Speak directly to the analyst to clarify any post sales queries you may have.

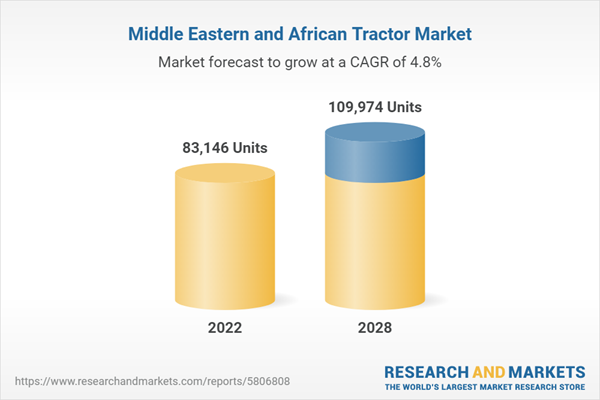

The Middle East and Africa tractor market is expected to grow at a CAGR of 4.77% from 2022-2028.

KEY HIGHLIGHTS

- The Middle East & Africa has over 578 million food consumers. The region witnessed a massive increase in farm mechanization in terms of agricultural and industrial productivity.

- The Middle East and Africa tractor market is highly concentrated, with the top players controlling most of the market. Domestic and global brands, on the other hand, are equally represented in the industry.

- The Middle East and Africa tractor market increased by 4.0% in 2022 from 2021. The increase in crop production and tractor sales was due to favorable climate conditions and government support to farmers.

- Several Middle East & African countries' governments plan to double the number of agricultural products and revenue from exporting these products by 2030.

- The Middle East & African government plans schemes and initiatives to facilitate credit and improve agriculture-related operations, which will contribute to the growth of the overall value chain of the industry.

MARKET TRENDS & OPPORTUNITIES

Use of Energy-efficient Agri Equipment

The Middle East & African countries’ governments aim to improve the living conditions of those in the agricultural supply chain and to provide essential equipment sustainably. This aim joins an already announced objective to reduce total greenhouse gas (GHG) emissions by 30-40% by 2030 and zero emissions by 2040. The adoption of energy-efficient agricultural equipment will enable the fulfillment of these objectives.

Technological Advances in Tractor Technology

A new frontier of innovation emerged as agriculture met digital technology, opening various paths to a smart agricultural future. Tractor manufacturers are competitive, and companies constantly strive to innovate and ensure product differentiation at affordable prices. State-of-the-art technology-based tractors are currently available in the market. GPS and remote sensing make farming more accurate and productive.

SEGMENTATION INSIGHTS

INSIGHTS BY HORSEPOWER

In 2022, the less 50 HP segment recorded a high share in the Middle East and Africa tractor market. The major factor for the steady growth of the low-power range of tractors is the increased business turnover among hobby and livestock farmers. Compact tractors are widely used by farmers engaged in row-crop farming and horticulture in Middle East & African countries. Individuals keen to grow organic foods at a small level also use these tractors. The less than 50 HP tractors are best suited for inter-culture operations and in and around crops with softer stems and low-rise plants. Moreover, compact tractors can be used for pesticide spraying.

Segmentation by Horsepower

- Less Than 50 HP

- HP-100 HP

- Above 100 HP

INSIGHTS BY WHEEL-DRIVE

The tractor market in MEA mainly consists of 2WD tractors and 4WD tractors are a few in the region. The prospect for both 2WD & 4WD tractors is promising in the region. The governments of MEA countries are focusing on farmers and devising policies such as financial assistance and subsidies to empower small-scale farmers. The Middle East and Africa tractor market is dominated by low-range HP 2WD tractors. Among the several tractor models available in the country, 2WD tractors are the most favored by farmers. The low relative cost of ownership, the sufficiency of features and haulage power, and convention make 2WD tractors more popular among farmers. Ease of driving and flexibility with light loads and in plain fields are major factors that boost the demand for two-wheel-drive tractors. John Deere, Massey Ferguson, and New Holland share most of the 2-wheel drive tractors segment.

Segmentation by Wheel Drive

- 2-Wheel-Drive

- 4-Wheel-Drive

GEOGRAPHICAL ANALYSIS

Turkey holds the highest Middle East and Africa tractor market share, accounting for around 80% in 2022. Mechanized feedlots typically characterize the agricultural scenario in Turkey through automatic irrigation systems and agricultural machinery. As the demand for food and associated resources from the Middle East & Africa’s largest economy rises, there has been a tremendous rise in input resources such as farm machinery usage to improve productivity and efficiency. Also, the agriculture sector in Turkey is typically marked by a tremendous decline in the labor force, a consistent rise in productivity, and the segregation of larger farms into smaller and medium ones. The Government of Turkey plays a major role in ensuring self-sufficiency in food grain production as per the increasing population. The government has consistently increased its budget allocation for agriculture and allied activities.

Segmentation by Geography

- Turkey

- Saudi Arabia

- South Africa

- Israel

- Others

COMPETITIVE LANDSCAPE

John Deere, New Holland, Massey Ferguson, and Mahindra dominated the Middle East and Africa tractor market with a collective industry share of over 40% in 2022. These brands have adopted several strategies to gain traction in the industry. These players are thriving on innovation in the tractor industry. They are increasingly investing in developing advanced agricultural tractor technology for precision farming and machine automation.

Key Company Profiles

- John Deere

- CNH Industrial

- AGCO

- Kubota

Other Prominent Vendors

- Mahindra

- Deutz-Fahr

- Claas

- TAFE

- V.S.T. Tillers Tractors Limited

- ISEKI & Co., Ltd.

- KIOTI

- Escorts

- Yanmar

Recent Developments

- In March 2023, John Deere announced MY24 updates for its 7, 8, and 9 Series Tractors lineup that will help prepare them for the future of precision agriculture.

- John Deere launched the new electric variable transmission (EVT) in March 2022 for select 8 Series Tractors and a new JD14X engine for 9 Series.

- Massey Ferguson launched the MF 6S series tractors in February 2022. This machine provides up to 180 HP with advanced technology.

- In February 2022, New Holland North America, CNH industrial brand, announced the launch of the world’s first production T6 Methane Power tractor in the US.

- CNH Industrial partnered with Monarch Tractors in March 2021, a US-based agri-technology company, to improve long-term sustainability and raise awareness of the importance of zero-emission agriculture among farmers.

WHY SHOULD YOU BUY THIS REPORT?

This report is among the few in the market that offer outlook and opportunity analyses forecast in terms of:

- Market Size & Forecast Volume (Units) 2020-2028

I. Segmentation by Horsepower

II. Segmentation by Wheel Drive

III. Segmentation by Geography

- Production and trade values

- Major current and upcoming projects and investments

- Competitive intelligence about the economic scenario, advantages in the Middle East & Africa, market dynamics, and market shares

- Latest and innovative technologies

- COVID-19 impact analysis of the market

- Company profiles of major and other prominent vendors

- Middle East and Africa tractor market shares of major vendors

KEY QUESTIONS ANSWERED:

- What are the expected units sold in the Middle East and Africa tractor market by 2028?

- What is the growth rate of the Middle East and Africa tractor market?

- How big is the Middle East and Africa tractor market?

- Who are the key companies in the Middle East and Africa tractor market?

- Which region holds the largest Middle East and Africa tractor market share?

Table of Contents

1 Research Methodology2 Research Objectives3 Research Process

Companies Mentioned

- John Deere

- CNH Industrial

- AGCO

- Kubota

- Mahindra

- Deutz-Fahr

- Claas

- TAFE

- V.S.T. Tillers Tractors Limited

- ISEKI & Co., Ltd.

- KIOTI

- Escorts

- Yanmar

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 162 |

| Published | May 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value in 2022 | 83146 Units |

| Forecasted Market Value by 2028 | 109974 Units |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 13 |