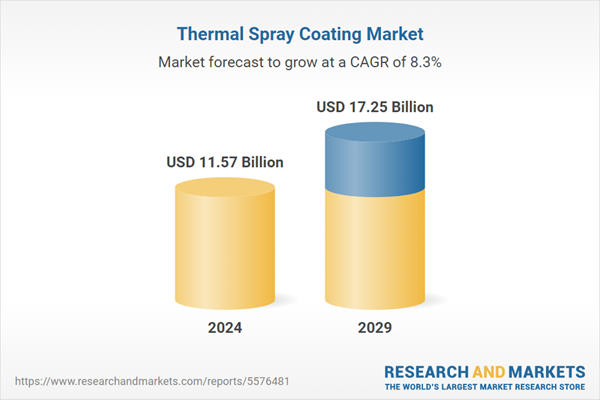

The thermal spray coating market is poised to grow from US$11.571 billion in 2024 to US$17.259 billion in 2029 at a CAGR of 8.32%.

Thermal coating is a process in which molten or semi-molten materials are used to coat surfaces. Materials that become plastic or are in a molten state can be used as coating substances. Thermal spray coating is usually done to protect the materials.Coating materials using thermal spray coating can increase the durability and wear resistance capacity of surfaces. This coating is widely used in mechanical moving parts and metal surfaces to prevent corrosion and increase life span. The wide range of applications of thermal spray coating in the automotive, aerospace, and mechanical industries is giving potential to the thermal spray coating market’s growth.

Thermal Spray Coating Market Drivers

Growing applicability in the medical sector has bolstered the market expansion.

Thermal spray coating can be efficiently applied to materials like metals, ceramics, and plastics. This property of thermal spray coating also increases its acceptability in industries and production sectors. The increasing market for more durable medical instruments and devices is a major factor driving its growth. The demand for corrosion-free medical instruments is hiking the market for thermal spray coating in the medical field. The need for corrosion-resistant and more durable parts in the automotive and aerospace industries also acts as a driver in the thermal spray coating market.Rising Demand from the automotive industry is propelling the market growth.

The need to protect moving mechanical parts in automobiles is raising the demand for thermal spray coating in the automotive industry. The break clutches, gear tooths, and crankshafts of automobiles are protected from corrosion and wear by coating with thermal spray coating. The low cost of coating materials and high efficiency in the protection provided by thermal spray coating is boosting its market growth. The developments and advancements of technologies in the coating process are increasing the efficiency and durability of thermal spray coating.The durability of mechanical parts is considered one of the major factors in the automobile industry. The protection offered by thermal spray coating from rust and scratches is also rising in the application of thermal spray coating in the automotive industry. WTO (World Trade Organisation) states that the automotive industry has shown drastic development in the last decade compared to other industrial sectors. According to IAO (International Automobile Organisation), the average life span of a high-working modern car is estimated to be 12+ years. Thermal spray coating is widely employed in the automobile industry to increase the lifespan of automobiles. The same source stated that in 2022, there was a 6% increase in global automotive production compared to 2021, such as hiking the market value of the thermal spray coating market.

Thermal Spray Coating Market Geographical Outlook

The North American market is expected to grow at a significant rate.

Geographically, North America shows tremendous market growth for thermal spray coating. The growing productivity in major sectors of the major regional economies, namely the United States and Canada, has paved the way for future market growth. According to the International Organization of Motor Vehicle Manufacturers, the United States experienced a 10% growth in automotive production in 2022. In contrast, Canada also witnessed the same production compared to the preceding year.Additionally, the General Aviation Manufacturers Association stated that the USA's total aircraft manufacturing output, including piston, turbine, and turboprop planes, reached 52 units in Q2 of 2023. This showcased a 47.8% increase over the previous quarter in the same year. Such an increase in manufacturing gives potential to the thermal spray coating market's growth. The economic developments and significant investments of major players in the Asia Pacific region are also boosting its regional market growth.

Thermal Spray Coating Market Key Developments

- In December 2023, Kymera International announced the acquisition of Metallization Limited, a leader in automation and technology in the thermal spray industry. The acquisition enhanced Kymera’s surface technologies and enabled it to become a leader in thermal spray applications.

- In June 2023, Oerlikon Metco launched its “Metco IIoT,” an industry 4.0 platform for the thermal spray industry. The digital solution enables thermal spray systems within the platform, thereby bolstering smart thermal spraying for various applications.

The Thermal Spray Coating market is segmented and analyzed as follows:

By Material Type

- Ceramics

- Metals

- Alloys

- Carbides

- Others

By Technology

- Cold spray

- Plasma spray

- Flame Spray

- High-velocity oxy-fuel (HVOF)

- Electric Arc

- Others

By Application

- Automotive

- Healthcare

- Aerospace

- Energy & Power

- Steel

- Pulp & Paper

- Others

By Process

- Combustion Flame

- Electrical Flame

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Turbocoating Spa

- Saint-Gobain S.A.

- Praxair Surface Technologies

- American Roller Company

- Oerlikon Balzers

- Powder Alloy Corp.

- Bodycote

- A&A Thermal Spray Coatings

- Sulzer

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 158 |

| Published | July 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 11.57 Billion |

| Forecasted Market Value ( USD | $ 17.25 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |