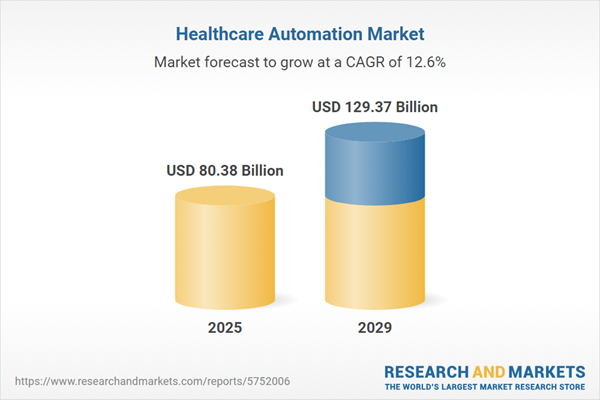

The healthcare automation market size has grown rapidly in recent years. It will grow from $72.59 billion in 2024 to $80.38 billion in 2025 at a compound annual growth rate (CAGR) of 10.7%. The growth in the historic period can be attributed to regulatory compliance, patient safety, increased ehr adoption, operational efficiency, medical device integration.

The healthcare automation market size is expected to see rapid growth in the next few years. It will grow to $129.37 billion in 2029 at a compound annual growth rate (CAGR) of 12.6%. The growth in the forecast period can be attributed to population health management, medication management, precision medicine, pandemic preparedness, increased aging population. Major trends in the forecast period include robotics in healthcare, artificial intelligence (ai) in diagnostics, blockchain for health data security, internet of things (iot) for healthcare, smart hospitals.

The growing adoption of automation is driving the expansion of the healthcare automation market. Automation adoption refers to the integration of advanced solutions in healthcare facilities. These facilities are implementing automation to boost efficiency and streamline operations. For example, in July 2023, Koninklijke Philips N.V., a Netherlands-based multinational corporation, published the Future Health Index 2023 Australian report, the largest global healthcare survey, revealing that nearly half (47%) of healthcare leaders are utilizing automation to improve patient processes, such as automating appointment scheduling, while 43% are using it to optimize internal operations like automating administrative tasks and enhancing workflows. Consequently, the increased adoption of automation is expected to fuel the growth of the healthcare automation market in the coming years.

A significant factor contributing to the expansion of the healthcare automation market is the increasing investment in healthcare automation. This involves allocating capital to implement technologies and processes that streamline healthcare operations, reduce costs, and enhance patient care. The growing investment in healthcare automation fosters innovation, accelerates adoption, and expands the market by improving technology accessibility and addressing evolving industry needs. According to the Healthcare Information and Management Systems Society (HIMSS), approximately 80% of health systems plan to increase their investments in digital healthcare over the next five years. The rising investment in healthcare automation is poised to play a crucial role in driving the growth of the healthcare automation market.

Artificial intelligence (AI) adoption has emerged as a prominent trend in the healthcare automation market. Major industry players are focusing on implementing AI in healthcare to assist providers in various aspects of patient care and administrative operations. Innovaccer Inc., a US-based healthcare data platform company, exemplifies this trend by launching the AI Automation Suite, Sara for Healthcare, in August 2023. This suite of AI solutions is designed to facilitate population health management, customer relationship management, value-based care, self-serve analytics, and care management and coordination. The integration of AI in healthcare automation is expected to enhance efficiency while maintaining safety, accuracy, security, compliance, and scalability specific to the needs of healthcare information technology (IT). This underscores the importance of AI as a driving force in the healthcare automation market.

Leading companies in the healthcare automation market are prioritizing technological advancements to maintain their market position, exemplified by offerings like the AGS Artificial Intelligence (AI) Platform. This innovative platform integrates artificial intelligence, automation, and human expertise to optimize healthcare revenue cycles. Launched by AGS Health, a US-based technology company, the AGS AI Platform provides enhanced operational visibility, predictive analytics, and customized solutions to prevent bottlenecks and revenue losses in healthcare settings. The platform utilizes intelligent worklists, productivity reports, customizable dashboards, root cause analysis, and executive reporting to offer comprehensive insights into daily operations and overall revenue cycle performance. With predictive analytics and performance trend analysis, the AGS AI Platform aids in mitigating revenue leakage, preventing bottlenecks, and reducing denials. This integration of automation and AI with human-in-the-loop services underscores the commitment to advancing technology for optimized healthcare operations.

In November 2023, qBotica, an India-based software company, acquired Healthomation for an undisclosed amount. This acquisition aims to expand qBotica's range of automation solutions in the healthcare sector. By leveraging their combined expertise in artificial intelligence (AI) and machine learning (ML), both companies plan to meet the increasing demand for automation in healthcare, enhancing patient care and streamlining operational processes. Healthomation is a US-based company specializing in healthcare automation solutions.

Major companies operating in the healthcare automation market include 3M Company, Accuray Inc., Aetna Inc., Allscripts Healthcare Solutions, Becton Co., Cerner Corporation, Danaher Corporation, Dickinson and Company, General Electric Company, International Business Machines Corporation, Intuitive Surgical Inc., Koninklijke Philips N.V., McKesson Corporation, MedeAnalytics, Medtronic plc, OptumHealth, Oracle Corporation, Stryker Corporation, Swisslog Holding AG, Tecan Group Ltd., Truven Health Analytics Pvt. Ltd., UnitedHealth Group Incorporated, Verisk Analytics Inc., Abbott Laboratories, Agilent Technologies, Athenahealth, Capsule Technologies Inc., Change Healthcare Co., Elekta, Epic Systems Corporation, Hologic Co., IBM Watson Health.

North America was the largest region in the healthcare automation market in 2024. The regions covered in the healthcare automation market share report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the healthcare automation market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

Healthcare automation involves the utilization of modern tools and software to enhance the efficiency of delivering medical services, focusing on monitoring the safety, security, and health status of patients.

The key components within healthcare automation encompass equipment, software, and services. Various applications include therapeutic automation, lab and pharmacy automation, logistics and training automation, diagnostics and monitoring automation, and others. In the healthcare automation market, therapeutic automation refers to digital therapy systems, which are software-based products designed for the prevention, management, and treatment of health issues. These systems find applications in pharmacies, research institutes and labs, home care, and other end-users.

The healthcare automation market research report is one of a series of new reports that provides healthcare automation market statistics, including healthcare automation industry global market size, regional shares, competitors with healthcare automation market share, detailed healthcare automation market segments, market trends and opportunities, and any further data you may need to thrive in the healthcare automation industry. This healthcare automation market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The healthcare automation market includes revenues earned by entities by care management systems, healthcare solutions enhancement systems, patient experience systems, and provider software solutions. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Healthcare Automation Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on healthcare automation market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for healthcare automation? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The healthcare automation market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) Covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Equipment; Software; Services2) By Application: Therapeutic Automation; Lab and Pharmacy Automation; Logistics and Training Automation; Diagnostics and Monitoring Automation; Other Applications

3) By End-User: Pharmacies; Research Institutes and Labs; Home Care; Other End-Users

Subsegments:

1) By Equipment: Automated Laboratory Equipment; Pharmacy Automation Systems; Surgical Robots; Point-of-Care Testing Devices2) By Software: Laboratory Information Management Systems (LIMS); Electronic Health Records (EHR) Systems; Workflow Management Software; Clinical Decision Support Systems (CDSS)

3) By Services: Consulting Services; Integration Services; Maintenance and Support Services; Training Services

Key Companies Mentioned: 3M Company; Accuray Inc.; Aetna Inc.; Allscripts Healthcare Solutions; Becton Co.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Healthcare Automation market report include:- 3M Company

- Accuray Inc.

- Aetna Inc.

- Allscripts Healthcare Solutions

- Becton Co.

- Cerner Corporation

- Danaher Corporation

- Dickinson and Company

- General Electric Company

- International Business Machines Corporation

- Intuitive Surgical Inc.

- Koninklijke Philips N.V.

- McKesson Corporation

- MedeAnalytics

- Medtronic plc

- OptumHealth

- Oracle Corporation

- Stryker Corporation

- Swisslog Holding AG

- Tecan Group Ltd.

- Truven Health Analytics Pvt. Ltd.

- UnitedHealth Group Incorporated

- Verisk Analytics Inc.

- Abbott Laboratories

- Agilent Technologies

- Athenahealth

- Capsule Technologies Inc.

- Change Healthcare Co.

- Elekta

- Epic Systems Corporation

- Hologic Co.

- IBM Watson Health

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 80.38 Billion |

| Forecasted Market Value ( USD | $ 129.37 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |