Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Cybersecurity Threats and Data Breaches

The increasing frequency and sophistication of cyberattacks are a major driver of the GCC cyber insurance market. Cybercriminals are targeting critical sectors such as banking, healthcare, government, and energy, leading to significant financial and reputational damage. Ransomware attacks, phishing schemes, and advanced persistent threats (APTs) are becoming more prevalent, compelling businesses to seek financial protection through cyber insurance.With the rapid adoption of digital technologies, businesses are storing vast amounts of sensitive data, making them more vulnerable to cyber risks. In 2024, the Kingdom experienced a 35% increase in cyber-attacks, with phishing and ransomware emerging as the most prevalent threats. Additionally, state-sponsored cyber threats and geopolitical tensions further exacerbate cybersecurity vulnerabilities in the region. The insurance industry is responding by offering specialized coverage, including protection against business interruption, regulatory fines, and incident response costs, making cyber insurance an essential risk management tool.

Key Market Challenges

Lack of Standardized Cyber Risk Assessment and Pricing

One of the major challenges in the GCC cyber insurance market is the absence of standardized risk assessment methodologies and pricing models. Unlike traditional insurance sectors, where risks are relatively predictable, cyber risks are dynamic and constantly evolving, making it difficult for insurers to accurately assess exposures. Many businesses in the region lack comprehensive cybersecurity frameworks, leading to inconsistent risk profiles across industries. This variation creates challenges for insurers in pricing policies effectively, often resulting in either overly expensive premiums or insufficient coverage.Additionally, insurers rely on historical data to determine pricing, but the rapidly changing nature of cyber threats means past incidents may not accurately predict future risks. As a result, businesses may either find cyber insurance unaffordable or purchase policies that do not provide adequate coverage. To address this issue, insurers need to collaborate with cybersecurity firms to develop advanced risk assessment models that consider real-time threats, regulatory requirements, and industry-specific vulnerabilities. Standardization in underwriting criteria will help insurers create more tailored and cost-effective cyber insurance solutions, ensuring better market penetration and risk management.

Key Market Trends

Growing Demand for Tailored and Industry-Specific Policies

The demand for customized cyber insurance policies tailored to specific industries is rising in the GCC market. Businesses in critical sectors such as banking, healthcare, energy, and government face unique cyber risks, requiring specialized coverage beyond generic policies. For instance, the banking sector is highly targeted for financial fraud, ransomware, and data breaches, necessitating coverage for fraudulent transactions and regulatory penalties. Similarly, the healthcare industry is vulnerable to medical data breaches, driving demand for policies that include patient data protection and compliance coverage under regional health data regulations.In response, insurers are developing industry-specific cyber policies with customized risk assessments, premium structures, and incident response support. For example, several insurers in the UAE and Saudi Arabia are offering cyber coverage designed explicitly for fintech firms, which include protections against digital payment fraud and cryptocurrency-related risks. This trend is expected to accelerate as more businesses recognize the need for tailored insurance solutions that align with their operational vulnerabilities and regulatory requirements.

Key Market Players

- American International Group, Inc.

- Chubb Limited

- AXA XL

- Allianz SE

- Zurich Insurance Company Ltd

- Marsh LLC

- Aon plc.

- Beazley Plc

- Qatar Insurance Company Q.S.P.C.

- Saudi Arabian Insurance Company (SAIC)

Report Scope:

In this report, the GCC Cyber Insurance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:GCC Cyber Insurance Market, By Insurance Type:

- Standalone

- Tailored

GCC Cyber Insurance Market, By Coverage:

- First-party

- Liability Coverage

GCC Cyber Insurance Market, By End User:

- Healthcare

- Retail

- BFSI

- IT

- Others

GCC Cyber Insurance Market, By Country:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Bahrain

- Kuwait

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the GCC Cyber Insurance Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- American International Group, Inc.

- Chubb Limited

- AXA XL

- Allianz SE

- Zurich Insurance Company Ltd

- Marsh LLC

- Aon plc.

- Beazley Plc

- Qatar Insurance Company Q.S.P.C.

- Saudi Arabian Insurance Company (SAIC)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | February 2025 |

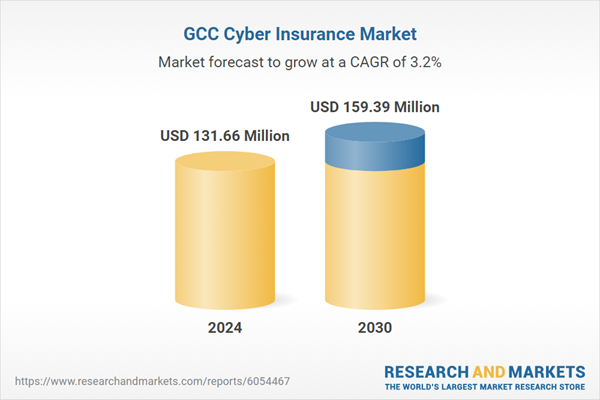

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 131.66 Million |

| Forecasted Market Value ( USD | $ 159.39 Million |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Middle East |

| No. of Companies Mentioned | 10 |