Global Pea Flour Market - Key Trends & Drivers Summarized

What Is Pea Flour & Why Is It Gaining Popularity in the Food Industry?

Pea flour is a high-protein, gluten-free flour made from ground yellow or green peas. It is gaining popularity in the food industry as a versatile ingredient that can be used in a wide variety of applications, including baking, cooking, and as a protein supplement. Pea flour is rich in essential nutrients such as protein, fiber, vitamins, and minerals, making it an attractive option for health-conscious consumers. Its naturally mild flavor allows it to blend well with other ingredients, making it suitable for a range of food products, from baked goods and pasta to smoothies and protein bars.The increasing demand for plant-based and gluten-free products has significantly contributed to the growth of the pea flour market. As consumers become more aware of the health benefits associated with plant-based diets and seek alternatives to wheat flour and other gluten-containing products, pea flour has emerged as a favorable option. Its nutritional profile and functional properties make it an appealing ingredient for manufacturers looking to create healthier, more sustainable food options.

How Does Pea Flour Enhance Nutritional Value & Culinary Versatility?

Pea flour enhances nutritional value by providing a high-quality source of protein, making it an excellent alternative to traditional flour for those seeking to increase their protein intake. With about 20-25% protein content, pea flour is particularly popular among vegetarians, vegans, and individuals looking to incorporate more plant-based protein sources into their diets. Additionally, it is rich in dietary fiber, which promotes digestive health and helps maintain a feeling of fullness, contributing to overall well-being.Culinary versatility is another significant advantage of pea flour. It can be used in various applications, including baked goods like bread, pancakes, and cookies, as well as in savory dishes such as soups, sauces, and plant-based protein products. The flour's binding properties make it suitable for creating vegan and gluten-free alternatives to traditional products, such as pasta and pastries. Moreover, pea flour can be combined with other flours and ingredients to enhance texture and flavor, making it a valuable ingredient in both home kitchens and commercial food production.

How Are Technological Advancements Shaping the Development of Pea Flour?

Technological advancements in processing and manufacturing have significantly improved the quality and functionality of pea flour, enhancing its appeal in the food industry. One major innovation is the use of advanced milling techniques that ensure a finer, more consistent texture, which is crucial for achieving desired results in various culinary applications. These improved milling processes also help preserve the nutritional profile of the peas, maximizing the health benefits associated with pea flour.Additionally, innovations in food technology have enabled the development of pea flour with enhanced functional properties, such as improved solubility and emulsification. This makes pea flour more versatile for use in a wider range of food products, including dairy alternatives and meat substitutes. The ability to create functional pea flour that performs well in various formulations is attracting food manufacturers looking to meet the growing consumer demand for plant-based and gluten-free products.

Research and development efforts are also focused on exploring new applications for pea flour beyond traditional food products. This includes its potential use in nutritional supplements, snack bars, and ready-to-eat meals, where its protein content and nutritional benefits can be highlighted. As these technological advancements continue to evolve, the pea flour market is likely to see an expansion in product offerings and applications.

What Factors Are Driving Growth in the Pea Flour Market?

The growth in the pea flour market is driven by several factors, including the increasing popularity of plant-based diets, rising consumer awareness of health and nutrition, the demand for gluten-free alternatives, and advancements in food technology. As more individuals adopt plant-based or flexitarian diets for health or environmental reasons, the demand for high-protein, plant-based ingredients like pea flour has surged. Consumers are actively seeking alternatives to animal protein sources and are drawn to the nutritional benefits that pea flour offers.The rising awareness of health and nutrition is also influencing consumer choices, with many people looking for wholesome, natural ingredients that can enhance their diets. Pea flour's rich protein and fiber content, along with its status as a gluten-free product, positions it favorably in the health food market. This trend is further supported by the growth of clean-label products, where consumers prefer ingredients that are minimally processed and recognizable.

The increasing demand for gluten-free alternatives has significantly boosted the pea flour market, as it provides a nutritious substitute for traditional wheat flour in a variety of applications. The growing popularity of gluten-free products, driven by dietary restrictions and preferences, is encouraging manufacturers to explore pea flour as a viable option for creating gluten-free food items. Emerging markets in Asia-Pacific and Latin America are also witnessing increased interest in healthy eating and plant-based diets, creating new opportunities for the pea flour market. With ongoing innovations, expanding applications in the food sector, and rising consumer demand for nutritious alternatives, the pea flour market is poised for sustained growth, driven by evolving dietary preferences and health trends.

Report Scope

The report analyzes the Pea Flour market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Conventional, Organic); Seed Coat Color (Yellow, Green); End-Use (Food & Beverage, Animal Feed, Household / Retail).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Conventional Pea Flour segment, which is expected to reach US$36.7 Billion by 2030 with a CAGR of a 15.3%. The Organic Pea Flour segment is also set to grow at 13.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.4 Billion in 2024, and China, forecasted to grow at an impressive 19% CAGR to reach $14.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pea Flour Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pea Flour Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pea Flour Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGT Food and Ingredients, Anchor Ingredients Co. LLC, Archer Daniels Midland Company, Avena Foods Ltd., Batory Foods and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Pea Flour market report include:

- AGT Food and Ingredients

- Anchor Ingredients Co. LLC

- Archer Daniels Midland Company

- Avena Foods Ltd.

- Batory Foods

- Bob’s Red Mill Natural Foods

- Globe ways Canada, Inc.

- GroupeLimagrain

- Hearthy Foods

- Hodmedod

- Ingredion GmbH

- King Arthur Flour Company, Inc.

- Nutriati Inc.

- Paula Ingredients

- Red River Commodities, Inc.

- Tata Chemicals Limited

- The Scoular Co.

- Vestkorn

- Woodland Foods. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGT Food and Ingredients

- Anchor Ingredients Co. LLC

- Archer Daniels Midland Company

- Avena Foods Ltd.

- Batory Foods

- Bob’s Red Mill Natural Foods

- Globe ways Canada, Inc.

- GroupeLimagrain

- Hearthy Foods

- Hodmedod

- Ingredion GmbH

- King Arthur Flour Company, Inc.

- Nutriati Inc.

- Paula Ingredients

- Red River Commodities, Inc.

- Tata Chemicals Limited

- The Scoular Co.

- Vestkorn

- Woodland Foods. Ltd.

Table Information

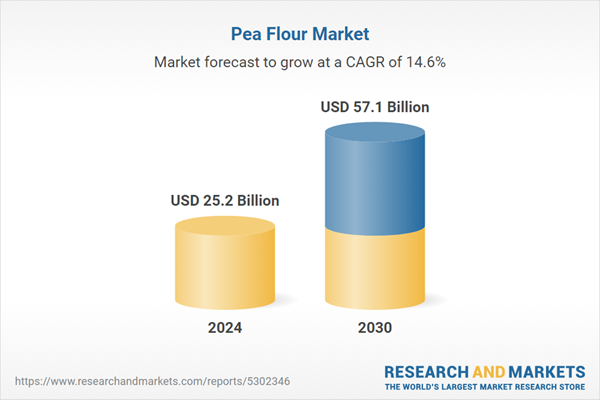

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.2 Billion |

| Forecasted Market Value ( USD | $ 57.1 Billion |

| Compound Annual Growth Rate | 14.6% |

| Regions Covered | Global |