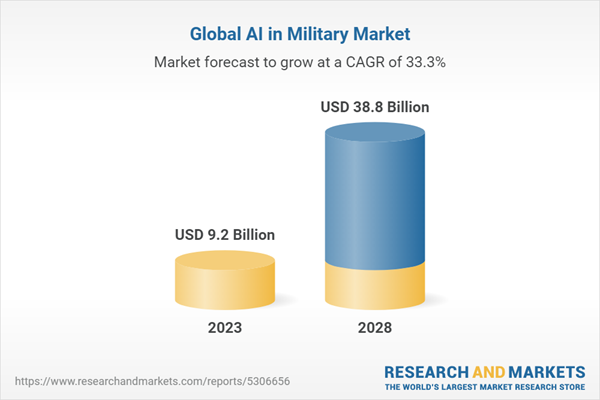

The AI in military market size is projected to grow from USD 9.2 billion in 2023 to USD 38.8 billion by 2028, at a CAGR of 33.3% during the forecast period.

Machine Learning Segment: The largest share of the AI in military market by technology in 2023

Machine learning is the ability of computers to learn without being programmed. It includes supervised learning (parametric/non-parametric algorithms, support vector machines, kernels, and neural networks) and unsupervised learning (clustering, dimensionality reduction, recommender systems, and deep learning). In the US, Intelligent Software Solutions is a leading provider of WebTAS software that integrates and visualizes data from multi-source data. This segment is further sub segmented into deep learning, supervised learning, unsupervised learning, reinforcement learning, generative adversarial networks, and others, which includes statistical learning and ensemble learning.

In January 2023, Lockheed Martin Corporation introduced its new AI model Aegis. This model is used to improve the operation efficiency of Agis Combat System. The AI enabled Agis combat system offers improved operator decision making, situational awareness, reduced reaction time, and the ability to defend against hypersonic threats. It also predictively determines when parts will need maintenance before they break.

In August 2020, Lockheed Martin signed a collaboration agreement with the University of Southern California (USC) Information Sciences Institute Space Engineering Research Center to build mission payloads for a small satellite program called La Jument, which enhances artificial intelligence and machine learning space technologies.

Airborne Segment: The largest segment of the AI in military market by platform in 2023

The airborne segment of the market for AI in military covers fighter jets, helicopters, special mission aircraft, and unmanned aerial vehicles (UAVs). One of the key factors driving the adoption of airborne AI systems is their autonomous nature and flexibility, which leads to wide-scale applications for surveillance to precision attacks.

In April 2023, Raytheon Technologies Corporation launched its new AI-assisted EO/IR system, RAIVEN. This solution allows military pilots to obtain faster and more accurate threat identification.

In December 2020, The Boeing Company, a multinational corporation that designs and manufactures airplanes, rotorcraft, rockets, satellites, telecommunications equipment, and missiles worldwide, announced that it completed the testing of five high-performance autonomous surrogate jets that employ artificial intelligence algorithms to teach the aircrafts’ brain to understand mission requirements and objectives.

North America to account for the largest share in the AI in military market in 2023

The adoption of AI in military in North America has increased continuously in recent years. The AI in military market in North America registered largest share in 2023. This large share is due to the increased investments and the development of AI in military technologies by countries in this region. Well-established and prominent manufacturers of these military systems in this region include Lockheed Martin (US), Northrop Grumman (US), L3Harris Technologies, Inc. (US), and Raytheon Technologies (US).

Break-up of profiles of primary participants in the AI in military market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-Level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America - 45%, Europe - 15%, Asia Pacific - 25%, Middle East & Africa - 10%, and Latin America - 5%

Prominent companies in the AI in military market are Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), BAE Systems PLC (UK), and Thales Group (France) among others.

Research Coverage

The market study covers an AI in military market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such offering, application, technology, platform, installation type, and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AI in military market and its subsegments. The report covers the entire ecosystem of the AI in military industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and there are several factors such as increase investments on development of AI-enabled solution to strengthen military capabilities, development of high-end AI chips, need for advanced surveillance systems and situational awareness, and others that could contribute to an increase in AI in military market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI in military market

- Market Development: Comprehensive information about lucrative markets - the report analyses the AI in military market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI in military market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), BAE Systems PLC (UK), and Thales Group (France), among others in the AI in military market.

Table of Contents

Companies Mentioned

- Anduril Industries, Inc.

- BAE Systems PLC

- Bluehalo

- C3.AI, Inc.

- Caci International Inc.

- Charles River Analytics

- Darktrace Limited

- General Dynamics Corporation

- Hensoldt Analytics GmbH

- Honeywell International Inc.

- International Business Machines Corp. (IBM)

- L3Harris Technologies, Inc.

- Leonardo S.p.A. (Leonardo)

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Nvidia Corporation

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Rheinmetall AG

- Safran SA

- Shield AI

- Soar Technologies Inc.

- Sparkcognition Inc.

- Thales Group

- The Boeing Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | May 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 9.2 Billion |

| Forecasted Market Value ( USD | $ 38.8 Billion |

| Compound Annual Growth Rate | 33.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |