Initiatives by Governments to Expand Their Military Troops Fuels North America Military Truck Market

Governments of various countries are working on expanding their military troops to enhance their capabilities. Moreover, the US, which is the top military power in the world according to the Global Firepower ranking, also focuses continuously on expanding its military troops. In January 2022, the US government announced that the Army’s active-duty force exceeded its goal of adding 57,500 members by 106 people, thus recruiting 57,606 personnel. In addition, the Navy’s active-duty force also exceeded its goal of recruiting 33,400 members by recruiting 33,559 new members in total by the end of September 2021. Thus, such growing recruitments in the military forces indicate the need for military trucks to transfer troops, fuel, and equipment along asphalted roads and unpaved dirt roads, thereby driving the growth of the North America military truck market.North America Military Truck Market Overview

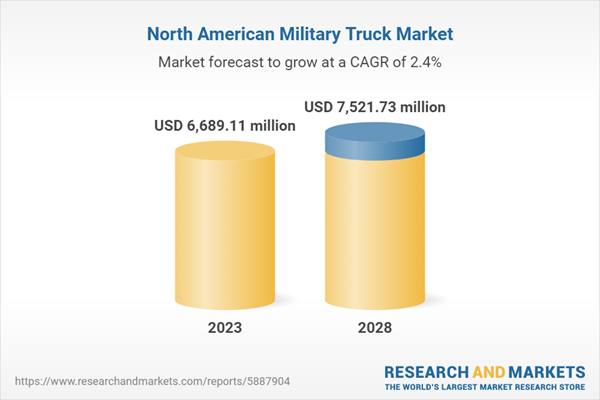

The North America military truck market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed to the increasing military spending by the aforementioned countries. In March 2023, the US Department of Defense released the fiscal year 2024 defense budget. Under this budget, it proposed a request of US$ 842 billion for the Department of Defense (DoD), an increase of US$ 26 billion from FY 2023 and US$ 100 billion from FY 2022. Similarly, in the 2022 Budget by the government of Canada, US$ 8 billion was allotted for five years to bolster the capacity of the Canadian Armed Forces, support members, and promote culture change. In 2021, the military expenditure of Mexico was US$ 8,681 million.Exhibit: North America Military Truck Market Revenue and Forecast to 2028 (US$ Million)

North America Military Truck Market Segmentation

The North America military truck market is segmented into application, truck type , propulsion type, transmission type, and country.Based on application, the North America military truck market is segmented into cargo/logistics carrier and troop carrier. The troop carrier segment held a larger share of the North America military truck market in 2023.

Based on truck type, the North America military truck market is segmented into light truck, medium truck, and heavy truck. The heavy truck segment held the largest share of the North America military truck market in 2023.

Based on propulsion type, the North America military truck market is segmented into electric/hybrid and diesel. The diesel segment held a larger share of the North America military truck market in 2023.

Based on transmission type, the North America military truck market is segmented into automatic transmission and manual transmission. The automatic transmission segment held a larger share of the North America military truck market in 2023.

Based on country, the North America military truck market is segmented int o the US, Canada, and Mexico. The US dominated the share of the North America military truck market in 2023.

AB Volvo; Hyundai Rotem Co; Iveco Group NV; Navistar Defense LLC; Oshkosh Corp; and Rheinmetall AG are the leading companies operating in the North America military truck market .

Table of Contents

Companies Mentioned

- AB Volvo

- Hyundai Rotem Co

- Iveco Group NV

- Navistar Defense LLC

- Oshkosh Corp

- Rheinmetall AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 106 |

| Published | June 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 6689.11 million |

| Forecasted Market Value ( USD | $ 7521.73 million |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | North America |

| No. of Companies Mentioned | 6 |