Global Satellite Cables and Assemblies Market - Key Trends & Drivers Summarized

Why Is The Demand For Satellite Cables And Assemblies Rising In The Space Industry?

The satellite cables and assemblies market is experiencing significant growth, driven by the increasing deployment of satellites for communications, Earth observation, navigation, and defense applications. As space exploration and commercial satellite projects expand, the need for highly durable, lightweight, and radiation-resistant cables and assemblies is rising. These components play a crucial role in ensuring seamless data transmission, power distribution, and signal integrity in satellite systems. With the proliferation of small satellites (smallsats) and mega-constellations for broadband internet services, such as Starlink and OneWeb, the demand for advanced cabling solutions is expected to surge. Additionally, the growing interest in deep-space missions and interplanetary exploration is pushing manufacturers to develop next-generation cables that can withstand extreme space environments.What Technological Innovations Are Enhancing Satellite Cables And Assemblies?

Advancements in material science and manufacturing techniques are improving the durability, flexibility, and performance of satellite cables and assemblies. The development of ultra-lightweight and high-temperature-resistant cables is reducing satellite launch weight while ensuring long-term reliability. Radiation-hardened cabling solutions are being designed to protect against space radiation and electromagnetic interference (EMI), ensuring uninterrupted operations. The integration of fiber optic cables in satellite systems is enhancing data transfer speeds, supporting high-bandwidth communication applications. Additionally, modular and standardized cable assemblies are enabling faster production and easier integration in satellite platforms. These innovations are critical in meeting the growing demands of the space industry while optimizing performance and cost efficiency.Which Sectors Are Driving The Growth Of The Satellite Cables And Assemblies Market?

The primary demand for satellite cables and assemblies comes from the aerospace and defense sectors, where high-reliability cabling solutions are essential for military-grade satellites, surveillance systems, and space exploration missions. The telecommunications industry is another major contributor, with satellite-based broadband services expanding to rural and remote areas. The Earth observation and scientific research sector is also fueling demand, as satellites play a key role in climate monitoring, disaster management, and environmental studies. Additionally, the rise of commercial space companies, including SpaceX, Blue Origin, and Rocket Lab, is driving investments in advanced satellite infrastructure. As satellite technology continues to evolve, the demand for high-performance cables and assemblies will remain strong.What Factors Are Fueling The Growth Of The Satellite Cables And Assemblies Market?

The growth in the satellite cables and assemblies market is driven by the increasing number of satellite launches, rising investments in space technology, and advancements in communication systems. The demand for high-speed internet connectivity via satellite-based broadband is boosting the need for robust cabling solutions. Government initiatives to expand space exploration and satellite applications for defense and navigation are further accelerating market growth. Additionally, innovations in materials and miniaturization are enhancing the efficiency of satellite components, making them more adaptable for smallsat and CubeSat applications. As space commercialization and satellite networking expand, the market for satellite cables and assemblies is set for significant growth.Report Scope

The report analyzes the Satellite Cables and Assemblies market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Satellite Type (Small Satellite, Medium Satellite, Large Satellite); Component (Cables, Connectors, Other Components); Cable Type (Round Cables, Flat Cables); Conductor Type (Twisted Pair Conductor, Coaxial Conductor, Fiber Optics Conductor, Shielded / Jacketed Conductor).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Small Satellite segment, which is expected to reach US$719.5 Million by 2030 with a CAGR of a 17.9%. The Medium Satellite segment is also set to grow at 20.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $107.4 Million in 2024, and China, forecasted to grow at an impressive 18% CAGR to reach $178.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Satellite Cables and Assemblies Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Satellite Cables and Assemblies Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Satellite Cables and Assemblies Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ArcelorMittal, Assan Panel A.S., Balex Metal sp. z o.o, DANA Group, Fischer Profil GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Satellite Cables and Assemblies market report include:

- AirBorn, Inc.

- Amphenol Corporation

- Axon' Cable SAS

- Carlisle Interconnect Technologies

- Cicoil Corporation

- Cinch Connectivity Solutions

- Consolidated Electronic Wire & Cable

- Eaton Corporation

- Glenair, Inc.

- Harbour Industries, LLC

- Huber+Suhner AG

- Leoni AG

- Meggitt PLC

- Nexans S.A

- Prysmian Group

- Radiall

- Smiths Group PLC

- TE Connectivity

- Times Microwave Systems

- W.L. Gore & Associates, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AirBorn, Inc.

- Amphenol Corporation

- Axon' Cable SAS

- Carlisle Interconnect Technologies

- Cicoil Corporation

- Cinch Connectivity Solutions

- Consolidated Electronic Wire & Cable

- Eaton Corporation

- Glenair, Inc.

- Harbour Industries, LLC

- Huber+Suhner AG

- Leoni AG

- Meggitt PLC

- Nexans S.A

- Prysmian Group

- Radiall

- Smiths Group PLC

- TE Connectivity

- Times Microwave Systems

- W.L. Gore & Associates, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 206 |

| Published | February 2026 |

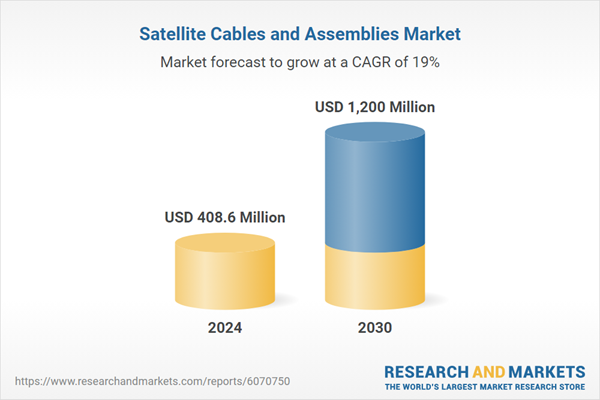

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 408.6 Million |

| Forecasted Market Value ( USD | $ 1200 Million |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Global |