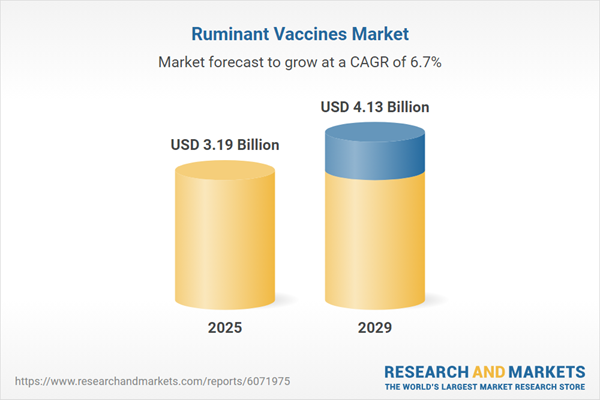

The ruminant vaccines market size has grown strongly in recent years. It will grow from $2.98 billion in 2024 to $3.19 billion in 2025 at a compound annual growth rate (CAGR) of 6.9%. The growth in the historic period can be attributed to increasing livestock populations, rising prevalence of zoonotic diseases, government initiatives for disease eradication, growing demand for animal protein, and increasing awareness about animal health.

The ruminant vaccines market size is expected to see strong growth in the next few years. It will grow to $4.13 billion in 2029 at a compound annual growth rate (CAGR) of 6.7%. The growth in the forecast period can be attributed to growing investments in research and development, expansion and modernization of veterinary clinics and hospitals, growing consumption of meat and dairy products, increasing focus on preventive healthcare in animals, and globalization of livestock trade. Major trends in the forecast period include adoption of recombinant and deoxyribonucleic acid (DNA) vaccines, innovation in autogenous vaccine usage, focus on developing thermostable vaccines, integration of artificial intelligence in vaccine development, and use of nanotechnology in vaccine delivery.

The growing demand for livestock products is anticipated to drive the expansion of the ruminant vaccines market in the future. Livestock products include goods derived from domesticated animals, such as meat, milk, eggs, wool, leather, and by-products like gelatin and animal fats. Factors contributing to the demand for these products include shifting dietary preferences, increased consumer access, greater affordability, economic growth, and changing lifestyle patterns. Ruminant vaccines play a crucial role in boosting livestock production by improving animal health, preventing disease outbreaks, enhancing productivity, increasing feed efficiency, and ensuring a stable and sustainable supply of meat, milk, and other by-products. For instance, in February 2024, a report from the Department for Environment, Food and Rural Affairs, a UK-based government agency, noted that the total livestock output in 2022 reached $25.05 billion, marking an increase of $3.5 billion (16%) compared to 2021. Thus, the rising demand for livestock products is driving the growth of the ruminant vaccines market.

Key players in the ruminant vaccines market are focusing on developing advanced products such as the bluetongue virus (BTV) serotype 3 vaccine, which provides effective protection against this virus. The BTV serotype 3 vaccine is designed to prevent bluetongue disease in ruminants such as cattle and sheep. For instance, in May 2024, Boehringer Ingelheim International GmbH, a Germany-based biopharmaceutical company, introduced Bultavo 3 to its ruminant vaccine lineup. This inactivated vaccine offers protection against bluetongue virus serotype 3, significantly reducing virus circulation, mortality, and clinical signs. Its launch addresses the urgent need for a BTV-3 vaccine due to recent outbreaks, helping to safeguard livestock health and reduce economic losses for farmers.

In April 2024, Virbac Group, a France-based animal health products manufacturer, acquired Sasaeah Pharmaceutical Co. Ltd. for an undisclosed amount. This acquisition aims to strengthen Virbac’s position in the Japanese livestock vaccine market, particularly for cattle, by leveraging Sasaeah's established production facilities, extensive R&D capabilities, and broad pharmaceutical portfolio. This move supports Virbac’s strategic growth and expansion in the animal health sector. Sasaeah Pharmaceutical Co. Ltd., based in Japan, specializes in manufacturing ruminant vaccines.

Major companies operating in the ruminant vaccines market are Boehringer Ingelheim International GmbH, Zoetis Inc., Merck & Co. Inc., Elanco Animal Health Inc., Ceva Santé Animale, Virbac, Phibro Animal Health Corporation, Vetoquinol S.A., Indian Immunologicals Ltd., Anicon Labor GmbH (SAN Group), IDT Biologika GmbH, Jinyu Bio-Technology Co. Ltd., Vaxxinova International B.V., Biogenesis Bagó S.A, CZ Vaccines, Hester Biosciences Limited, Choong Ang Vaccine Laboratories Co. Ltd., Hipra Corporations, VETVACO National Veterinary Joint Stock Company, Kyoto Biken Laboratories Inc., Fatro Spa.

North America was the largest region in the ruminant vaccines market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the ruminant vaccines market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the ruminant vaccines market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Ruminant vaccines are designed to safeguard ruminant animals from a range of infectious diseases. Ruminants, which include animals with a four-compartment stomach (rumen, reticulum, omasum, and abomasum), are herbivores that process fibrous plant material. These vaccines are crucial for maintaining the health, productivity, and welfare of ruminants by preventing diseases such as foot-and-mouth disease, brucellosis, bovine respiratory disease, and clostridial infections.

The primary types of ruminant vaccines include inactivated vaccines, attenuated or modified live vaccines, and others. Inactivated vaccines consist of pathogens that have been killed or inactivated, which helps to elicit an immune response without causing disease. These vaccines are used to protect against various conditions such as bovine respiratory diseases (BRD), diarrhea or scours, foot-and-mouth disease (FMD), clostridial diseases, leptospirosis, and bovine viral diarrhea (BVD) infection. They can be administered via intramuscular, subcutaneous, intranasal, or oral routes. Ruminant vaccines are used for cattle, sheep, and other ruminants, and are typically provided to veterinary hospitals and clinics, livestock farms, and research institutes.

The ruminant vaccines market research report is one of a series of new reports that provides ruminant vaccines market statistics, including ruminant vaccines industry global market size, regional shares, competitors with a ruminant vaccines market share, detailed ruminant vaccines market segments, market trends and opportunities, and any further data you may need to thrive in the ruminant vaccines industry. This ruminant vaccines market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The ruminant vaccines market consists of sales of brucellosis vaccines, bluetongue virus vaccines, E. coli vaccines, mycoplasma vaccines, and chlamydia vaccines. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Ruminant Vaccines Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on ruminant vaccines market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for ruminant vaccines? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The ruminant vaccines market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Vaccine Type: Inactivated Vaccines; Attenuated or Modified Live Vaccines; Other Vaccine Types2) by Indication: Bovine Respiratory Diseases (BRD); Diarrhea or Scours; Foot-and-Mouth Disease (FMD); Clostridial Diseases; Leptospirosis; Bovine Viral Diarrhea (BVD) Infection; Other Indication

3) by Route of Administration: Intramuscular; Subcutaneous; Intranasal; Oral

4) by Application: Cattle; Sheep; Other Applications

5) by End-User: Veterinary Hospitals and Clinics; Livestock Farms; Research Institutes

Subsegments:

1) by Inactivated Vaccines: Killed Virus Vaccines; Bacterial Inactivated Vaccines; Subunit Vaccines2) by Attenuated or Modified Live Vaccines: Live Attenuated Virus Vaccines; Live Bacterial Vaccines; Recombinant Live Vaccines

3) by Other Vaccine Types: DNA Vaccines; mRNA Vaccines; Viral Vector Vaccines

Key Companies Mentioned: Boehringer Ingelheim International GmbH; Zoetis Inc.; Merck & Co. Inc.; Elanco Animal Health Inc.; Ceva Santé Animale

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Ruminant Vaccines market report include:- Boehringer Ingelheim International GmbH

- Zoetis Inc.

- Merck & Co. Inc.

- Elanco Animal Health Inc.

- Ceva Santé Animale

- Virbac

- Phibro Animal Health Corporation

- Vetoquinol S.A.

- Indian Immunologicals Ltd.

- Anicon Labor GmbH (SAN Group)

- IDT Biologika GmbH

- Jinyu Bio-Technology Co. Ltd.

- Vaxxinova International B.V.

- Biogenesis Bagó S.A

- CZ Vaccines

- Hester Biosciences Limited

- Choong Ang Vaccine Laboratories Co. Ltd.

- Hipra Corporations

- VETVACO National Veterinary Joint Stock Company

- Kyoto Biken Laboratories Inc.

- Fatro Spa

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.19 Billion |

| Forecasted Market Value ( USD | $ 4.13 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |