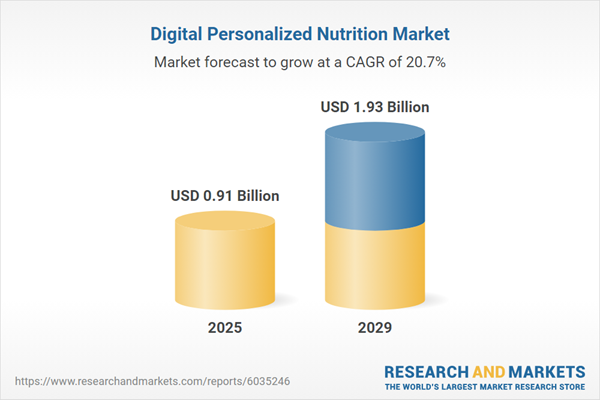

The digital personalized nutrition market size has grown exponentially in recent years. It will grow from $0.75 billion in 2024 to $0.91 billion in 2025 at a compound annual growth rate (CAGR) of 21.1%. The growth in the historic period can be attributed to introduction of wearable solution, increase in the incidence of various illnesses, rise in geriatric population, growth in popularity of receiving nutritional guidance, and rise in disposable income.

The digital personalized nutrition market size is expected to see exponential growth in the next few years. It will grow to $1.93 billion in 2029 at a compound annual growth rate (CAGR) of 20.7%. The growth in the forecast period can be attributed to rising demand for retained nutrition products, increasing in smartphone penetration and health application, increasing consumer health awareness, increasing preference for healthy lifestyle, and surge in consumer preference for high-quality food. Major trends in the forecast period include technological advancements, product innovations, emerging startup ecosystem with surging adoption of online personalized nutrition services, and advancements in health monitoring apps.

The rising prevalence of lifestyle diseases is anticipated to drive the growth of the digital personalized nutrition market. Lifestyle diseases, which are primarily influenced by an individual's lifestyle choices and behaviors rather than solely by infections or genetic factors, include conditions such as heart disease, diabetes, and obesity. Contributing factors to these diseases include modern lifestyle changes, urbanization, sedentary behavior, poor diet, increased intake of processed foods, and heightened stress levels. Digital personalized nutrition addresses these challenges by offering customized dietary recommendations based on individual health data, thereby supporting healthier eating habits and potentially mitigating or reducing the severity of conditions like diabetes, obesity, and cardiovascular disease. For example, the International Diabetes Federation reported in 2021 that around 537 million adults aged 20-79 were living with diabetes globally, a figure projected to rise to 643 million by 2030 and 783 million by 2045. This growing incidence of lifestyle diseases is fueling the demand for digital personalized nutrition solutions.

Leading companies in the digital personalized nutrition market are focusing on technological innovations, such as AI-driven nutrition platforms, to offer more precise and personalized dietary recommendations, boost user engagement, and improve health outcomes for individuals dealing with lifestyle-related diseases. AI-driven nutrition platforms leverage artificial intelligence to analyze individual health data and create optimized nutrition plans. For instance, in December 2023, Helo Corp, a U.S.-based health and wellness technology company, introduced Nutramatic, an AI-powered personalized nutrition service. Nutramatic provides customized diet plans based on comprehensive health assessments, ongoing dietary recommendations, and integration with wearable devices, along with real-time health metrics monitoring and adaptive recommendations to improve user wellness.

In November 2023, Viome Life Sciences, a U.S.-based company specializing in personalized dietary recommendations derived from advanced health and microbiome data, acquired Naring Health for an undisclosed amount. This acquisition aims to enhance Viome's ability to deliver more detailed and tailored nutrition solutions by leveraging Naring Health's expertise and technology. Naring Health, a U.S.-based digital health and wellness company, offers personalized clinical and molecular data to support informed decision-making.

Major companies operating in the digital personalized nutrition market are Noom Inc., 23andMe Holding Co., MyFitnessPal Inc., DayTwo Inc., Nutrisense Inc., Viome Life Sciences Inc., Lumen Technologies Inc, Healthifyme Wellness Products and Services Private Limited, Nutrium, Habit LLC, Levels Health Inc., Lifesum AB, Second Nature Healthy Habits Ltd, InsideTracker, BiogeniQ Inc., CircleDNA, Persona Nutrition, Nutrigenomix Inc., Rootine, Caligenix Inc., GenoPalate Inc., Culina Health Inc., Baze Labs GmbH, Foodvisor.

North America was the largest region in the digital personalized nutrition market in 2023. The regions covered in the digital personalized nutrition market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the digital personalized nutrition market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Digital personalized nutrition involves a customized approach to dietary recommendations and meal planning that utilizes digital technology and data analytics. By incorporating individual-specific information - such as genetic data, health metrics, lifestyle habits, and personal preferences - this approach aims to create tailored nutrition plans. The goal is to enhance individual health and wellness with more effective dietary guidance than generalized recommendations.

The main purchase models in the digital personalized nutrition market include subscription and one-time purchase. The subscription model provides customers with ongoing access to personalized nutrition plans, dietary recommendations, and continuous support through digital platforms, typically for a regular fee (monthly, quarterly, or annually). Applications of digital personalized nutrition cover areas such as general health and fitness, disease-specific needs, and sports nutrition, and are utilized by various end-users including direct consumers, wellness and fitness centers, hospitals and clinics, and institutions.

The digital personalized nutrition market research report is one of a series of new reports that provides digital personalized nutrition market statistics, including the digital personalized nutrition industry global market size, regional shares, competitors with digital personalized nutrition market share, detailed digital personalized nutrition market segments, market trends, and opportunities, and any further data you may need to thrive in the digital personalized nutrition industry. These digital personalized nutrition market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The digital personalized nutrition market consists of revenues earned by entities by providing services such as personalized meal plans, genetic testing, wearable devices, mobile apps, online consultations, nutritional supplements, food sensitivity testing, behavioral coaching, and meal delivery services. The market value includes the value of related goods sold by the service provider or included within the service offering. The digital personalized nutrition market includes sales of genetic testing kits, food sensitivity test kits, and DNA and microbiome testing kits. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Digital Personalized Nutrition Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on digital personalized nutrition market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for digital personalized nutrition ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The digital personalized nutrition market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Purchase Model: Subscription; One Time Purchase2) By Application: Generic Health and Fitness; Disease Based; Sports Nutrition

3) By End-User: Direct Consumers; Wellness and Fitness Centers; Hospitals and Clinics; Institutions

Subsegments:

1) By Subscription: Monthly Subscription Plans; Quarterly Subscription Plans; Annual Subscription Plans; Personalized Meal Plans Subscription; Nutritional Supplement Subscription; AI-Based Subscription Nutrition Services2) By One-Time Purchase: Single Purchase of Personalized Nutrition Plans; One-Time Purchase of Nutritional Supplements; Custom Meal Kit Purchases; One-Time Purchase of Nutritional Assessments; Single Purchase of DNA or Blood Testing Kits for Nutrition

Key Companies Mentioned: Noom Inc.; 23andMe Holding Co.; MyFitnessPal Inc.; DayTwo Inc.; Nutrisense Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Digital Personalized Nutrition market report include:- Noom Inc.

- 23andMe Holding Co.

- MyFitnessPal Inc.

- DayTwo Inc.

- Nutrisense Inc.

- Viome Life Sciences Inc.

- Lumen Technologies Inc

- Healthifyme Wellness Products and Services Private Limited

- Nutrium

- Habit LLC

- Levels Health Inc.

- Lifesum AB

- Second Nature Healthy Habits Ltd

- InsideTracker

- BiogeniQ Inc.

- CircleDNA

- Persona Nutrition

- Nutrigenomix Inc.

- Rootine

- Caligenix Inc.

- GenoPalate Inc.

- Culina Health Inc.

- Baze Labs GmbH

- Foodvisor

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 0.91 Billion |

| Forecasted Market Value ( USD | $ 1.93 Billion |

| Compound Annual Growth Rate | 20.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |