Increasing Demand for Sustainable Menstrual Products Boosts Middle East & Africa Menstrual Cups Market

The surging demand for sustainable menstrual products is a primary driver propelling the menstrual cup market. In recent years, there has been a global shift toward sustainability, with consumers becoming increasingly aware of the environmental impact of traditional disposable menstrual products. Traditional pads and tampons contribute significantly to plastic waste, and their production involves consuming resources and energy. Every year, an average woman trashes nearly 150 kilograms of nonbiodegradable waste. Menstrual cups have emerged as a leading choice as individuals seek eco-friendly alternatives due to their reusable nature. This heightened environmental consciousness drives consumers to opt for products that minimize their ecological footprint, boosting the demand for menstrual cups.The increased demand for sustainable menstrual products is closely tied to a broader movement advocating women's health and well-being. Consumers are increasingly prioritizing products that are not only good for the environment but also safe and beneficial for their health. Menstrual cups, typically made from medical-grade silicone, rubber, or thermoplastic elastomers, are considered safe and hygienic, reducing the risk of irritation and allergic reactions often associated with traditional products. The alignment of menstrual cups with environmental sustainability and women's health contributes to their appeal, acting as a driver for their rising popularity.

The call for sustainability in menstrual products has been amplified by various advocacy groups, NGOs, and government initiatives that aim to raise awareness about the environmental impact of disposable options. Campaigns promoting sustainable menstruation have been crucial in educating the public about the benefits of reusable alternatives like menstrual cups. The growing visibility and endorsement of sustainable menstrual practices contribute to a positive shift in consumer attitudes, fostering greater acceptance and adoption of menstrual cups.

The demand for sustainable menstrual products is also fueled by a younger generation of consumers prioritizing eco-conscious choices. Millennials and Generation Z, in particular, drive the demand for sustainable and ethical products across various industries, including personal care. These demographics' awareness and preferences influence market trends, and menstrual cups, being a sustainable and forward-thinking option, align well with their values. As this demographic continues to grow in purchasing power, the demand for menstrual cups will also grow, reinforcing their position in the market as a leading sustainable menstrual product.

Middle East & Africa Menstrual Cups Market Overview

In the Middle East & Africa, there is a surge in demand for menstrual cups due to rising cultural shifts and increasing access to education that challenges taboos surrounding menstruation. As awareness grows, individuals seek alternatives that provide greater comfort and convenience. With their long-lasting and reusable nature, menstrual cups are gaining acceptance as a practical and discreet solution, allowing women in the Middle East & Africa to manage their menstrual hygiene in a flexible manner. Many campaigns also contribute to the surge of benefits associated with menstrual cups. For instance, THE CUP Foundation is a global campaign, in partnership with a few of the leading menstrual cup producers, that aims to provide a menstrual cup to one million girls living in poverty and to enroll them in a two-week program that covers several social, physical, and emotional issues faced by them Currently, the program is helping girls aged 9-14 in schools in Kenya, and it aims to expand to India in the near future.Furthermore, the focus on hygiene and sanitation in the Middle East & Africa drives the demand for menstrual cups. Access to clean and affordable sanitary products might be limited to a few areas, leading individuals to explore sustainable options that do not compromise hygiene. Menstrual cups are reusable and easy to maintain and offer a reliable solution that aligns with the region's emphasis on maintaining good hygiene practices, especially in areas where traditional sanitary options might be less accessible.

Additionally, the environmental impact of disposable menstrual products is gaining attention in the Middle East & Africa. As knowledge about sustainability and environmental consciousness grows, individuals in the region become more aware of the ecological consequences of single-use items. Menstrual cups' reusable and eco-friendly nature appeals to those seeking a solution that minimizes waste and contributes to a more sustainable approach to menstrual hygiene in the Middle East & Africa.

Middle East & Africa Menstrual Cups Market Segmentation

The Middle East & Africa menstrual cups market is categorized into type, material, distribution channel, and country.Based on type, the Middle East & Africa menstrual cups market is bifurcated into reusable and disposable. The reusable segment held a larger market share in 2022.

In terms of material, the Middle East & Africa menstrual cups market is categorized into medical grade silicon, rubber, and thermoplastic elastomer. The medical grade silicon segment held a larger market share in 2022.

By distribution channel, the Middle East & Africa menstrual cups market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The online retail segment held the largest market share in 2022.

By country, the Middle East & Africa menstrual cups market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa menstrual cups market share in 2022.

Diva International Inc, Lena Cup LLC, Lune Group Oy Ltd, Pixie Cup LLC, Saalt LLC, and The Flex Co are among the leading companies operating in the Middle East & Africa menstrual cups market.

Table of Contents

Companies Mentioned

- Diva International Inc

- Lena Cup LLC

- Lune Group Oy Ltd

- Pixie Cup LLC

- Saalt LLC

- The Flex Co

Table Information

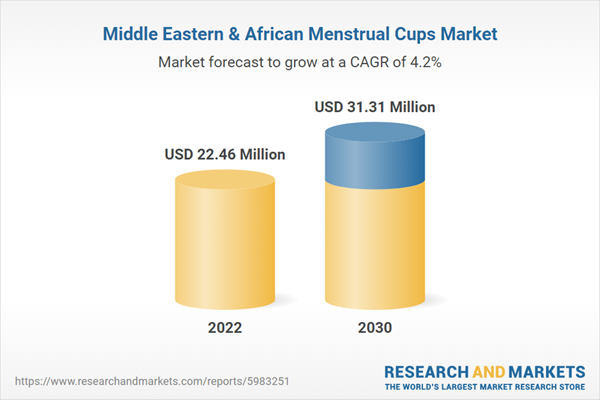

| Report Attribute | Details |

|---|---|

| No. of Pages | 69 |

| Published | May 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 22.46 Million |

| Forecasted Market Value ( USD | $ 31.31 Million |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 6 |