3D Chips (3D IC) - Key Trends and Drivers

3D chips, also known as 3D integrated circuits (3D ICs), represent a transformative advancement in semiconductor technology, addressing the limitations of traditional 2D ICs. These chips are created by stacking multiple layers of silicon wafers or dies and connecting them vertically using through-silicon vias (TSVs). This architectural design significantly enhances chip performance by increasing density and reducing power consumption. The vertical stacking shortens the interconnect lengths between layers, which improves signal transmission speed and reduces latency. This allows for integrating various types of circuits, such as logic, memory, and analog, within a single package, enhancing functionality and performance in a compact form factor. The impact of 3D ICs is profound across various applications, including high-performance computing, mobile devices, data centers, and Internet of Things (IoT) devices, offering a path to overcoming the physical and economic barriers of traditional semiconductor scaling.One of the most prominent trends in the 3D IC market is the escalating demand for high-performance and energy-efficient computing solutions. As data centers and cloud computing services expand rapidly, there is a pressing need for processors capable of handling vast amounts of data with minimal energy consumption. 3D ICs are particularly well-suited for these demands due to their superior performance and energy efficiency. Additionally, the surge in artificial intelligence (AI) and machine learning (ML) applications necessitates chips that can execute complex computations swiftly. The compactness and enhanced performance of 3D ICs make them ideal for these applications. Moreover, the ongoing trend of miniaturization in consumer electronics, such as smartphones and wearable devices, is propelling the adoption of 3D ICs. These chips enable more functionality within smaller packages, addressing consumer demand for more powerful yet compact devices. The development of heterogeneous integration, where different types of circuits are combined in a single 3D package, further expands the potential applications of 3D ICs, offering solutions tailored to specific needs across various sectors.

The growth in the 3D IC market is driven by several factors. One major driver is the increasing complexity of electronic devices and the need for higher integration levels. As devices become more sophisticated, there is a greater demand for chips that can integrate more functions within a single package, which 3D ICs can provide.

The report analyzes the 3D Chips (3D IC) market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.

- Segments: Product (Memory, LEDs, Sensors, MEMS); Type (Stacked 3D, Monolithic 3D); End-Use (Consumer Electronics, Telecommunications, Automotive, Military & Aerospace, Medical Devices, Industrial Sector, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Memory segment, which is expected to reach US$22.2 Billion by 2030 with a CAGR of a 19.2%. The LEDs segment is also set to grow at 18.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.6 Billion in 2024, and China, forecasted to grow at an impressive 16.6% CAGR to reach $6.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global 3D Chips (3D IC) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global 3D Chips (3D IC) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global 3D Chips (3D IC) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3D AG, 3M Company, Advanced Track & Trace SA, Agfa Graphics, AlpVision S.A and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 26 companies featured in this 3D Chips (3D IC) market report include:

- Amkor Technology, Inc.

- Applied Materials, Inc.

- ASE Technology Holding, Co., Ltd.

- Micron Technology, Inc.

- NVIDIA Corporation

- Renesas Electronics Corporation

- STATS ChipPAC Pte., Ltd.

- STMicroelectronics NV

- Taiwan Semiconductor Manufacturing Co., Ltd. (TSMC)

- Toshiba Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amkor Technology, Inc.

- Applied Materials, Inc.

- ASE Technology Holding, Co., Ltd.

- Micron Technology, Inc.

- NVIDIA Corporation

- Renesas Electronics Corporation

- STATS ChipPAC Pte., Ltd.

- STMicroelectronics NV

- Taiwan Semiconductor Manufacturing Co., Ltd. (TSMC)

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

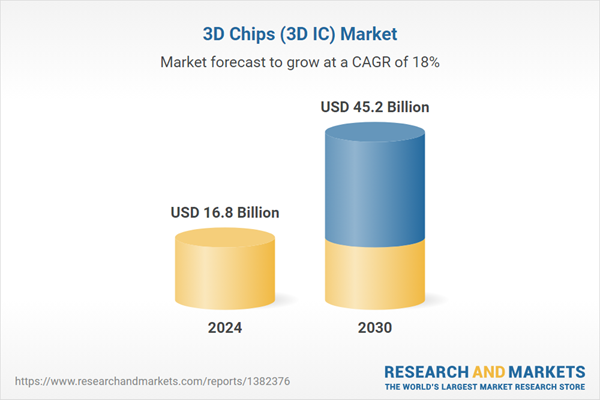

| Estimated Market Value ( USD | $ 16.8 Billion |

| Forecasted Market Value ( USD | $ 45.2 Billion |

| Compound Annual Growth Rate | 18.0% |

| Regions Covered | Global |