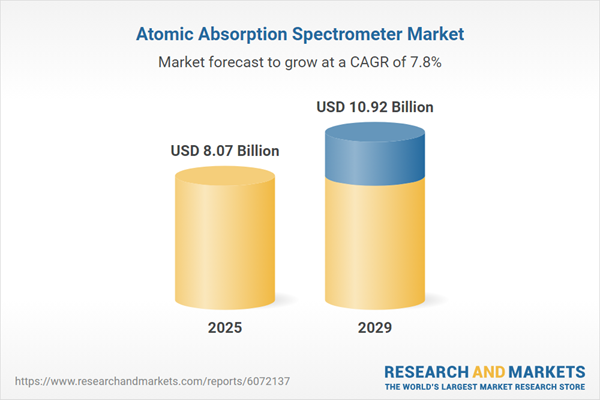

The atomic absorption spectrometer market size has grown strongly in recent years. It will grow from $7.47 billion in 2024 to $8.07 billion in 2025 at a compound annual growth rate (CAGR) of 8.1%. The growth in the historic period can be attributed to advances in analytical techniques, regulatory requirements, growth in environmental monitoring, expansion of pharmaceutical and clinical research, and technological innovations.

The atomic absorption spectrometer market size is expected to see strong growth in the next few years. It will grow to $10.92 billion in 2029 at a compound annual growth rate (CAGR) of 7.8%. The growth in the forecast period can be attributed to increasing environmental regulations, growth in industrialization, rising focus on food safety, growth in water and wastewater treatment, and increasing awareness of health and safety. Major trends in the forecast period include increased integration with automation, advancement in sensitivity and detection limits, the growing need for on-site and field analysis, enhanced software capabilities, and a focus on multi-element analysis.

The growing concerns around food safety are expected to drive the expansion of the atomic absorption spectrophotometer market in the future. These concerns stem from the increasing incidences of foodborne illnesses, contamination, and the rising complexity of global food supply chains. Atomic absorption spectrometers play a key role in food safety by detecting and measuring trace levels of heavy metals and other contaminants, ensuring compliance with safety standards and regulatory limits. For example, according to the Department of Health, an Australian government agency, in September 2023, Western Australia (WA) saw a record 28% rise in campylobacteriosis cases in 2022 compared to 2021. As a result, heightened food safety concerns are fueling the demand for atomic absorption spectrophotometers.

Leading companies in the atomic absorption spectrophotometer market are focused on developing innovative products, such as flame atomic absorption spectrophotometers, to gain a competitive edge. These instruments measure the concentration of metal elements in a sample by analyzing the light absorbed by atoms excited in a flame. For instance, in September 2022, Shimadzu Corporation, a Japanese manufacturer, launched the AA-7800 series of atomic absorption spectrophotometers. These devices are designed for high-performance and sensitive analysis across diverse applications while prioritizing safety. With features such as a vibration sensor and gas leak detection, the AA-7800 spectrophotometers are well-suited for flame analysis using acetylene gas and can effectively analyze samples with high concentrations or organic solvents.

In October 2023, Calibre Scientific Inc., a U.S.-based precision instrument manufacturer, acquired CPS Analitica Srl for an undisclosed amount. This acquisition strengthens Calibre Scientific's position as a global provider of life science reagents, tools, instruments, and consumables across various industries, including laboratory research, diagnostics, and biopharmaceuticals. CPS Analitica Srl, an Italian company, offers a range of analytical solutions, including absorption spectrometers.

Major companies operating in the atomic absorption spectrometer market are Hitachi Ltd, Thermo Fisher Scientific Inc., Agilent Technologies, Sartorius AG, Shimadzu Corporation, PerkinElmer Inc., Bio-Rad Laboratories, Bruker Corporation, Horiba Scientific, Eppendorf, Anton Paar, Metrohm AG, Malvern Panalytical, Leco Corporation, Techcomp, Analytik Jena, Spectro Analytical Instruments, Berthold Technologies, CEM Corporation, GBC Scientific Equipment, Buck Scientific Instruments LLC.

North America was the largest region in the atomic absorption spectrometer market in 2024. The regions covered in the atomic absorption spectrometer market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the atomic absorption spectrometer market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

An atomic absorption spectrometer (AAS) is an analytical tool used to determine the concentration of specific elements in a sample by measuring the amount of light absorbed by free atoms in a gaseous state. The instrument includes a light source, atomizer, monochromator, and detector, which work in tandem to quantify elements based on their unique light absorption properties.

The primary types of atomic absorption spectrometers are flame atomic absorption spectrometers, graphite furnace atomic absorption spectrometers, and integrated atomic absorption spectrometers. A flame atomic absorption spectrometer uses a flame to atomize the sample, converting it into free atoms for analysis. This type is commonly employed for routine metal analysis in environmental, clinical, and industrial contexts due to its straightforward operation and relatively low cost. Flame atomic absorption spectrometers are used in various applications, including environmental testing, food and beverage analysis, and biotechnology, serving industries such as pharmaceuticals, mining, petrochemicals, and agriculture.

The atomic absorption spectrometer market research report is one of a series of new reports that provides atomic absorption spectrometer market statistics, including atomic absorption spectrometer industry global market size, regional shares, competitors with a atomic absorption spectrometer market share, detailed atomic absorption spectrometer market segments, market trends and opportunities, and any further data you may need to thrive in the atomic absorption spectrometer industry. This atomic absorption spectrometer market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The atomic absorption spectrometer market consists of sales of hydride generation atomic absorption spectrometers (Hydride AAS), cold vapor atomic absorption spectrometers (Cold Vapor AAS), and atomic absorption spectrometers with electrothermal atomization (ETA-AAS). Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Atomic Absorption Spectrometer Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on atomic absorption spectrometer market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for atomic absorption spectrometer? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The atomic absorption spectrometer market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Flame Atomic Absorption Spectrometer; Graphite Furnace Atomic Absorption Spectrometer; Integrated Atomic Absorption Spectrometer2) by Application: Environmental Analysis; Food and Beverages Testing; Biotechnology; Other Applications

3) by End User: Pharmaceutical Industry; Mining Industry; Petrochemical Industry; Agriculture Industry; Other End Users

Subsegments:

1) by Flame Atomic Absorption Spectrometer: Single Element Flame Atomic Absorption Spectrometers; Multi-Element Flame Atomic Absorption Spectrometers; Portable Flame Atomic Absorption Spectrometers; High-Throughput Flame Atomic Absorption Spectrometers2) by Graphite Furnace Atomic Absorption Spectrometer: Single Element Graphite Furnace Atomic Absorption Spectrometers; Multi-Element Graphite Furnace Atomic Absorption Spectrometers; Automated Graphite Furnace Atomic Absorption Spectrometers; High-Resolution Graphite Furnace Atomic Absorption Spectrometers

3) by Integrated Atomic Absorption Spectrometer: Combination Flame and Graphite Furnace Atomic Absorption Spectrometers; Integrated Systems With Spectroscopy and Chromatography; Modular Integrated Atomic Absorption Spectrometers; Software-Integrated Atomic Absorption Spectrometers

Key Companies Mentioned: Hitachi Ltd; Thermo Fisher Scientific Inc.; Agilent Technologies; Sartorius AG; Shimadzu Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Atomic Absorption Spectrometer market report include:- Hitachi Ltd

- Thermo Fisher Scientific Inc.

- Agilent Technologies

- Sartorius AG

- Shimadzu Corporation

- PerkinElmer Inc.

- Bio-Rad Laboratories

- Bruker Corporation

- Horiba Scientific

- Eppendorf

- Anton Paar

- Metrohm AG

- Malvern Panalytical

- Leco Corporation

- Techcomp

- Analytik Jena

- Spectro Analytical Instruments

- Berthold Technologies

- CEM Corporation

- GBC Scientific Equipment

- Buck Scientific Instruments LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.07 Billion |

| Forecasted Market Value ( USD | $ 10.92 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |