Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Governments and international organizations are providing crucial support and incentives, while investors increasingly prioritize sustainable practices in their portfolios. As resource scarcity concerns grow and the cost competitiveness of sustainable technologies improves, businesses are more inclined to embrace sustainable chemical solutions. This dynamic landscape underscores a fundamental shift in the chemical industry, where social and environmental responsibility are becoming key drivers of innovation, market expansion, and long-term competitiveness. The sustainable chemicals market stands at the forefront of a transformative era, reflecting a collective commitment to building a more sustainable and resilient future.

Key Market Drivers

Surge in Corporate Sustainability Initiatives

Corporate Sustainability Initiatives play a pivotal role in shaping the growth trajectory of the sustainable chemicals market. As businesses increasingly recognize the importance of aligning their strategies with environmental and social considerations, they are incorporating sustainability into their core initiatives. Many companies are committing to reducing their carbon footprint, minimizing the use of hazardous substances, and adopting eco-friendly practices throughout their supply chains. This strategic shift is driving the demand for sustainable chemicals as a fundamental component of achieving corporate sustainability goals.Innovation within Corporate Sustainability Initiatives is fostering the development of eco-friendly technologies and processes, promoting the use of renewable resources, and advancing green chemistry. This, in turn, is contributing to the expansion of the sustainable chemicals market. Companies are investing in research and development to discover novel, sustainable solutions, further accelerating the market's growth.

Consumers are increasingly making purchasing decisions based on a company's commitment to sustainability. As a result, businesses are integrating sustainable chemicals into their product offerings to meet the evolving preferences of environmentally conscious consumers. This consumer-driven demand acts as a catalyst for companies to invest in and adopt sustainable practices, influencing the growth of the sustainable chemicals market.

Corporate Sustainability Initiatives also enhance a company's reputation and attractiveness to investors. Investors are showing a growing interest in companies that prioritize environmental and social responsibility, which, in turn, incentivizes businesses to incorporate sustainable chemicals into their operations.

Rise in Innovation and Research Development

Innovation and Research Development (RD) are driving forces behind the robust growth of the sustainable chemicals market, contributing significantly to the development, adoption, and commercialization of eco-friendly alternatives. The continuous pursuit of more sustainable and environmentally friendly solutions has spurred substantial investments in RD across industries, leading to breakthroughs in green chemistry, bio-based materials, and renewable resources.The emphasis on sustainability has catalyzed a wave of innovation, giving rise to novel technologies that minimize environmental impact. Researchers are exploring alternative raw materials, such as biomass and agricultural waste, to replace traditional petrochemical sources. Green chemistry principles guide the design of processes that reduce or eliminate hazardous by-products, energy consumption, and waste generation. These innovations not only align with environmental goals but also contribute to the overall growth and competitiveness of the sustainable chemicals market.

Advancements in sustainable chemical technologies are fostering the development of new and improved products. Companies are investing in RD to create eco-friendly alternatives to conventional chemicals without compromising performance or functionality. This not only addresses environmental concerns but also meets the growing demand from consumers and businesses for sustainable options.

Key Market Challenges

Growth in Cost Competitiveness

One of the primary challenges faced by the sustainable chemicals market is achieving cost competitiveness against traditional chemical products. The initial stages of research, development, and implementation of sustainable technologies often involve higher costs than well-established conventional methods. This cost disparity can hinder the widespread adoption of sustainable alternatives, particularly when companies are driven by economic considerations. To address this challenge, there is a need for continuous innovation and process optimization to reduce production costs.As the demand for sustainable products increases, economies of scale may play a role in driving down costs. Government incentives and subsidies can also help bridge the cost gap, encouraging businesses to invest in and adopt sustainable practices. Striking a balance between environmental sustainability and economic viability is crucial to overcoming this challenge and ensuring that sustainable chemicals can compete effectively in the market. As technological advancements progress and more companies embrace sustainable practices, it is expected that cost competitiveness will improve, making sustainable chemicals more attractive to a broader range of industries and consumers.

Limited Availability of Feedstock

A significant challenge facing the sustainable chemicals market is the limited availability of suitable feedstocks, particularly those that are renewable and environmentally friendly. The production of sustainable chemicals often relies on biomass, agricultural crops, or waste materials as feedstocks. However, the competition for these resources can be intense, and there are concerns about their sustainability and impact on food production.The demand for bio-based feedstocks can potentially lead to conflicts between using land for food crops and dedicating it to feedstock production for sustainable chemicals. Additionally, the geographic distribution of feedstock sources may create logistical challenges in ensuring a stable and consistent supply chain.

Key Market Trends

Growing Adoption of Bio-Based Materials

The trend towards bio-based materials represents a significant shift in the sustainable chemicals market. Bio-based materials are derived from renewable biological resources, such as plants, algae, or agricultural waste, as opposed to traditional petrochemical sources. This trend is driven by a growing awareness of the environmental impact of conventional chemical production and a desire to reduce dependence on fossil fuels.Bio-based materials offer several advantages, including a lower carbon footprint, reduced greenhouse gas emissions, and decreased reliance on finite resources. Companies are investing in research and development to discover innovative ways to extract chemicals and materials from biomass, creating a more sustainable and environmentally friendly alternative to traditional chemical manufacturing.

This trend aligns with broader goals of achieving a more circular and sustainable economy. It promotes the use of resources that can be replenished, supporting biodiversity and reducing the environmental degradation associated with extracting and processing non-renewable resources.

Various industries, including packaging, textiles, and automotive, are increasingly incorporating bio-based materials into their products to meet consumer demands for more sustainable and eco-friendly options. The bio-based materials trend reflects a broader commitment to transitioning from a linear, resource-intensive economy to one that embraces principles of sustainability, circularity, and environmental stewardship.

Growth in Green Chemistry

The adoption of circular economy practices is a key trend influencing the sustainable chemicals market. A circular economy is an economic system designed to eliminate waste and promote the continual use and reuse of resources. In the context of the chemical industry, circular economy practices involve reducing the consumption of raw materials, minimizing waste, and designing products and processes that can be easily recycled or repurposed.This trend is driven by a recognition of the environmental impacts associated with linear production and consumption models. In a circular economy, the end goal is to keep products, materials, and resources in use for as long as possible, extracting the maximum value from them before recovering and regenerating materials at the end of their lifecycle.

For the sustainable chemicals market, circular economy practices translate into the development of processes that use recycled or regenerated feedstocks, reducing the dependence on virgin resources. Additionally, it involves creating chemicals and materials that can be easily integrated into closed-loop systems, where they can be recovered and reused without significant environmental impact.

Circular economy initiatives in the chemical industry often focus on extending the lifespan of products, encouraging recycling, and finding innovative ways to recover and reprocess waste materials. This approach aligns with sustainability goals by minimizing resource depletion, reducing energy consumption, and mitigating the environmental impact associated with the production and disposal of chemicals. As regulatory frameworks and consumer preferences increasingly favor circular economy practices, the sustainable chemicals market is likely to see continued growth in this direction.

Segmental Insights

Products Insights

Bio-alcohols have emerged as a dominant segment in the global sustainable chemicals market due to their versatility, renewability, and eco-friendly characteristics. These alcohols, including ethanol and methanol derived from biomass sources such as sugarcane, corn, and lignocellulosic feedstocks, offer a sustainable alternative to traditional petrochemical-based alcohols. The production of bio-alcohols aligns with the increasing demand for cleaner and greener chemicals, as they significantly reduce carbon emissions compared to their fossil fuel counterparts.Bio-alcohols can be used as key building blocks for a wide range of sustainable products, including bio-based plastics, solvents, and fuels, contributing to the overall growth of the sustainable chemicals market. The emphasis on reducing dependence on finite fossil resources and addressing environmental concerns has driven the prominence of bio-alcohols, making them a cornerstone in the transition towards a more sustainable and environmentally conscious chemical industry.

Application Insights

The dominance of the Industrial Chemicals sector in the application of sustainable chemicals can be attributed to several factors. First and foremost, the industrial and chemical industry is a major consumer of diverse chemical products for manufacturing processes, making it a key target for sustainable alternatives. As industries face increasing pressure to reduce their environmental footprint and adhere to stringent regulations, the adoption of sustainable chemicals aligns with their sustainability goals.In the Industrial Chemicals sector, sustainability considerations are crucial for maintaining operational efficiency and meeting environmental compliance standards. Sustainable chemicals offer solutions that not only minimize the environmental impact of industrial processes but also often improve overall efficiency and resource utilization.

The industrial sector often has a significant influence on supply chain dynamics. When major players in the industrial and chemical industry incorporate sustainable practices, it can have a cascading effect throughout the supply chain, encouraging suppliers and manufacturers to follow suit.

The drive for sustainability in the Industrial Chemicals sector is further reinforced by increasing consumer awareness and demand for environmentally friendly products. Companies in this sector recognize the importance of aligning with consumer preferences and are investing in sustainable chemicals to enhance their brand image and market competitiveness.

Regional Insights

Europe's dominance in the global sustainable chemicals market can be attributed to a combination of regulatory initiatives, robust industrial infrastructure, and heightened corporate sustainability commitments. The region has been at the forefront of implementing stringent environmental regulations, encouraging the adoption of sustainable practices. The presence of well-established industries actively embracing eco-friendly alternatives, along with significant research and development investments, has propelled Europe to a leadership position in the sustainable chemicals market.Growing consumer awareness and demand for sustainable products further stimulates the adoption of green technologies, contributing to the region's dominance in shaping the future of environmentally conscious chemical production.

Report Scope: In this report, the Global Sustainable Chemicals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Global Sustainable Chemicals Market, By Products:

- Bio-Alcohols

- Bio-Organic Acids

- Bio-Ketones

- Bio-Polymers

- Others

Global Sustainable Chemicals Market, By Application:

- Industrial Chemicals

- Pharmaceuticals

- Construction

- Packaging

- Automotive

- Others

Global Sustainable Chemicals Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Sweden

- Belgium

- Russia

- Poland

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Vietnam

- Thailand

- Philippines

- South America

- Brazil

- Argentina

- Colombia

- Middle East Africa

- South Africa

- Saudi Arabia

- UAE

- Nigeria

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Sustainable Chemicals Market.Available Customizations:

Global Sustainable Chemicals market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- The Dow Chemical Company

- Saudi Basic Industries Corporation

- Johnson Matthey PLC

- Evonik Industries AG

- Global Bioenergies

- Terraverdae Bioworks Inc.

- Avantium N.V.

- Toray Industries, Inc.

- CJ Biomaterials, Inc.

- Novozymes A/S

- LanzaTech Global, Inc.

- Mitsubishi Chemical Corporation

- TotalEnergies Corbion B.V.

- Vertec BioSolvents, Inc.

- GFBiochemicals Ltd.

- Eastman Chemical Company

- Arkema Group

- Braskem SA

- Plantic Technologies Ltd.

Table Information

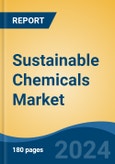

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | April 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 75.15 Billion |

| Forecasted Market Value ( USD | $ 112.53 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |