Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product

1.1.2. Technology

1.1.3. Regional scope

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

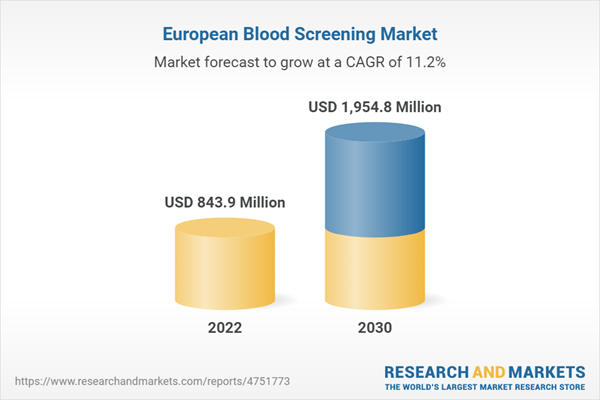

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Technology outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Europe Blood Screening Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.4. Europe Blood Screening Market Analysis Tools

3.4.1. Industry Analysis - Porter’s Five Forces

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Technological landscape

3.4.2.3. Economic Landscape

Chapter 4. Europe Blood Screening: Product Estimates & Trend Analysis

4.1. Europe Blood Screening Market: Key Takeaways

4.2. Europe Blood Screening Market: Product Movement & Market Share Analysis, 2022 & 2030

4.3. Reagent

4.3.1. Reagent Market Estimates and Forecasts, 2018 to 2030 (USD Million)

4.4. Instrument

4.4.1. Instrument Market Estimates and Forecasts, 2018 to 2030 (USD Million)

Chapter 5. Europe Blood Screening Market: Technology Estimates & Trend Analysis

5.1. Europe Blood Screening Market: Key Takeaways

5.2. Europe Blood Screening Market: Technology Movement & Market Share Analysis, 2022 & 2030

5.3. Nucleic Acid Amplification Test

5.3.1. Nucleic Acid Amplification Test Market Estimates and Forecasts, 2018 to 2030 (USD Million)

5.4. ELISA

5.4.1. ELISA Market Estimates and Forecasts, 2018 to 2030 (USD Million)

5.5. Chemiluminescence Immunoassay

5.5.1. Chemiluminescence Immunoassay Market Estimates and Forecasts, 2018 to 2030 (USD Million)

5.6. Next-Generation Sequencing

5.6.1. Next Generation Sequencing Market Estimates and Forecasts, 2018 to 2030 (USD Million)

5.7. Western Blotting

5.7.1. Western Blotting Market Estimates and Forecasts, 2018 to 2030 (USD Million)

Chapter 6. Europe Blood Screening Market: Regional Estimates & Trend Analysis

6.1. Regional Outlook

6.2. Europe Blood Screening Market by Region: Key Takeaways

6.3. Europe

6.3.1. UK

6.3.1.1. Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Million)

6.3.2. Germany

6.3.2.1. Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Million)

6.3.3. France

6.3.3.1. Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Million)

6.3.4. Italy

6.3.4.1. Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Million)

6.3.5. Spain

6.3.5.1. Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Million)

6.3.6. Denmark

6.3.6.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

6.3.7. Sweden

6.3.7.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

6.3.8. Norway

6.3.8.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.2.1. Danaher Corporation

7.2.1.1. Company Overview

7.2.1.2. Financial Performance

7.2.1.3. Product Benchmarking

7.2.1.4. Strategic Initiatives

7.2.2. Beckman Coulter, Inc.

7.2.2.1. Company Overview

7.2.2.2. Financial Performance

7.2.2.3. Product Benchmarking

7.2.2.4. Strategic Initiatives

7.2.3. Abbott Laboratories

7.2.3.1. Company Overview

7.2.3.2. Financial Performance

7.2.3.3. Product Benchmarking

7.2.3.4. Strategic Initiatives

7.2.4. Thermo Fisher Scientific, Inc.

7.2.4.1. Company Overview

7.2.4.2. Financial performance

7.2.4.3. Product benchmarking

7.2.4.4. Strategic initiatives

7.2.5. Becton, Dickinson and Company

7.2.5.1. Company overview

7.2.5.2. Financial performance

7.2.5.3. Product benchmarking

7.2.5.4. Strategic Initiatives

7.2.6. Grifols

7.2.6.1. Company overview

7.2.6.2. Financial performance

7.2.6.3. Product benchmarking

7.2.6.4. Strategic initiatives

7.2.7. Ortho Clinical Diagnostics

7.2.7.1. Company overview

7.2.7.2. Financial performance

7.2.7.3. Product benchmarking

7.2.7.4. Strategic initiatives

7.2.8. F. Hoffmann-La Roche Ltd.

7.2.8.1. Company overview

7.2.8.2. Financial performance

7.2.8.3. Product benchmarking

7.2.8.4. Strategic initiatives

7.2.9. Bio-Rad Laboratories, Inc.

7.2.9.1. Company overview

7.2.9.2. Financial performance

7.2.9.3. Product benchmarking

7.2.9.4. Strategic initiatives

7.2.10. Siemens AG

7.2.10.1. Company overview

7.2.10.2. Financial performance

7.2.10.3. Product benchmarking

7.2.10.4. Strategic initiatives

List of Tables

Table 1 List of Abbreviations

Table 2 Europe blood screening market, by product, 2018 - 2030 (USD Million)

Table 3 Europe blood screening market, by technology, 2018 - 2030 (USD Million)

Table 4 Europe blood screening market, by region, 2018 - 2030 (USD Million)

Table 5 Germany blood screening market, by product, 2018 - 2030 (USD Million)

Table 6 Germany blood screening market, by technology, 2018 - 2030 (USD Million)

Table 7 UK blood screening market, by product, 2018 - 2030 (USD Million)

Table 8 UK blood screening market, by technology, 2018 - 2030 (USD Million)

Table 9 France blood screening market, by product, 2018 - 2030 (USD Million)

Table 10 France blood screening market, by technology, 2018 - 2030 (USD Million)

Table 11 Italy blood screening market, by product, 2018 - 2030 (USD Million)

Table 12 Italy blood screening market, by technology, 2018 - 2030 (USD Million)

Table 13 Spain blood screening market, by product, 2018 - 2030 (USD Million)

Table 14 Spain blood screening market, by technology, 2018 - 2030 (USD Million)

Table 15 Denmark blood screening market, by product, 2018 - 2030 (USD Million)

Table 16 Denmark blood screening market, by technology, 2018 - 2030 (USD Million)

Table 17 Sweden blood screening market, by product, 2018 - 2030 (USD Million)

Table 18 Sweden blood screening market, by technology, 2018 - 2030 (USD Million)

Table 19 Norway blood screening market, by product, 2018 - 2030 (USD Million)

Table 20 Norway blood screening market, by technology, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Europe blood screening: Market outlook

Fig. 9 Europe blood screening competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 Europe blood screening market driver impact

Fig. 15 Europe blood screening market restraint impact

Fig. 16 Europe blood screening market strategic initiatives analysis

Fig. 17 Europe blood screening market: Product movement analysis

Fig. 18 Europe blood screening market: Product outlook and key takeaways

Fig. 19 Reagent market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 20 Instrument market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 21 Europe blood screening market: Technology movement analysis

Fig. 22 Europe blood screening market: Technology outlook and key takeaways

Fig. 23 Nucleic acid amplification test market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 24 ELISA market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 25 Chemiluminescence Immunoassay market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 26 Next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 27 Western blotting market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 28 Europe market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 29 UK market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 30 Germany market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 31 France market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 32 Italy market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 33 Spain market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 34 Sweden market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 Norway market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 36 Denmark market estimates and forecasts, 2018 - 2030 (USD Million)