Dental professionals often recommend tongue cleaners as part of daily oral care routines to reduce bacteria and improve oral health. This advice reinforces the benefits of using tongue cleaners among Canadians, boosting market demand. As per Statistics Canada, nearly two-thirds (65%) of Canadians reported seeing a dental professional in the 12 months preceding 2022. A higher proportion of women (68%) reported having had a recent dental visit than men (62%).

Hence, the North America region witnessed a substantial revenue share in the tongue cleaner market in 2023. In terms of volume, 38.21 million units of tongue cleaners would be utilized in North American market by the year 2301. Tongue cleaning is recognized as an essential component of maintaining optimal oral health, contributing to fresher breath and reducing the risk of oral diseases.

There is a growing emphasis on overall oral health beyond just brushing teeth. Professionals and individuals recognize that maintaining oral hygiene involves more than just brushing. Dental professionals and health organizations actively promote tongue cleaning as part of a complete oral care routine. These campaigns emphasize the advantages of cleansing the tongue's surface to enhance oral health by removing bacteria, food debris, and dead cells. Therefore, increasing awareness of comprehensive oral hygiene drives the market's growth.

Additionally, the personal care industry's expansion has spurred significant innovation in tongue cleaner design, materials, and functionalities. Manufacturers continually introduce new products with advanced features such as ergonomic handles, antimicrobial coatings, and innovative cleaning mechanisms. These innovations enhance product effectiveness, user comfort, and overall oral hygiene benefits, catering to diverse consumer preferences and driving market growth.

However, Tongue cleaners' effectiveness and safety can vary without consistent standards and quality control measures. Consumers may encounter products that do not perform as expected or pose risks such as irritation or damage to the tongue or oral tissues. Inconsistent quality can erode consumer trust in tongue cleaners and the brands that produce them. Consumers rely on standardized products to deliver expected results in terms of oral hygiene. When products vary in quality, it undermines confidence and can lead to reluctance to purchase or use tongue cleaners. In conclusion, standardization and quality control inconsistencies hamper the market's growth.

Driving and Restraining Factors

Drivers- Increasing Awareness of Comprehensive Oral Hygiene

- Expansion Of the Personal Care and Hygiene Industry

- Increasing Incidence of Oral Health Issues

- Inconsistencies In Standardization and Quality Control

- Lack Of Scientific Consensus

- Wider Availability and Accessibility

- Influence Of Dental Professionals

- Perceived Discomfort or Inconvenience

- Competition From Other Oral Care Products

Demographics Outlook

On the basis of demographics, the market is segmented into adults and kids. The adults segment recorded 54% revenue share in the market in 2023. In terms of volume, 83.53 million units of tongue cleaners are expected to be utilized by Adults by the year 231. Adults typically have a higher level of awareness regarding oral hygiene practices compared to children or teenagers. They comprehend the significance of maintaining oral health to prevent dental issues, including gum disease, tooth decay, and bad odor (halitosis).Material Outlook

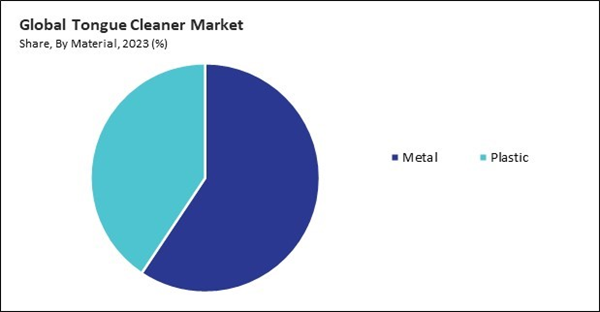

Based on material, the market is divided into metal and plastic. In 2023, the metal segment garnered 59% revenue share in the market. In terms of volume, 85.03 million units of Metal tongue cleaners are expected to be utilized by the year 2031. Metal tongue cleaners are praised for thoroughly cleaning the tongue's surface. The smooth yet firm surface of stainless-steel scrapers allows for efficiently removing bacteria, food debris, and other residues that accumulate on the tongue. This effectiveness is particularly valued by individuals who seek a thorough cleaning experience as part of their oral hygiene routine.Distribution Channel Outlook

By distribution channel, the market is divided into supermarket/hypermarket, online store, retail store, and others. The online channels segment procured 11% revenue share in the market in 2023. In terms of volume, it is expected that 20.79 million units of tongue cleaners would be sold through Online channels by the year 2031. Online channels provide consumers unparalleled convenience, enabling them to browse, compare, and purchase tongue cleaners from the comfort of their residences or while using mobile devices.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 37% revenue share in the market. In terms of volume, 63.72 million units of tongue cleaners are expected to be utilized in Asia Pacific by the year 2031. In many Asian cultures, tongue cleaning has been a part of traditional oral hygiene practices for centuries. These cultural influences continue to shape consumer preferences and behaviors, promoting tongue cleaners as integral components of holistic oral care regimens.List of Key Companies Profiled

- Church & Dwight Co., Inc.

- Oxyfresh Worldwide, Inc.

- AMANO Products limited

- Wisdom Toothbrushes Ltd.

- Banyan Botanicals Products

- Prestige Consumer Healthcare, Inc.

- supersmile

- TePe Munhygienprodukter AB

- Tung's Products, Inc.

Market Report Segmentation

By Material (Volume, Thousand Units, USD Million, 2020-2031)- Metal

- Plastic

- Supermarket/Hypermarket

- Retail Store

- Online Store

- Others

- Adults

- Kids

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Church & Dwight Co., Inc.

- Oxyfresh Worldwide, Inc.

- AMANO Products limited

- Wisdom Toothbrushes Ltd.

- Banyan Botanicals Products

- Prestige Consumer Healthcare, Inc.

- supersmile

- TePe Munhygienprodukter AB

- Dr. Tung's Products, Inc.