Global Hotel Franchise Market - Key Trends & Drivers Summarized

Why Are Hotel Franchises Gaining Momentum in a Post-Pandemic Travel Economy?

Hotel franchises are witnessing renewed global momentum as operators seek resilient, scalable, and brand-driven models to navigate the post-pandemic hospitality landscape. Franchising allows hotel owners to operate under an established brand with a proven reputation, standardized service models, and access to global reservation systems, marketing platforms, and operational support. In a market where consumer confidence is returning but competition remains high, franchise affiliations provide smaller and independent owners with the tools and visibility needed to capture demand across both leisure and business travel segments. The standardized brand promise, loyalty program integration, and digital booking infrastructure of franchises also serve to reduce the customer acquisition cost and increase occupancy consistency across seasons.The model's appeal is further reinforced by the balance it offers between brand control and operational independence. Franchisees benefit from access to staff training, procurement networks, design guidelines, and technology systems, while retaining ownership and day-to-day control of the property. This structure appeals especially to regional investors, family businesses, and first-time hoteliers seeking to mitigate market entry risks without building brand equity from scratch. As travelers increasingly prioritize hygiene, consistency, and digitally enabled experiences, hotel franchises have emerged as a trusted option, offering standardized safety protocols, app-based guest engagement, and recognizable service levels - all of which contribute to stronger post-pandemic recovery trajectories across urban, suburban, and resort markets.

How Are Brand Diversification and Asset-Light Strategies Reshaping Franchise Expansion?

Global hotel chains are accelerating their asset-light growth strategies by expanding their franchise portfolios across price points, niche categories, and geographies. This trend is reshaping the competitive landscape, as multinational hospitality groups launch sub-brands and soft brands to cater to increasingly segmented traveler preferences. From economy and midscale to boutique lifestyle and extended-stay formats, franchisors are creating flexible brand identities that allow franchisees to target distinct demographics - ranging from digital nomads and wellness travelers to long-term guests and budget-conscious tourists. These diversified brand portfolios enable hospitality groups to maximize market penetration while offering investors more tailored franchising opportunities based on location, target market, and capital requirements.Simultaneously, franchisors are emphasizing simplified conversion models and turnkey development packages to drive faster onboarding of existing independent hotels or underperforming properties. Many brands now offer streamlined brand adaptation kits that include design templates, technology infrastructure, and marketing support, significantly reducing time-to-market for new franchisees. This approach is proving effective in secondary cities, suburban corridors, and emerging markets where local operators are looking to elevate service standards and revenue potential through global branding. As interest in lifestyle-focused, digitally enabled, and experience-rich hotel formats rises, franchisors are also forging partnerships with real estate developers and institutional investors to co-develop brand-driven properties optimized for both profitability and scalability.

What Economic, Regulatory, and Technological Trends Are Influencing Franchise Operator Strategy?

Economic uncertainty, rising construction costs, and evolving labor dynamics are pushing hotel franchise operators to adopt leaner and more flexible business models. Many are reevaluating site selection, room size configurations, and staffing models to maintain operating margins in fluctuating demand environments. Franchisors are also refining their fee structures and performance-based incentives to attract qualified franchisees and align long-term interests. These adjustments are particularly important in developing markets, where cost sensitivity is high and return-on-investment timelines are closely scrutinized. Meanwhile, global economic recovery and pent-up travel demand are reigniting investment interest in hotel franchising, particularly in markets where tourism infrastructure is being prioritized as part of national economic development strategies.On the regulatory front, the franchising landscape is being influenced by evolving disclosure requirements, labor laws, and zoning regulations. Markets such as the U.S., Canada, the EU, and Australia are introducing stricter compliance and franchisee protection frameworks, which impact contractual structures, brand control clauses, and dispute resolution mechanisms. Technology adoption continues to be a key performance differentiator, with franchisors investing in cloud-based property management systems (PMS), centralized revenue management platforms, digital guest engagement tools, and AI-powered analytics. These technologies are helping franchisees drive operational efficiency, improve pricing strategy, and elevate the guest experience across all touchpoints. As automation, personalization, and sustainability emerge as core hospitality themes, franchisors are embedding them into their brand standards to remain competitive and franchisee-relevant.

What Is Driving the Growth of the Hotel Franchise Market Across Segments and Regions?

The growth in the hotel franchise market is driven by rising global travel demand, changing ownership preferences, and the expanding footprint of branded hospitality in underserved regions. In North America and Europe, franchise growth is being sustained by the recovery of domestic travel, the return of business events, and the reactivation of loyalty programs. Midscale and upper-midscale franchises continue to dominate these mature markets, offering a strong balance of affordability, service consistency, and brand recognition. In Asia-Pacific, Latin America, and the Middle East, the proliferation of urban hubs, tourism corridors, and infrastructural investments is creating new opportunities for branded hotels - especially in tier 2 and tier 3 cities - where franchising offers a fast-track to modern hospitality standards and international visibility.Across segments, the extended-stay, economy, and lifestyle categories are experiencing the fastest franchise growth, driven by demand for affordable and flexible lodging options amid rising travel frequency, digital workforce trends, and a heightened focus on experiential stays. New-generation travelers are increasingly prioritizing authenticity, design, and wellness, leading to a surge in demand for boutique-style franchise formats that deliver local flavor within a branded service framework. Government-led tourism initiatives, foreign investment incentives, and smart city developments are further catalyzing franchise-based hotel expansion in emerging regions. Collectively, these trends are establishing franchising as a foundational pillar in the global hotel industry’ s post-pandemic recovery and future-ready growth trajectory.

Report Scope

The report analyzes the Hotel Franchises market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Chain Value (Luxury, Upscale, Midscale, Economy); Hotel Type (Extended stay, Residence, Select service, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Luxury Hotel Chains segment, which is expected to reach US$19.9 Billion by 2030 with a CAGR of a 4.3%. The Upscale Hotel Chains segment is also set to grow at 7.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.4 Billion in 2024, and China, forecasted to grow at an impressive 9.4% CAGR to reach $11.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hotel Franchises Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hotel Franchises Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hotel Franchises Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arctic Spas, Aspen Spas, Beachcomber Hot Tubs, Bullfrog Spas, Cal Spas and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Hotel Franchises market report include:

- ACCOR SA

- Best Western Hotels

- BWH Hotels

- Choice Hotels Development

- Drury Hotels

- Extended Stay America

- G6 Hospitality

- Hilton Worldwide Holdings Inc.

- Hyatt Hotels & Resorts

- InterContinental Hotels Group PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACCOR SA

- Best Western Hotels

- BWH Hotels

- Choice Hotels Development

- Drury Hotels

- Extended Stay America

- G6 Hospitality

- Hilton Worldwide Holdings Inc.

- Hyatt Hotels & Resorts

- InterContinental Hotels Group PLC

Table Information

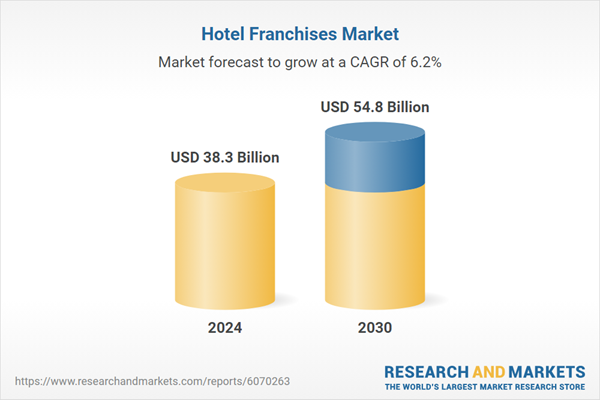

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 38.3 Billion |

| Forecasted Market Value ( USD | $ 54.8 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |