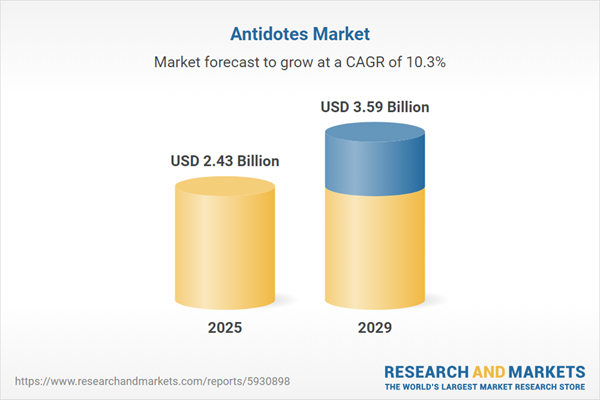

The antidotes market size is expected to see rapid growth in the next few years. It will grow to $3.59 billion in 2029 at a compound annual growth rate (CAGR) of 10.3%. The growth in the forecast period can be attributed to drug overdose crisis, emerging toxins, regulatory support, telemedicine and remote consultation. Major trends in the forecast period include combination antidotes, personalized poison management, digital poison control, pediatric antidotes.

The forecast of 10.3% growth over the next five years reflects a slight reduction of 0.1% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff escalations are likely to burden U.S. emergency departments by driving up costs of specialized antidotes like fomepizole and digoxin immune Fab sourced from France and Switzerland, exacerbating poisoning treatment expenses and increasing toxicology care burdens. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

An increase in poisoning incidents is expected to drive the growth of the antidotes market in the coming years. Poisoning incidents occur when individuals are exposed to, ingest, or come into contact with substances that are toxic to their health. Antidotes are vital in such situations as they counteract the harmful effects of dangerous substances. These antidotes neutralize, mitigate, or reverse the damaging impacts of poisons. For example, in October 2023, a report from Cable News Network (CNN), a U.S.-based multinational news channel, stated that there were 112,024 overdose deaths in May 2023, a 2.5% increase from 109,261 in May 2022. Hence, the rise in poisoning incidents is driving the expansion of the antidotes market.

The growing prevalence of medical conditions is expected to propel the growth of the antidotes market. Medical conditions such as opioid poisoning, cyanide poisoning, or benzodiazepine poisoning negatively impact the structure or function of the body and can be treated or prevented with antidotes. These antidotes work by binding to the poison, neutralizing it, or blocking its harmful effects on the body. For instance, in December 2023, UnitedHealth Group Incorporated, a U.S.-based multinational health insurance and services company, reported that the prevalence of diabetes among adults surged to 11.5%, affecting 31.9 million adults, while the prevalence of depression increased to 21.7%, impacting 54.2 million adults. Therefore, the rising prevalence of medical conditions is driving the growth of the antidotes market.

Prominent market players are dedicating their efforts to introduce innovative products like atropine sulfate injections to extend their market presence and provide enhanced treatment alternatives. Atropine sulfate injection is a type of antimuscarinic medication designed to inhibit the action of acetylcholine at muscarinic receptors within the parasympathetic nervous system. For instance, in August 2022, American Regent Inc., a US-based pharmaceutical company specializing in sterile injectables for healthcare providers, launched an atropine sulfate injection, USP. This traditional injectable medication is used as an antisialagogue, an antidote for organophosphorus poisoning or muscarinic mushroom poisoning, and to treat bradyasystolic cardiac arrest. Its primary purpose is to temporarily block severe or life-threatening muscarinic effects.

In July 2022, Soligenix Inc., a US-based biopharmaceutical company, established a partnership with SERB Pharmaceuticals to develop a novel ricin antigen for the treatment of ricin toxin poisoning. This collaboration aims to create a medical solution for ricin toxin poisoning. It combines Soligenix's antigen expertise with SERB Pharmaceuticals' proficiency in antibody research and manufacturing. SERB Pharmaceuticals, based in France, specializes in emergency care and is dedicated to developing and providing antidotes for critical conditions.

Major companies operating in the antidotes market are Pfizer Inc., Johnson & Johnson, Merck & Co., Bayer AG, Novartis AG, Bristol Myers Squibb, Alexion Pharmaceuticals Inc., AstraZeneca PLC, Sanofi S.A., Eli Lilly and Company, Boehringer Ingelheim International GmbH, Baxter International Inc., Teva Pharmaceutical Industries Ltd., Mylan N.V., CSL Behring, Daiichi Sanko Inc., Fresenius Kabi AG, Aurobindo Pharma Limited, Dr. Reddy’s Laboratories Ltd., Hikma Pharmaceuticals PLC, Ferring B.V., Lupin Limited, Zydus Lifesciences Ltd., Mallinckrodt Pharmaceuticals Ltd., Nichi-Iko Pharmaceutical Co. Ltd., Akorn Incorporated, Meridian Medical Technologies Inc., Alvogen Pharma India Pvt. Ltd., Wockhardt Limited, ADAPT Pharma Inc.

North America was the largest region in the antidotes market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in antidotes report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the antidotes market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The antidotes market research report is one of a series of new reports that provides antidotes market statistics, including antidotes industry global market size, regional shares, competitors with an antidotes market share, detailed antidotes market segments, market trends and opportunities and any further data you may need to thrive in the antidotes industry. This antidotes market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Antidotes are substances or therapeutic interventions developed to counter and alleviate the harmful effects of poisons or toxic substances within the body, with the aim of mitigating or neutralizing the toxic impact of these substances.

Antidotes come in several types, including chemical antidotes, physical antidotes, pharmacological antidotes, and others. Chemical antidotes are substances or compounds specifically formulated to counteract the toxic effects of particular chemical substances or poisons. They are employed in situations where exposure to a harmful substance has occurred, with the objective of neutralizing, mitigating, or reversing the toxic effects. These chemical antidotes can be administered through various forms, such as injectables, oral medications, capsules, tablets, and syrups. They find applications in diverse scenarios, including the treatment of animal bites and heavy metal poisoning, and are typically administered by healthcare providers in hospitals, homecare settings, specialty clinics, and other relevant healthcare facilities.

The antidotes market consists of sales of opioid antidotes, anticholinergic antidotes, benzodiazepine antidotes, anticoagulant antidotes, iron chelators, cyanide antidotes, heavy metal antidotes and digoxin antidotes. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Antidotes Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on antidotes market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for antidotes? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The antidotes market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Chemical Antidotes; Physical Antidotes; Pharmacological Antidotes; Other Types2) By Route of Administration: Injectable; Oral; Capsules and Tablets; Syrup

3) By Application: Animal Bites; Heavy Metal Poisoning

4) By End-User: Hospitals; Homecare; Specialty Clinics; Other End-Users

Subsegments:

1) By Chemical Antidotes: Chelating Agents; Oxidizing Agents; Reducing Agents2) By Physical Antidotes: Activated Charcoal; Gastric Lavage; Whole Bowel Irrigation

3) By Pharmacological Antidotes: Opioid Antagonists; Benzodiazepine Antagonists; Cholinesterase Reactivators

4) By Other Types: Supportive Therapies; Adjunctive Treatments

Companies Mentioned: Pfizer Inc.; Johnson & Johnson; Merck & Co.; Bayer AG; Novartis AG; Bristol Myers Squibb; Alexion Pharmaceuticals Inc.; AstraZeneca plc; Sanofi S.A.; Eli Lilly and Company; Boehringer Ingelheim International GmbH; Baxter International Inc.; Teva Pharmaceutical Industries Ltd.; Mylan N.V.; CSL Behring; Daiichi Sanko Inc.; Fresenius Kabi AG; Aurobindo Pharma Limited; Dr. Reddy’s Laboratories Ltd.; Hikma Pharmaceuticals plc; Ferring B.V.; Lupin Limited; Zydus Lifesciences Ltd.; Mallinckrodt Pharmaceuticals Ltd.; Nichi-Iko Pharmaceutical Co. Ltd.; Akorn Incorporated; Meridian Medical Technologies Inc.; Alvogen Pharma India Pvt. Ltd.; Wockhardt Limited; ADAPT Pharma Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Antidotes market report include:- Pfizer Inc.

- Johnson & Johnson

- Merck & Co.

- Bayer AG

- Novartis AG

- Bristol Myers Squibb

- Alexion Pharmaceuticals Inc.

- AstraZeneca plc

- Sanofi S.A.

- Eli Lilly and Company

- Boehringer Ingelheim International GmbH

- Baxter International Inc.

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- CSL Behring

- Daiichi Sanko Inc.

- Fresenius Kabi AG

- Aurobindo Pharma Limited

- Dr. Reddy’s Laboratories Ltd.

- Hikma Pharmaceuticals plc

- Ferring B.V.

- Lupin Limited

- Zydus Lifesciences Ltd.

- Mallinckrodt Pharmaceuticals Ltd.

- Nichi-Iko Pharmaceutical Co. Ltd.

- Akorn Incorporated

- Meridian Medical Technologies Inc.

- Alvogen Pharma India Pvt. Ltd.

- Wockhardt Limited

- ADAPT Pharma Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.43 Billion |

| Forecasted Market Value ( USD | $ 3.59 Billion |

| Compound Annual Growth Rate | 10.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |