Global Conversion Coatings Market - Key Trends & Drivers Summarized

What Are Conversion Coatings, And Why Are They Important in Modern Industrial Applications?

Conversion coatings refer to surface treatments applied to metals, typically aluminum, zinc, and steel, to enhance their corrosion resistance, paint adhesion, and overall durability. These coatings chemically modify the metal surface by converting it into a corrosion-resistant oxide layer or phosphate film, which acts as a protective barrier against environmental factors such as moisture, chemicals, and rust. Conversion coatings are widely used across industries including automotive, aerospace, construction, and electronics, where long-term protection of metal surfaces is critical. The most common types of conversion coatings include phosphate coatings, chromate coatings, and newer, eco-friendly alternatives such as zirconium-based or trivalent chromium coatings.The importance of conversion coatings lies in their ability to improve the performance and longevity of metal components. They provide an essential layer of defense against corrosion, which can lead to metal degradation, structural failures, and expensive repairs if left unchecked. Additionally, conversion coatings enhance the adhesion of subsequent paint layers, ensuring that finishes remain intact and do not peel or flake over time. This makes them vital for industries that require high-performance coatings, such as automotive manufacturing, where painted metal parts must withstand extreme weather conditions, road salts, and mechanical wear. By offering both protective and aesthetic benefits, conversion coatings play a critical role in maintaining the integrity and appearance of metal surfaces in a wide range of applications.

What Are the Main Applications of Conversion Coatings, And How Do They Cater to Industry-Specific Needs?

Conversion coatings have diverse applications across several industries, including automotive, aerospace, construction, and electronics, where they provide enhanced corrosion resistance, improved paint adhesion, and increased durability of metal surfaces. In the automotive industry, conversion coatings are widely used to treat metal components such as chassis, body panels, and engine parts. Phosphate coatings, in particular, are applied to automotive parts before painting to ensure strong adhesion of the paint to the metal surface, which prevents peeling and rusting over time. Additionally, conversion coatings protect metal components from the effects of road salts, moisture, and other corrosive substances that vehicles are exposed to during their lifespan. This is critical for ensuring the longevity and safety of vehicles, particularly in harsh environmental conditions.In the aerospace industry, conversion coatings are essential for protecting the lightweight aluminum and steel alloys used in aircraft manufacturing. Chromate coatings, though increasingly regulated due to environmental concerns, have historically been the go-to choice for aerospace applications because of their superior corrosion resistance. These coatings not only protect aircraft parts from corrosion but also help to improve paint adhesion, ensuring that the aircraft's surface coatings withstand the extreme temperatures, pressures, and environmental exposure experienced during flight. With the growing emphasis on lightweight materials in the aerospace sector, conversion coatings play a crucial role in extending the life of critical components without adding unnecessary weight to the aircraft.

Construction and infrastructure industries also benefit from the use of conversion coatings, particularly for steel structures like bridges, buildings, and pipelines. Conversion coatings applied to steel reinforcements help prevent rust and degradation, which can weaken structural integrity over time. By providing an additional layer of protection against corrosion, conversion coatings ensure that metal infrastructure maintains its strength and durability, even in corrosive environments such as marine or industrial settings. In the electronics industry, conversion coatings are used on metal parts to protect them from oxidation and enhance solderability, which is essential for the longevity and reliability of electronic devices. These coatings ensure that electrical connections remain stable and that components are protected from the elements, further enhancing product reliability and lifespan.

Across all industries, conversion coatings cater to specific needs by offering tailored solutions that improve the performance and longevity of metal surfaces. Whether for preventing corrosion in automotive parts, protecting aerospace components from extreme conditions, or enhancing the structural integrity of construction materials, conversion coatings are integral to a wide array of industrial applications.

How Are Technological Advancements Impacting the Conversion Coatings Market?

Technological advancements in materials science, environmental sustainability, and application processes are driving innovation in the conversion coatings market, enhancing the performance and eco-friendliness of these treatments. One of the most significant advancements is the development of environmentally friendly alternatives to traditional chromate coatings. Chromate conversion coatings, particularly hexavalent chromium, have long been valued for their superior corrosion resistance, but due to their toxicity and environmental impact, regulations like the European Union's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) directive have pushed manufacturers to find safer alternatives. In response, new non-toxic alternatives such as zirconium-based, trivalent chromium, and titanium-based coatings have emerged, offering comparable corrosion protection without the environmental and health risks associated with hexavalent chromium.In the automotive and aerospace sectors, advancements in nanotechnology are significantly improving the effectiveness of conversion coatings. Nanocoatings, which incorporate nanoparticles into the conversion coating formulation, offer enhanced corrosion resistance, increased durability, and improved surface smoothness. These nanostructured coatings provide a more uniform protective layer, increasing resistance to wear and tear while reducing the overall thickness of the coating, which is particularly beneficial in weight-sensitive applications like aerospace and electric vehicles. Moreover, these nanocoatings can be applied more precisely, improving the efficiency of the coating process and reducing material waste. As industries increasingly seek high-performance coatings that align with sustainability goals, nanotechnology is becoming an integral part of the evolution of conversion coatings.

Another technological advancement impacting the conversion coatings market is the introduction of advanced pre-treatment processes and automation in manufacturing. Modern pre-treatment systems, such as multi-stage spray systems and immersion baths, ensure uniform application of conversion coatings across metal surfaces, improving adhesion and corrosion resistance. Automated systems equipped with robotics and smart sensors allow manufacturers to optimize the application of conversion coatings, ensuring consistent quality and reducing labor costs. These advancements also minimize human exposure to potentially hazardous chemicals, enhancing worker safety. Furthermore, innovations in application methods such as plasma electrolytic oxidation (PEO) and laser surface treatments are expanding the capabilities of conversion coatings, allowing for more specialized, durable, and wear-resistant surfaces tailored to the specific needs of industries like automotive and aerospace.

Sustainability is another critical focus area, with research and development centered on creating more sustainable conversion coatings that reduce the use of harmful chemicals and minimize the environmental footprint. Waterborne coatings, which contain fewer volatile organic compounds (VOCs), are gaining popularity as eco-friendly alternatives to traditional solvent-based systems. Additionally, researchers are developing bio-based and recyclable coatings to further reduce the environmental impact of the conversion coatings industry. These technological innovations are transforming the market, ensuring that conversion coatings remain effective while complying with global environmental standards and addressing the increasing demand for sustainability across industries.

What Is Driving the Growth in the Conversion Coatings Market?

The growth in the conversion coatings market is driven by several key factors, including the rising demand for corrosion protection in critical industries, advancements in automotive and aerospace manufacturing, and the increasing focus on environmentally friendly coatings. One of the primary drivers is the need for enhanced corrosion protection in industries such as automotive, aerospace, construction, and oil and gas. Metal components and structures in these sectors are frequently exposed to harsh environmental conditions, making corrosion resistance a top priority. Conversion coatings offer a cost-effective and efficient solution for preventing metal degradation, reducing maintenance costs, and extending the service life of components. This has led to growing adoption of conversion coatings in infrastructure development, vehicle manufacturing, and heavy industrial equipment.The expanding automotive industry, particularly with the rise of electric vehicles (EVs), is another significant factor driving market growth. Automakers are increasingly using lightweight materials such as aluminum and high-strength steel to improve fuel efficiency and reduce emissions. Conversion coatings are essential in ensuring that these materials maintain their structural integrity and corrosion resistance, particularly in EVs, where battery casings and lightweight frames are critical to vehicle performance. Additionally, the shift toward more environmentally sustainable manufacturing processes is pushing the adoption of eco-friendly conversion coatings that meet strict regulatory requirements, further boosting the market.

The aerospace industry is also contributing to the growing demand for conversion coatings, especially as aircraft manufacturers seek to use lighter materials such as aluminum alloys to improve fuel efficiency. Conversion coatings provide essential corrosion protection for these lightweight materials, ensuring that they can withstand extreme temperatures, pressures, and environmental exposure over the lifespan of an aircraft. Moreover, with the increasing production of commercial and military aircraft, the demand for high-performance conversion coatings that meet stringent safety and durability standards is expected to rise.

Environmental regulations and sustainability initiatives are playing a critical role in shaping the conversion coatings market. As governments and regulatory bodies impose stricter limits on the use of toxic chemicals like hexavalent chromium, manufacturers are investing in the development of eco-friendly alternatives. This has led to the adoption of non-toxic coatings, such as zirconium and trivalent chromium, which offer comparable performance without the environmental and health risks. The growing emphasis on sustainability, particularly in regions like Europe and North America, is driving the shift toward greener coatings, which are becoming a key differentiator for companies looking to comply with environmental standards and enhance their brand reputation.

Lastly, technological advancements in the development and application of conversion coatings are also driving market growth. Innovations such as nanotechnology, automated application systems, and advanced pre-treatment processes are improving the performance, efficiency, and cost-effectiveness of conversion coatings. These advancements enable industries to achieve better corrosion protection with less material waste, shorter application times, and lower environmental impact. As industries continue to prioritize both performance and sustainability, conversion coatings will play an increasingly important role in the global market, supporting the growth of key sectors while meeting evolving environmental and regulatory requirements.

In conclusion, the conversion coatings market is poised for continued growth due to its essential role in protecting metals, driving innovations in critical industries, and advancing sustainability. As the demand for high-performance, eco-friendly coatings increases, conversion coatings will remain at the forefront of industrial surface treatment technologies, ensuring the long-term durability and safety of metal components across a range of applications.

Report Scope

The report analyzes the Conversion Coatings market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Transportation, Construction, General Industry, Industrial Machinery, Packaging, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Transportation Application segment, which is expected to reach US$3.3 Billion by 2030 with a CAGR of a 7.7%. The Construction Application segment is also set to grow at 6.8% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Conversion Coatings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Conversion Coatings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Conversion Coatings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Axalta Coating Systems, Llc, Basf Se, Crest Chemicals, Freiborne Industries, Henkel Ag & Company, Kgaa and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Conversion Coatings market report include:

- Axalta Coating Systems, Llc

- Basf Se

- Crest Chemicals

- Freiborne Industries

- Henkel Ag & Company, Kgaa

- Hubbard Hall

- Keystone Corporation

- Nihon Parkerizing Co., Ltd.

- Ppg Industries, Inc.

- Sherwin-Williams Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Axalta Coating Systems, Llc

- Basf Se

- Crest Chemicals

- Freiborne Industries

- Henkel Ag & Company, Kgaa

- Hubbard Hall

- Keystone Corporation

- Nihon Parkerizing Co., Ltd.

- Ppg Industries, Inc.

- Sherwin-Williams Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

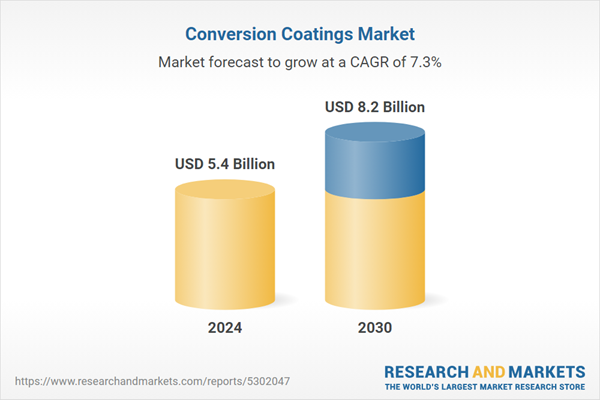

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.4 Billion |

| Forecasted Market Value ( USD | $ 8.2 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |