emerging economies.Report Scope

The report analyzes the Tertiary Water and Wastewater Treatment Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Equipment (Tertiary Clarifier, Filter, Chlorination Systems, Others); Application (Municipal, Industrial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Tertiary Clarifier segment, which is expected to reach US$13.8 Billion by 2030 with a CAGR of a 2.4%. The Filter segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.1 Billion in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $7.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Tertiary Water and Wastewater Treatment Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Tertiary Water and Wastewater Treatment Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Tertiary Water and Wastewater Treatment Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Chemistry, Arakawa Chemical Industries, Ltd., BOC Sciences, ChemPoint (Univar Solutions Inc.), DRT (Les Dérivés Résiniques et Terpéniques) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Tertiary Water and Wastewater Treatment Equipment market report include:

- 3M Company

- Alfa Laval AB

- Aquatech International LLC

- Calgon Carbon Corporation

- ClearBlu Environmental

- CWT (Complete Water Treatment)

- Dow Water & Process Solutions

- DuPont de Nemours, Inc.

- Ecolab Inc.

- Ecologix Environmental Systems

- Fluence Corporation

- GE Water & Process Technologies

- HUBER SE

- Kurita Water Industries Ltd.

- Lenntech B.V.

- Mitsubishi Chemical Aqua Solutions

- Ovivo Inc.

- Pall Corporation

- Pentair plc

- SUEZ Water Technologies & Solutions

- Thermax Limited

- Toray Industries, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Alfa Laval AB

- Aquatech International LLC

- Calgon Carbon Corporation

- ClearBlu Environmental

- CWT (Complete Water Treatment)

- Dow Water & Process Solutions

- DuPont de Nemours, Inc.

- Ecolab Inc.

- Ecologix Environmental Systems

- Fluence Corporation

- GE Water & Process Technologies

- HUBER SE

- Kurita Water Industries Ltd.

- Lenntech B.V.

- Mitsubishi Chemical Aqua Solutions

- Ovivo Inc.

- Pall Corporation

- Pentair plc

- SUEZ Water Technologies & Solutions

- Thermax Limited

- Toray Industries, Inc.

Table Information

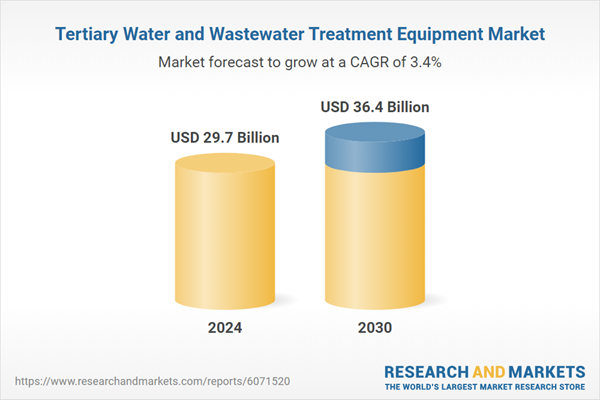

| Report Attribute | Details |

|---|---|

| No. of Pages | 278 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 29.7 Billion |

| Forecasted Market Value ( USD | $ 36.4 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |