Global Loader Cranes Market - Key Trends & Drivers Summarized

How Are Loader Cranes Revolutionizing Material Handling Across Industries?

Loader cranes, pivotal in modern construction, logistics, and manufacturing sectors, streamline the movement and placement of heavy materials with unparalleled efficiency and precision. These versatile machines, mounted on trucks or trailers, offer a dynamic solution for handling bulky goods that traditional stationary cranes cannot, particularly in confined or hard-to-reach areas. The utility of loader cranes extends beyond mere transport, facilitating operations in varied settings - from urban construction sites to remote oil fields. As the demand for rapid, safe, and cost-effective material handling grows, especially in bustling urban environments, loader cranes are increasingly recognized for their ability to significantly reduce labor costs, enhance operational speed, and minimize the physical strain on workers, thereby improving overall site safety.What Technological Advancements Are Pushing the Boundaries for Loader Cranes?

Technological enhancements in loader cranes have substantially elevated their performance and user safety. Today's models are equipped with sophisticated hydraulic systems and high-performance electronics that ensure smoother operation and greater control. Innovations such as variable stability logic and active load stabilization improve operational safety and efficiency, allowing for precise handling even under challenging conditions. Remote-control technology, another critical advancement, allows operators to maneuver cranes from a distance, enhancing safety and visibility. Moreover, the integration of telematics systems supports predictive maintenance and operational diagnostics, preventing downtime and extending the machinery's lifespan. These technological strides not only drive efficiency and safety but also cater to a broader range of applications, reinforcing the loader crane's role as a fundamental piece of equipment in modern industrial operations.Emerging Trends and Market Dynamics Influencing Loader Cranes Adoption

The loader crane market is witnessing a shift towards automation and electrification, reflecting broader trends across industrial sectors. The move toward electric loader cranes, for instance, responds to increasing environmental regulations and the industry's push towards sustainability. These electric models offer reduced emissions and lower noise levels, making them ideal for urban projects. Furthermore, the global rise in infrastructure investment, particularly in developing countries, has propelled the demand for robust and reliable heavy machinery, with loader cranes being no exception. The market is also benefiting from regulatory trends that emphasize workplace safety, driving demand for cranes with advanced safety features and performance monitoring systems.What Drives the Growth of the Loader Cranes Market?

The growth in the loader cranes market is driven by several factors, each linked to significant industry or technological trends. Innovations in crane technology, such as increased lift capacity, enhanced control systems, and improved safety mechanisms, make these machines indispensable for modern construction and logistics operations. Economic development in emerging markets has led to increased urbanization and infrastructure projects, which in turn fuels the demand for loader cranes. The construction sector, a primary user of loader cranes, benefits from these machines' ability to operate in tight spaces and varied environments, thereby enhancing work site efficiency. Additionally, the shift towards more sustainable and environmentally friendly equipment has led to innovations in electric and hybrid loader cranes, expanding their appeal across global markets. As industries continue to seek solutions that offer both performance and flexibility, the loader cranes market is set to experience sustained growth, driven by ongoing advancements and expanding application scopes.Report Scope

The report analyzes the Loader Cranes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Construction, Forestry, Agriculture, Oil & Gas, Manufacturing, Transport & Logistics, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Construction End-Use segment, which is expected to reach US$2.8 Billion by 2030 with a CAGR of 5.3%. The Forestry End-Use segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Loader Cranes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Loader Cranes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Loader Cranes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anlev Elex, ATLAS GmbH, BIA Group, Bigge Crane & Rigging Company Inc., Briggs Equipment UK Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Loader Cranes market report include:

- Anlev Elex

- ATLAS GmbH

- BIA Group

- Bigge Crane & Rigging Company Inc.

- Briggs Equipment UK Ltd.

- Cargotec Corporation

- Cashman Equipment

- CNH Industrial N.V.

- Dalian Shidao Industry Co.,Ltd

- Emak SpA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anlev Elex

- ATLAS GmbH

- BIA Group

- Bigge Crane & Rigging Company Inc.

- Briggs Equipment UK Ltd.

- Cargotec Corporation

- Cashman Equipment

- CNH Industrial N.V.

- Dalian Shidao Industry Co.,Ltd

- Emak SpA

Table Information

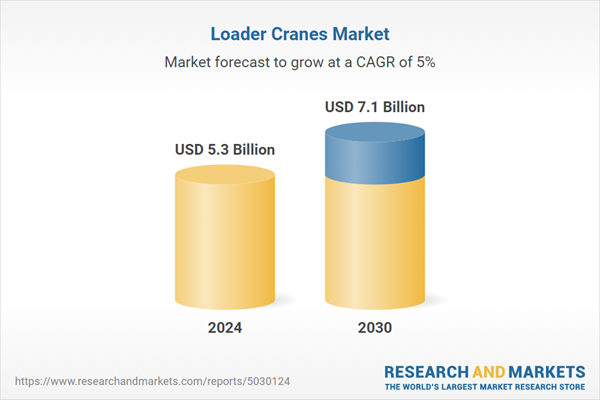

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.3 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |