Global Compact Loaders Market - Key Trends and Drivers Summarized

What Are the Core Features of Compact Loaders?

Compact loaders, known for their versatility and efficiency, are crucial pieces of machinery in industries ranging from construction and landscaping to agriculture. These machines are designed to perform a wide range of tasks in confined spaces, making them essential for projects that demand maneuverability and precision. Key features of compact loaders include their small size, articulated steering, and the ability to accommodate a variety of attachments, such as buckets, forks, and augers. This flexibility allows operators to perform multiple functions with a single machine, reducing the need for a larger, more expensive fleet of equipment. Compact loaders come in various types, including skid-steer loaders, compact track loaders, and mini wheel loaders, each suited to specific environments and tasks. Skid-steer loaders are favored for their zero-radius turning capability, making them ideal for tight spaces, while compact track loaders excel in soft or uneven terrain thanks to their rubber tracks that distribute weight more evenly than tires. Overall, these machines are built for durability and efficiency, designed to withstand harsh environments while delivering reliable performance in small-scale projects.How Are Technological Advancements Shaping Compact Loaders?

The compact loader industry is evolving rapidly, driven by technological innovations that are transforming the capabilities and efficiency of these machines. One of the most significant advancements is the integration of telematics, which allows operators and fleet managers to monitor machine performance in real-time. This includes tracking fuel usage, operating hours, and maintenance schedules, enabling proactive maintenance that reduces downtime and extends the lifespan of the equipment. In addition to telematics, automation is making its mark on compact loaders. While fully autonomous loaders are still in the developmental stage, semi-autonomous features such as automated bucket leveling and return-to-dig functions are already in use, making tasks easier and more precise. Electric compact loaders are also becoming a growing trend, particularly in urban environments where noise and emissions regulations are strict. Electric motors offer quieter operation and lower emissions compared to traditional diesel-powered models, making them an attractive option for environmentally conscious contractors. Moreover, advancements in hydraulic systems have led to improved lifting capacities and more efficient power delivery, allowing compact loaders to handle heavier loads and more demanding tasks than ever before.What Are the Latest Trends in the Compact Loader Industry?

Several key trends are shaping the future of the compact loader market, many of which reflect broader shifts toward sustainability, efficiency, and technological integration in the construction industry. One of the most prominent trends is the rising demand for electric and hybrid compact loaders. With increasing regulatory pressure to reduce emissions, many manufacturers are focusing on developing battery-powered models that deliver the same power and performance as their diesel counterparts. This trend is especially noticeable in urban areas, where zero-emission construction equipment is becoming a requirement for certain projects. Another trend is the growing emphasis on operator comfort and safety. Compact loaders now feature more ergonomic designs, with improved visibility, climate-controlled cabins, and intuitive controls that reduce operator fatigue and increase productivity. Additionally, advancements in attachment technology are allowing these machines to become even more versatile. Quick-attach systems and an expanding range of specialized attachments mean that a single compact loader can now handle everything from digging and grading to material handling and demolition. Finally, the use of smart technologies, such as GPS tracking and real-time data analytics, is enabling more efficient job site management by optimizing machine use, tracking progress, and reducing fuel consumption.What Factors Are Fueling Expansion of the Compact Loader Market?

The growth in the compact loader market is driven by several factors, including increasing demand for versatile and efficient machinery, technological advancements, and regulatory changes. One of the primary drivers is the rise in small to medium-sized construction projects, particularly in urban areas, where space constraints necessitate the use of compact equipment. The ability of compact loaders to navigate tight spaces while performing multiple functions with various attachments makes them indispensable in these environments. Additionally, the ongoing trend toward green construction is fueling demand for electric and hybrid compact loaders, as construction companies seek to meet stricter emissions standards while maintaining productivity. Another key factor is the rapid pace of technological innovation, with features such as telematics, automation, and smart attachments enhancing the overall efficiency and ease of use for operators. The growing focus on operator comfort and safety is also a factor, as contractors are increasingly prioritizing equipment that can reduce fatigue and improve productivity on the job site. Lastly, the expansion of rental markets is contributing to the sector's growth, as more businesses opt for renting rather than purchasing equipment outright, which provides access to the latest models without the high upfront costs. These combined factors are creating a robust demand for compact loaders across various industries and regions.Report Scope

The report analyzes the Compact Loaders market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Construction, Agriculture & Forestry, Industrial, Utilities).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Construction End-Use segment, which is expected to reach US$6.7 Billion by 2030 with a CAGR of 4.1%. The Agriculture & Forestry End-Use segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.2 Billion in 2024, and China, forecasted to grow at an impressive 5.9% CAGR to reach $3.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Compact Loaders Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Compact Loaders Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Compact Loaders Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Caterpillar, Inc., CNH Industrial N.V., Deere & Company, Doosan Corporation, Hitachi Construction Machinery Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Compact Loaders market report include:

- Caterpillar, Inc.

- CNH Industrial N.V.

- Deere & Company

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Kubota Corporation

- Liebherr Group

- Sany Heavy Industry Co., Ltd.

- Takeuchi Manufacturing Co., Ltd.

- Volvo Construction Equipment AB

- Xuzhou Construction Machinery Group Co., Ltd.

- Yanmar Holdings Co., Ltd

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Caterpillar, Inc.

- CNH Industrial N.V.

- Deere & Company

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Kubota Corporation

- Liebherr Group

- Sany Heavy Industry Co., Ltd.

- Takeuchi Manufacturing Co., Ltd.

- Volvo Construction Equipment AB

- Xuzhou Construction Machinery Group Co., Ltd.

- Yanmar Holdings Co., Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 296 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

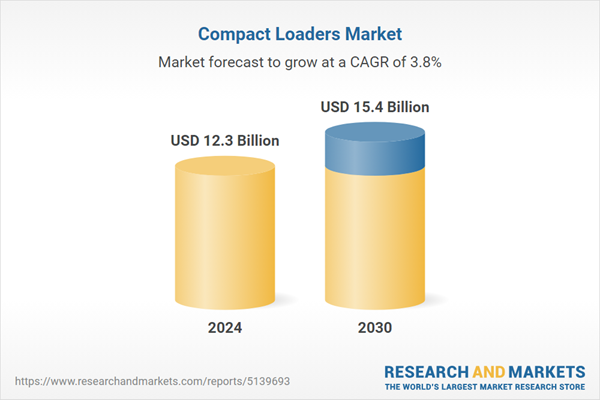

| Estimated Market Value ( USD | $ 12.3 Billion |

| Forecasted Market Value ( USD | $ 15.4 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |