The global nanoparticle formulation market is estimated to grow from USD 5.1 billion in 2025, to USD 15.1 billion by 2035, at a CAGR of 9.4% during the forecast period to 2035.

Nanoparticle Formulation Market: Growth and Trends

Having demonstrated a strong therapeutic potential across a myriad of diseases, nanoparticle-based drugs have emerged as a promising treatment alternative within a short span. In fact, given the current ongoing pace of research, experts believe that remarkable innovations in the field of nanoparticles (in terms of improvement in disease diagnosis and treatment specificity) are likely to revolutionize the pharma industry in the coming years. Furthermore, the recent initiatives focused on nanotechnology for the detection and control of vector-borne diseases, dialysis, and molecular imaging, have further fueled the demand for these nanoparticles.

In addition, the nanoparticles can be engineered to achieve optimal delivery and overcome the limitations of biological barriers (systemic, microenvironmental and cellular) in the patient’s body owing to their modifiable properties (such as size, shape, surface properties and charge). However, the complex interplay between nanoparticle properties and biological systems requires careful consideration to ensure the safety and efficacy of these nanoscale materials. Various stakeholders, such as contract research organizations, (CROs), and contract development and manufacturing organizations (CDOs / CDMOs) are likely to play a pivotal role in supporting researchers and drug developers to navigate the complexities associated with its design, development and manufacturing.

By leveraging the multifaceted expertise in the field, contract service providers can help streamline the nanoparticle development process, reduce costs, and accelerate the translation of promising nanoparticles from lab scale to clinical scale. Driven by technological advancements and the rising demand for nanoparticle-based drugs, the nanoparticle formulation services market is anticipated to witness notable growth in the foreseen future.

Nanoparticle Formulation Market: Key Insights

The report delves into the current state of the nanoparticle formulation market and identifies potential growth opportunities within the industry.

Some key findings from the report include:

- Presently, more than 100 nanoparticle formulation technologies are being offered by companies across the globe in order to augment the development and manufacturing of nanoparticle-based drugs.

- Close to 80% of technologies are designed for the formulation of organic nanoparticles; of these, nearly 50% are intended for drug delivery via injectable route, primarily targeting oncological disorders.

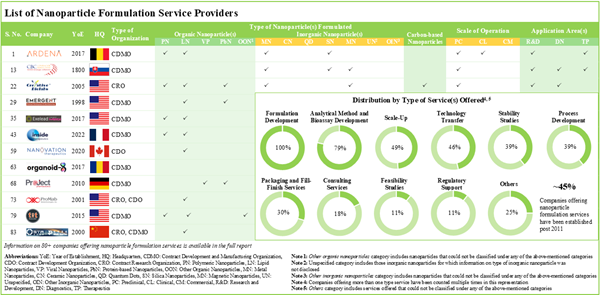

- The current service providers landscape has over 80 companies offering a wide range of nanoparticle formulation services at various scales of operation.

- The market landscape features the presence of both well-established players and new entrants with the requisite expertise to develop / manufacture nanoparticle-based drugs for an extensive range of application areas.

- Owing to the rise in demand for nanoparticle-based formulations, service providers are continuously expanding their existing capabilities to enhance their respective service portfolios.

- A steady growth in the partnership activity has been observed in recent years; R&D agreements have been the most prominent type of partnership model adopted by players based in the US.

- More than 1,700 patents related to nanoparticle formulation and development have been filed by / granted to various organizations in order to protect intellectual property.

- The nanoparticle formulation services market is likely to grow at a CAGR of ~9% over the next decade, driven by revenues generated from commercial scale operation.

Nanoparticle Formulation Market: Key Segments

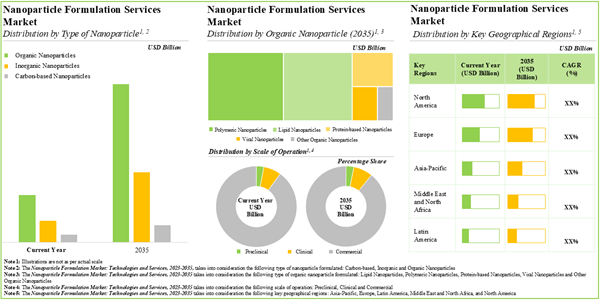

Organic Nanoparticles are Likely to Dominate the Nanoparticle Formulation Market During the Forecast Period

Based on the type of nanoparticle, the market is segmented into organic nanoparticles, inorganic nanoparticles and carbon-based nanoparticles. At present, organic nanoparticles hold the maximum share of the nanoparticle formulation market. This trend is unlikely to change in the near future.

Protein-based Nanoparticles Segment is the Fastest Growing Segment of the Nanoparticle Formulation Market During the Forecast Period

Based on the type of organic nanoparticle, the market is segmented into polymeric nanoparticles, lipid nanoparticles, viral nanoparticles, protein-based nanoparticles, and other organic nanoparticles. It is worth highlighting that, currently, lipid nanoparticles hold a larger share of the nanoparticle formulation market. However, the nanoparticle formulation market for protein-based nanoparticles is likely to grow at a higher CAGR in the coming decade.

Commercial Operations Occupy the Largest Share of the Nanoparticle Formulation Market

Based on scales of operation, the market is segmented into preclinical, clinical and commercial scales. At present, commercial operations capture the maximum share of the nanoparticle formulation market. It is worth highlighting that the nanoparticle formulation market at the clinical scale is likely to grow at a higher CAGR in the near future.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the world. The majority share is expected to be captured by service providers based in North America and Europe. It is worth highlighting that, over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Nanoparticle Formulated

- Organic Nanoparticles

- Inorganic Nanoparticles

- Carbon-based Nanoparticles

Type of Organic Nanoparticle Formulated

- Polymeric Nanoparticles

- Lipid Nanoparticles

- Viral Nanoparticles

- Protein-based Nanoparticles

- Other Organic Nanoparticles

Scale of Operation

- Preclinical

- Clinical

- Commercial

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Sample Players in the Nanoparticle Formulation Market, Profiled in the Report

- Ascension Sciences

- DIANT Pharma

- ExonanoRNA

- Nanoform

- NanoVation Therapeutics

- NanoVelos

- NTT Biopharma

- Organoid-X BioTech

- Vaxinano

Nanoparticle Formulation Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the nanoparticle formulation market, focusing on key market segments, including type of nanoparticle formulated, type of organic nanoparticle formulated, scale of operation and key geographical regions.

- Market Landscape 1: A comprehensive evaluation of nanoparticle formulation technologies, considering various parameters, such as type of nanoparticle(s) formulated, type of molecule(s) delivered, therapeutic area(s), compatible dosage form(s) and route(s) of administration. Further, the chapter provides information on various technology developers, along with analysis based on multiple parameters, such as year of establishment, company size, location of headquarters and most active players (in terms of number of technologies developed).

- Market Landscape 2: A comprehensive evaluation of nanoparticle formulation service providers, considering various parameters, such as year of establishment, company size (in terms of number of employees), location of headquarters, location of facilities, type of service provider(s), type of nanoparticle(s) formulated, type of service(s) offered, scale of operation and application area(s).

- Technology Competitiveness: A comprehensive competitive analysis of nanoparticle formulation technologies, examining factors, such as developer power, technology strength and technology applicability.

- Company Competitiveness: A comprehensive competitive analysis of nanoparticle formulation service providers, examining factors, such as company strength and service strength.

- Company Profiles: In-depth profiles of key industry players offering technologies and services for nanoparticle formulation across North America, Europe and Asia-Pacific, focusing on company overviews, technology portfolio, service portfolio, recent developments and an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2018, covering technology licensing agreements, research and development agreements, product development agreements, manufacturing agreements, mergers and acquisitions, technology integration agreements and other relevant agreements.

- Patent Analysis: Detailed analysis of various patents filed / granted related to nanoparticle formulation based on publication year, geographical region, CPC symbols, leading players (in terms of number of patents filled / granted) and type of organization. It also includes a patent benchmarking analysis and a detailed valuation analysis.

- Nanoparticle Evaluation Framework: An insightful framework evaluating types of nanoparticles based on various parameters, such as number of technologies, nanoparticle efficacy, number of clinical trials evaluating nanoparticle-based drugs, extent of innovation, trends in research activity and current global competition. It also provides a value addition matrix for respective types of nanoparticles currently adopted by stakeholders.

- Case Study: A case study of the recent technology licensing agreements, along with information on deal amounts.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ascension Sciences

- DIANT Pharma

- ExonanoRNA

- Nanoform

- NanoVation Therapeutics

- NanoVelos

- NTT Biopharma

- Organoid-X BioTech

- Vaxinano

Methodology

LOADING...