Speak directly to the analyst to clarify any post sales queries you may have.

Introducing the Executive Overview of Automotive Over-The-Air Technologies and Their Pivotal Role in Revolutionizing Vehicle Connectivity and Software Updates Across the Industry Landscape

The automotive arena is undergoing a profound technological transformation driven by the surge of over-the-air capabilities. As vehicles evolve into sophisticated software platforms, the need for robust remote update mechanisms has become paramount. This introduction examines how firmware over-the-air and software over-the-air implementations are redefining maintenance paradigms, elevating customer experiences, and reinforcing cybersecurity postures without the reliance on traditional dealership visits.Over the past decade, the seamless delivery of critical updates has shifted from a convenience feature to an essential component of vehicle lifecycle management. Manufacturers now integrate modular architectures that support incremental patches, feature enhancements, and security hardening without disrupting end-user operations. This shift has fostered an ecosystem where agility in software distribution correlates directly with brand reputation and operational efficiency.

Moreover, connectivity frameworks ranging from Bluetooth and cellular networks to evolving satellite and vehicle-to-everything standards underpin the resilience of these remote update systems. With the integration of 5G and emerging low-earth-orbit infrastructures, data throughput and latency improvements have unlocked new possibilities for advanced driver assistance enhancements and onboard diagnostics. Consequently, automotive stakeholders are compelled to reassess their technology roadmaps and partner ecosystems, ensuring they align with the stringent demands of secure, seamless over-the-air deployments.

Examining the Convergence of Edge Computing, Cryptographic Assurance, and Predictive Maintenance That Is Reshaping Over-The-Air Software Delivery in Automobiles

The landscape for over-the-air software delivery is being reshaped by a confluence of forces that extend well beyond incremental improvements. It begins with the advent of edge computing, which relocates processing closer to the vehicle, reducing latency and enabling real-time analytics. This decentralization has catalyzed the proliferation of distributed update frameworks that can process large data volumes without overwhelming central servers.Simultaneously, the integration of advanced encryption standards and blockchain-inspired ledger systems is transforming how update authenticity and integrity are guaranteed. By embedding immutable cryptographic proofs into each update package, manufacturers can thwart supply-chain attacks and ensure that every deployed patch has verifiable provenance. This shift addresses growing concerns over cyber intrusions that exploit outdated firmware vulnerabilities.

Additionally, the rise of artificial intelligence and machine-learning-driven diagnostics has introduced predictive maintenance into the over-the-air paradigm. Vehicles now self-monitor critical systems, anticipate component failures, and request targeted updates proactively. This predictive approach enhances uptime, lowers warranty costs, and elevates customer satisfaction by minimizing unplanned service visits.

Underpinning these technological advances is an evolving regulatory mosaic. Authorities are increasingly mandating rigorous testing and validation of remote update processes, with safety and security requirements becoming more prescriptive. As such, automakers and suppliers must adapt to ensure compliance while preserving flexibility in their software distribution pipelines. Together, these transformative shifts are redefining how updates are conceived, authorized, and executed across the automotive value chain.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Semiconductor Inputs and Over-The-Air Connectivity Hardware Strategies for Automotive OEMs

The imposition of new tariff structures by the United States in 2025 has introduced substantial headwinds for over-the-air technology providers and automotive OEMs alike. By raising duties on key semiconductor components and telematics hardware, these measures have elevated landed costs, compelling companies to reassess global sourcing and manufacturing footprints. In response, many organizations have accelerated nearshoring initiatives, relocating assembly lines closer to major consumer markets to mitigate tariff impacts.Moreover, higher input costs have spurred a wave of supplier consolidation and strategic joint ventures aimed at preserving margin stability. Over-the-air module suppliers are negotiating long-term contracts and volume guarantees to secure preferential pricing tiers. Concurrently, OEMs are exploring design standardization to facilitate interoperability across IoT platforms, thereby reducing dependency on region-specific parts that incur punitive tariffs.

These fiscal dynamics have also intensified the emphasis on total cost of ownership considerations. Fleet operators and mobility service providers are scrutinizing subscription models and bundled service agreements to balance upfront hardware costs with recurring revenue streams from software updates. Consequently, there is a growing preference for modular architectures that allow phased investments in connectivity equipment and feature activation based on evolving operational needs.

Despite these challenges, the tariff environment has catalyzed innovation in cost-effective connectivity solutions. Manufacturers are piloting hybrid communication stacks that dynamically leverage lower-cost protocols such as Bluetooth or Wi-Fi for noncritical updates, reserving premium cellular or satellite channels for security patches and urgent bug fixes. This adaptive strategy underscores the industry’s resilience and strategic agility in the face of trade policy shifts.

Dissecting Automotive Over-The-Air Market Dynamics through Integrated Analysis of Technology, Connectivity, Propulsion, Application, and Vehicle Class Segmentation

Insights derived from a granular segmentation framework reveal distinct trajectories across technology, connectivity, propulsion, application, and vehicle classes. When analyzed by firmware over-the-air versus software over-the-air modalities, software-centric updates have gained traction in premium vehicle segments where feature differentiation and personalized in-app enhancements drive customer loyalty. Conversely, firmware updates remain critical in segments prioritizing system stability and safety assurances.Connectivity variations further nuance this landscape. While cellular networks dominate for high-bandwidth update delivery, satellite communication is emerging as a reliable fallback in remote or offshore operations. Meanwhile, vehicle-to-everything protocols are poised to support coordinated updates for platooning fleets, and Wi-Fi hotspots continue to serve as cost-efficient corridors for non-urgent telematics synchronization.

Propulsion type introduces additional complexity. Electric vehicles demand frequent battery management system improvements and user interface refinements, amplifying the value of over-the-air agility. In contrast, internal combustion engine platforms prioritize emissions calibration and engine control unit firmware hardening, where stability and regulatory compliance outweigh feature velocity.

Application-level segmentation highlights that advanced driver assistance systems and safety control modules require rigorous validation pipelines, driving investment in secure boot mechanisms. Infotainment and telematics control units, by contrast, focus on user experience enhancements and seamless content streaming, benefiting from adaptive update schedules that align with off-peak connectivity windows.

Vehicle type segmentation underscores divergent adoption rates. In heavy commercial vehicles, light commercial vehicles, and passenger car subclasses such as hatchback, sedan, and SUV, over-the-air utilities vary based on operational criticality, total lifecycle considerations, and brand positioning. Understanding these nuances enables stakeholders to tailor solution offerings that resonate with specific market niches.

Exploring Regional Variations in Over-The-Air Adoption Rates and Regulatory Frameworks across the Americas, EMEA, and Asia-Pacific Automotive Markets

Regional insights reveal that the Americas maintain a strong leadership position driven by early adoption of advanced telematics and widespread 5G network deployment. In the United States, consumer expectations for seamless over-the-air servicing have catalyzed partnerships between OEMs and telecommunication operators, fostering integrated connectivity packages that span urban and rural geographies. Latin American initiatives, while nascent, are gaining momentum through pilot programs focused on fleet telematics and last-mile logistics optimization.In Europe, the Middle East, and Africa, regulatory frameworks are harmonizing safety and cybersecurity mandates, prompting manufacturers to implement robust over-the-air verification protocols. The European Union’s emphasis on functional safety and data protection has accelerated investments in secure encryption modules and continuous vulnerability assessments. In the Middle East, high-end luxury vehicle markets are adopting advanced infotainment updates, supported by satellite-enabled connectivity solutions that address infrastructure gaps.

Asia-Pacific is characterized by rapid digitalization and localized innovation ecosystems. China’s domestic players are leveraging indigenous telematics platforms and chipsets to drive cost-efficient over-the-air deployments. Japan and South Korea continue to pioneer next-generation V2X implementations and predictive analytics frameworks, while Southeast Asian markets explore hybrid connectivity models to overcome intermittent network availability. Collectively, regional disparities underscore the need for adaptive strategies that align with localized infrastructure maturity, regulatory environments, and consumer preferences.

Highlighting Key Industry Players Driving Innovation and Strategic Alliances in the Automotive Over-The-Air Hardware and Software Ecosystem

Leading participants in the over-the-air ecosystem encompass a diverse array of OEMs, tier-one suppliers, chipset providers, and software integrators. Automakers are establishing captive software development centers to retain greater control over update roadmaps and cybersecurity protocols. Tier-one electronic control unit manufacturers are forging alliances with telecommunications vendors to deliver bundled connectivity and application management services.Semiconductor designers are differentiating through integrated security features, such as hardware root-of-trust modules that verify update authenticity. Connectivity specialists are expanding their networking portfolios to include hybrid cellular and satellite offerings that mitigate service disruptions. Meanwhile, software platform vendors are consolidating capabilities to provide end-to-end over-the-air orchestration, encompassing update authoring tools, distribution management consoles, and real-time performance dashboards.

Strategic collaborations have emerged as a hallmark of this market segment, with cross-industry consortiums coalescing around common standards to streamline interoperability. Open-source initiatives are maturing, enabling stakeholders to contribute to reference implementations while retaining proprietary enhancements. These collective efforts are intended to accelerate adoption, reduce integration overhead, and foster a competitive environment where differentiation is driven by service quality and innovation velocity rather than closed ecosystems.

Strategic Recommendations for Strengthening Cybersecurity, Modular Architecture, and Collaboration to Optimize Over-The-Air Software Delivery in Vehicles

Industry leaders should prioritize a multi-layered cybersecurity approach that combines secure boot, encrypted communication channels, and continuous threat monitoring. By implementing zero-trust architectures within vehicle networks, stakeholders can minimize the attack surface and maintain end-to-end integrity of over-the-air updates. It is also imperative to establish robust rollback mechanisms to revert to known safe configurations in the event of update anomalies.Strategic investment in modular software architectures will facilitate incremental feature rollouts and expedite compliance with evolving safety standards. Organizations should embrace microservices-based frameworks that decouple functional elements, enabling parallel development streams and rapid remediation cycles. This architectural agility will prove invaluable as regulatory requirements and consumer expectations continue to evolve.

Collaborating with telecom partners to secure flexible connectivity agreements will optimize data transmission costs and enhance reliability. Adopting dynamic network selection capabilities allows vehicles to switch seamlessly between cellular, satellite, and local Wi-Fi hotspots based on cost-benefit analyses and service level objectives.

Finally, cultivating a culture of cross-disciplinary collaboration between IT, cybersecurity, R&D, and field service teams will be essential. This collaborative ethos ensures that over-the-air strategies are holistic, aligning technical feasibility with operational readiness and customer value propositions. Regular scenario simulations and incident response drills will further reinforce the organization’s capacity to respond swiftly to emerging threats or operational disruptions.

Detailing the Comprehensive Research Framework Incorporating Primary Expert Engagement, Secondary Data Validation, and Scenario-Based Modeling for Market Insights

Our research methodology integrates primary interviews with industry experts, secondary data analysis, and scenario-based modeling to ensure comprehensive coverage of the over-the-air landscape. Primary engagements include structured conversations with OEM software architects, cybersecurity specialists, telematics operations managers, and tier-one component suppliers. These interviews inform qualitative insights into adoption drivers, integration challenges, and future technology roadmaps.Secondary sources encompass technical white papers, regulatory filings, patent databases, and publicly disclosed financial reports to validate market dynamics and corroborate emerging trends. Scenario-based modeling leverages real-world case studies to assess the impact of variables such as tariff fluctuations, regulatory mandates, and network infrastructure shifts on deployment strategies.

In constructing our segmentation framework, we applied a multi-tiered analysis that cross-references technology modalities, connectivity protocols, propulsion types, application domains, and vehicle classes. This holistic approach ensures that recommendations are grounded in the intricacies of each market subset and reflect the nuanced interplay between system requirements and operational constraints.

Quality control measures include peer reviews by domain specialists, statistical validation of secondary data inputs, and rigorous cross-checking against independent industry benchmarks. The result is a robust, data-driven report that balances technical depth with strategic foresight.

Summarizing the Interplay of Technological Innovation, Regulatory Dynamics, and Strategic Imperatives Driving the Automotive Over-The-Air Revolution

In conclusion, the automotive over-the-air domain stands at the nexus of technological innovation, regulatory complexity, and competitive differentiation. The synergy of edge computing, advanced cryptographic measures, and predictive maintenance systems is forging new paradigms in remote software delivery. Simultaneously, evolving tariff regimes and regional infrastructure disparities necessitate adaptive strategies to sustain growth and margin stability.Segmentation insights underscore that success will hinge on the ability to tailor offerings across firmware and software modalities, connectivity types, propulsion platforms, and application ecosystems. Regional nuances further amplify the importance of flexible business models and localized compliance frameworks. Meanwhile, strategic alliances and standardization efforts are reducing integration barriers, accelerating time-to-market for novel over-the-air services.

Industry stakeholders who embrace multi-layered security architectures, modular software designs, and dynamic connectivity solutions will be best positioned to capture value in this rapidly evolving environment. By aligning technical capabilities with customer expectations and regulatory obligations, organizations can transform over-the-air updates from a cost center into a strategic differentiator. The insights and recommendations presented herein provide a roadmap for navigating the complexities of this transformative market.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Automotive Over-The-Air Market

Companies Mentioned

The key companies profiled in this Automotive Over-The-Air market report include:- Airbiquity Inc.

- Applied Intuition, Inc.

- Aptiv PLC

- Aurora Labs Ltd.

- AutoPi ApS

- Continental AG

- Cubic Telecom Limited

- Cyient Limited

- DENSO Corporation

- Excelfore Corporation

- Harman International Industries, Inc.

- HERE Global B.V.

- Hyundai Motor Company

- Intel Corporation

- Intellias Ltd.

- Lear Corporation

- Polestar Performance AB

- Rambus Inc.

- Robert Bosch GmbH

- Sierra Wireless, Inc.

- Sonatus Inc.

- T-Systems International GmbH

- Telenor Connexion AS

- Verizon Communications Inc.

- WirelessCar AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

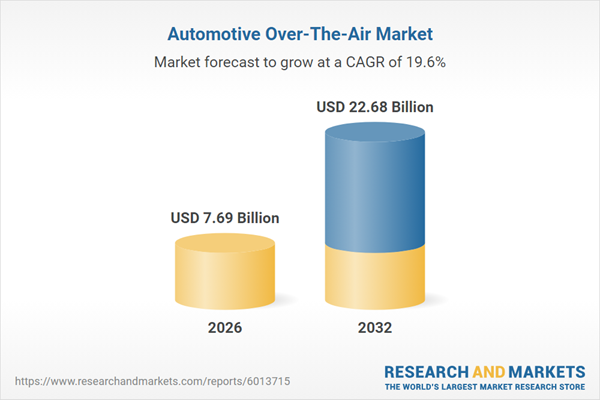

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 7.69 Billion |

| Forecasted Market Value ( USD | $ 22.68 Billion |

| Compound Annual Growth Rate | 19.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |