Global Commercial Insurance Market - Key Trends & Drivers Summarized

How Is the Commercial Insurance Industry Evolving in an Era of Risk and Uncertainty?

The commercial insurance sector is undergoing a major transformation as businesses face a rapidly evolving risk landscape driven by technological disruptions, regulatory changes, climate-related threats, and cybersecurity vulnerabilities. As companies expand their operations, the demand for specialized insurance coverage - ranging from property and liability insurance to cyber risk and business interruption policies - is surging. The rise of digitalization and remote work has introduced new challenges in data security and regulatory compliance, prompting insurers to develop tailored policies that address emerging business risks. Additionally, natural disasters, supply chain disruptions, and geopolitical instability are increasing the complexity of risk management, making commercial insurance an essential financial safeguard for enterprises. Businesses are also seeking more flexible, customized insurance solutions that provide real-time coverage adjustments, reflecting dynamic operational changes. Insurtech innovations, including AI-powered underwriting, blockchain-driven claims processing, and IoT-based risk assessment tools, are transforming the industry by improving efficiency, reducing fraud, and enhancing policyholder experiences. As businesses prioritize resilience and financial security, commercial insurance providers are adapting to meet evolving demands, ensuring comprehensive risk mitigation strategies tailored to industry-specific needs.What Are the Emerging Innovations and Trends Reshaping Commercial Insurance?

Technology is playing a transformative role in the commercial insurance market, with AI, big data analytics, and automation driving significant improvements in risk assessment, policy customization, and claims management. AI-powered underwriting algorithms are streamlining policy approval processes, enabling insurers to analyze historical data, market trends, and predictive analytics to offer more accurate risk assessments. The rise of telematics and IoT-enabled monitoring systems is further enhancing insurance models, allowing businesses to receive dynamic premium adjustments based on real-time risk exposure. Blockchain technology is revolutionizing claims processing by increasing transparency, reducing fraud, and enabling faster payouts through smart contracts. Additionally, parametric insurance models are gaining traction, particularly in industries vulnerable to natural disasters, where pre-defined triggers enable automated claims settlement without lengthy assessments. The growing emphasis on Environmental, Social, and Governance (ESG) factors is also influencing insurance offerings, with businesses seeking coverage options that align with sustainability and climate resilience initiatives. The expansion of embedded insurance - where coverage is seamlessly integrated into commercial transactions, supply chains, and service agreements - is reshaping how businesses access protection. As risks become more dynamic and unpredictable, commercial insurers are leveraging innovation to offer smarter, more adaptive, and customer-centric solutions, ensuring businesses remain resilient in an ever-changing economic landscape.Report Scope

The report analyzes the Commercial Insurance market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Commercial Motor Insurance, Liability Insurance, Marine Insurance, Commercial Property Insurance, Other Types); Enterprise (Large Enterprises, SMEs).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Commercial Motor Insurance segment, which is expected to reach US$618.8 Billion by 2030 with a CAGR of a 7.3%. The Liability Insurance segment is also set to grow at 6.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $248.4 Billion in 2024, and China, forecasted to grow at an impressive 10.2% CAGR to reach $274.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AERCO International, Inc., Baxi Heating UK Limited, Bosch Industriekessel GmbH, Bryan Boilers, Burnham Commercial Boilers and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Commercial Insurance market report include:

- Allianz SE

- American International Group, Inc.

- AXA Group

- Berkshire Hathaway Homestate Companies

- Chubb Limited

- CNA Financial Corporation

- Generali Group

- Liberty Mutual Insurance Company

- Lloyd's of London (Lloyd's)

- MetLife, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allianz SE

- American International Group, Inc.

- AXA Group

- Berkshire Hathaway Homestate Companies

- Chubb Limited

- CNA Financial Corporation

- Generali Group

- Liberty Mutual Insurance Company

- Lloyd's of London (Lloyd's)

- MetLife, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

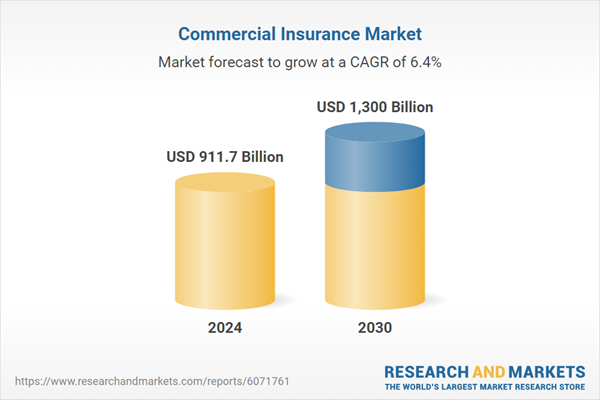

| Estimated Market Value ( USD | $ 911.7 Billion |

| Forecasted Market Value ( USD | $ 1300 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |