Global Gold Market - Key Trends & Drivers Summarized

What Is the Significance of Gold and Its Historical Context?

Gold has been a symbol of wealth and a form of currency, jewelry, and investment for thousands of years. Its allure stems from its physical properties: it is malleable, resistant to tarnish, and its brilliant luster. Historically, gold has played a central role in many economies and has been used as a stable foundation for monetary systems. Even today, countries hold large reserves of gold as a safeguard to stabilize national economies and as a hedge against inflation or economic uncertainty. This precious metal is mined in several countries, with China, Australia, Russia, and the United States being the largest producers. The process of mining gold can be intensive and complex, involving extensive exploration, excavation, and processing.How Are Technological Advancements Impacting Gold Production and Use?

Technological advancements have significantly transformed the methods of extracting and processing gold, increasing efficiency and environmental sustainability. Modern techniques in gold mining include bio-mining, which uses microbial processes to extract gold from ore and reduce the environmental impact associated with traditional extraction methods such as cyanide leaching. In gold refining, advancements have streamlined processes to reduce waste and improve the purity of the final product. Technology has also expanded the use of gold beyond adornment and currency into applications such as electronics, where gold's excellent conductivity makes it valuable for use in high-end connectors and circuit boards, and healthcare, where it is used in diagnostic procedures and treatments.What Are the Current Market Dynamics Influencing Gold Demand?

The demand for gold is influenced by various factors that make it unique compared to other commodities. It is driven not only by its practical uses in jewelry and technology but also by its role as an investment vehicle. During times of economic uncertainty, gold is often seen as a 'safe haven' investment due to its intrinsic value and historical reliability. This has been evident during economic downturns, where an increase in investment demand for gold often offsets the declines in its industrial and jewelry use. Additionally, the growing middle class in emerging markets has spurred demand for gold jewelry, particularly in countries like China and India, where gold is deeply woven into the cultural fabric. Central bank policies, inflation rates, and currency stability also significantly affect gold prices and investment demand.What Drives the Growth of the Gold Market?

The growth in the gold market is driven by several factors. Economic volatility and uncertainty often lead investors to gold as a safe store of value, pushing up its price and demand. Technological advancements that lower the cost of gold extraction and processing also contribute to market growth by sustaining its supply at lower costs. Moreover, the expansion of the middle class in emerging economies boosts demand for gold jewelry and ornaments, further propelling the market. Additionally, as new uses for gold in technology and medicine are developed, its industrial demand continues to expand. Global trade policies and geopolitical tensions can also impact the gold market, influencing investor behavior and gold prices.Report Scope

The report analyzes the Gold market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Jewelry, Bars & Coins, ETFs & Similar Products, Central Banks & Other Investments, Technology).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gold Jewelry segment, which is expected to reach 3 Thousand Tonnes by 2030 with a CAGR of a 5.6%. The Gold Bars & Coins segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 1.2 Thousand Tonnes in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach 1.4 Thousand Tonnes by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gold Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gold Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gold Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AngloGold Ashanti, Barrick Gold Corporation, Furukawa Co., Ltd., Gabriel Resources Ltd., Harmony Gold Mining Company Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 366 companies featured in this Gold market report include:

- AngloGold Ashanti

- Barrick Gold Corporation

- Furukawa Co., Ltd.

- Gabriel Resources Ltd.

- Harmony Gold Mining Company Limited

- Jinshan Gold

- Johnson Matthey PLC

- Kinross Gold Corporation

- New Gold Inc.

- New mont Mining Corporation

- Tertiary Minerals PLC

- Vedanta Resources PLC

- Zijin Mining Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AngloGold Ashanti

- Barrick Gold Corporation

- Furukawa Co., Ltd.

- Gabriel Resources Ltd.

- Harmony Gold Mining Company Limited

- Jinshan Gold

- Johnson Matthey PLC

- Kinross Gold Corporation

- New Gold Inc.

- New mont Mining Corporation

- Tertiary Minerals PLC

- Vedanta Resources PLC

- Zijin Mining Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 513 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

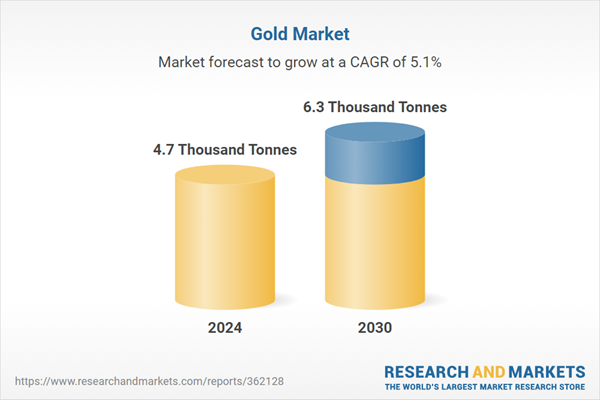

| Estimated Market Value in 2024 | 4.7 Thousand Tonnes |

| Forecasted Market Value by 2030 | 6.3 Thousand Tonnes |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |