Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This is aligned with the EU and French climate goals, including ambitious CO₂ reductions and a net-zero outlook by 2050, reinforced with municipal low-emission zones that favor electric delivery vehicles. Meanwhile, technological advances in battery chemistries - especially lithium iron phosphate (LFP), which offers superior safety, longevity, and cost-efficiency, and dominant coverage in BEV battery packs (~99%) - are driving down operating costs while improving range and performance.

Moreover, developments in telematics, energy-efficient powertrains, regenerative braking, and regenerative energy systems, along with software-defined platforms like Flexis’s Ampere SDV, are enabling smarter and more modular commercial vehicles tailored for last-mile logistics. On the infrastructure front, France has steadily expanded its public and private fast-charging networks, including pilot corridors for heavy-duty electric trucks and hydrogen-powered fleets, alleviating range anxiety for fleet managers. These investments dovetail with growing freight electrification pilots - particularly for urban logistics networks, bus fleets, and heavy-duty routes - as exemplified by the Clean Transport Network Alliance and substantial OEM investments from Renault, Volvo, Iveco, Scania, and Stellantis .

Economic variables also favor adoption: soaring diesel and fuel prices, TCO advantages of EVs, corporate sustainability priorities, and heightened consumer awareness of green logistics are pushing businesses to electrify. While upfront costs remain a constraint, data-driven fleet management and lower lifecycle costs are offsetting initial premiums, making electric fleets economically compelling over several years. The market outlook is optimistic: LCVs dominate, but electric MCVs and HCVs are gaining traction; BEVs are already the dominant propulsion (especially in LCVs), with PHEVs, FCEVs, and hybrids filling niche roles.

Industry consolidation and collaboration - such as the Renault/Volvo/CMA CGM Flexis JV and OEM partnerships on batteries and charging infrastructure - are accelerating innovation and supply-capacity scaling While challenges remain - high capital outlays, payload-range trade-offs due to battery mass, charging harmonization, supply chain pressures, and residual value uncertainty - ongoing investment, standardization efforts, and ecosystem maturation are steadily addressing them. Altogether, France’s ECV market is undergoing a strategic transformation fueled by policy coherence, tech innovation, infrastructure expansion, and market readiness. This positions it to be a European frontrunner in commercial vehicle electrification through 2028 and beyond.

Key Market Drivers

Robust Regulatory Framework and Government Incentives Driving Fleet Electrification

One of the most significant drivers propelling the electric commercial vehicle market in France is the strong support from both national and European regulatory frameworks aimed at accelerating the transition to sustainable mobility. France has implemented ambitious policies aligned with the European Union's Green Deal and “Fit for 55” package, which seek to reduce greenhouse gas emissions by 55% by 2030 and achieve climate neutrality by 2050. These frameworks are actively pushing automotive OEMs and fleet operators to shift away from internal combustion engine (ICE) vehicles to low- and zero-emission alternatives. At the national level, France offers a suite of financial incentives to encourage adoption.The “bonus écologique” provides up to €5,000 in subsidies for electric commercial vehicle purchases, while additional regional grants - such as Île-de-France’s top-up incentive of up to €4,000 - create a favorable environment for small and medium enterprises (SMEs) to transition their fleets. Furthermore, tax exemptions on company cars and favorable depreciation rules significantly reduce the total cost of ownership (TCO) for fleet operators.

These incentives are paired with stringent regulatory levers, such as the establishment of “Zones à Faibles Émissions” (Low Emission Zones or LEZs) in major French cities including Paris, Lyon, Marseille, and Grenoble, where only electric or ultra-low-emission vehicles are allowed unrestricted access. This has created a regulatory pressure-cum-opportunity scenario, especially for last-mile delivery companies and public service providers that must maintain inner-city mobility compliance. Together, these mechanisms not only provide economic justification but also make fleet electrification a strategic imperative for logistics, utility, municipal, and service vehicle operators.

Key Market Challenges

High Upfront Costs and Uncertain Total Cost of Ownership (TCO) in Heavier Segments

Despite growing government incentives and operational savings over time, the high upfront cost of electric commercial vehicles continues to act as a major barrier to widespread adoption - especially for medium and heavy commercial vehicle segments in France. Battery costs, which contribute to nearly 30-40% of an EV’s price, remain significant, particularly for larger vehicles that require high-capacity packs. While LCVs are beginning to achieve TCO parity with diesel vehicles within a few years of use, MCVs and HCVs still face a longer breakeven period due to heavier payload requirements, longer range needs, and more robust powertrain components.For small and medium-sized fleet operators or independent logistics companies, this upfront capital requirement can be prohibitive, despite subsidies and tax benefits. Additionally, many businesses remain uncertain about long-term maintenance costs, insurance premiums, resale values, and battery replacement timelines. The resale market for electric commercial vehicles is still nascent, creating further hesitation among cost-sensitive buyers.

Compounding the issue is the lack of clarity around the durability of EVs under harsh operational conditions such as high payload, long operating hours, and seasonal temperature variations - especially in rural or regional logistics. These uncertainties introduce perceived financial risks that deter fleet operators from making large-scale transitions to electric fleets, particularly in applications beyond last-mile delivery. While leasing models and pay-per-use schemes are emerging to alleviate CAPEX concerns, they are not yet universally available or well-understood, limiting their impact at present.

Key Market Trends

Transition Toward Purpose-Built Electric Commercial Vehicles (eLCVs and eHCVs)

One of the most prominent trends in the French electric commercial vehicle market is the shift from retrofitted electric variants of internal combustion engine (ICE) vehicles to purpose-built electric commercial vehicles (PBVs). French and European OEMs are increasingly moving away from adapting ICE chassis and platforms for EV drivetrains and instead designing commercial EVs from the ground up. This shift allows for greater flexibility in battery placement, better weight distribution, more efficient use of interior space, and enhanced safety standards tailored to electric powertrains.Companies like Renault Trucks are pioneering this trend with dedicated platforms such as the E-Tech T and E-Tech D Wide for urban and regional logistics, which offer modularity in battery sizes and body configurations. Stellantis and Citroën are also investing in electric vans that are not just ICE conversions but are built specifically for urban deliveries with short turning radii, optimized payload-to-range ratios, and advanced driver-assistance systems.

This trend is being accelerated by customer demand for more reliable, longer-range, and lower-maintenance solutions as well as by regulations requiring the phaseout of diesel engines in city centers. Purpose-built EVs are also becoming critical in meeting sector-specific demands, such as temperature-controlled transport, municipal waste collection, and utility service operations. This evolution is transforming the engineering approach to commercial mobility, signaling a maturing market that is focused not just on electrification but on overall operational optimization through design innovation.

Key Market Players

- Groupe Renault S.A.

- Renault Trucks SAS

- Volvo Group

- Daimler AG

- Stellantis N.V.

- AB Volvo

- Volkswagen AG

- IVECO S.p.A.

- Scania AB

- Volta Trucks Ltd.

Report Scope:

In this report, the France Electric Commercial Vehicle market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:France Electric Commercial Vehicle Market, By Vehicle Type:

- Light Commercial Vehicle (LCV)

- Medium Commercial Vehicle (MCV)

- Heavy Commercial Vehicle (HCV)

France Electric Commercial Vehicle Market, By Range:

- 0-150 Miles

- 151-250 Miles

- 251-500 Miles

- Above 500 Miles

France Electric Commercial Vehicle Market, By Propulsion:

- BEV

- HEV

- PHEV

- FCEV

France Electric Commercial Vehicle Market, By Region:

- Northern

- Western

- Southern

- Eastern

- Central

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the France Electric Commercial Vehicle market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Groupe Renault S.A.

- Renault Trucks SAS

- Volvo Group

- Daimler AG

- Stellantis N.V.

- AB Volvo

- Volkswagen AG

- IVECO S.p.A.

- Scania AB

- Volta Trucks Ltd.

Table Information

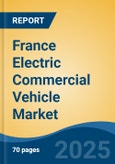

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | August 2025 |

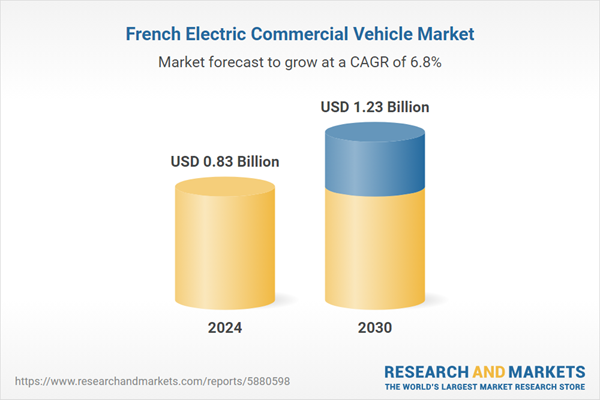

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.83 Billion |

| Forecasted Market Value ( USD | $ 1.23 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | France |

| No. of Companies Mentioned | 10 |