Personal lubricant refers to specialized lubes, liquids, and gels that are applied on individuals’ private parts, including the vagina, anus, and penis, to reduce pain and friction during masturbation and sexual intercourse, providing a pleasurable experience. It is manufactured from the combination of various ingredients, such as glycerin, purified or deionized water, vinyl dimethicone, polyethylene glycol, hydroxyethyl cellulose, and carboxymethyl cellulose.

Currently, personal lubricant is commercially available in water-, silicone-, oil-, and hybrid-based product types. They help relieve pain, curl vaginal dryness or chafing, mitigate irritations, reduce the risk of injuries, and provide protection against sexually transmitted infections (STIs), including human immunodeficiency virus (HIV). Based on these properties, personal lubricant is used to enhance arousal and allow deeper penetration.

Personal Lubricant Market Trends:

The increasing need for various personal care products and the rising prevalence of vaginal dryness and erectile dysfunction has facilitated the widespread adoption of personal lubricants as a practical substitute to improve the sexual experience, which, in turn, is majorly driving the market growth. Additionally, the extensive utilization of water-based personal lubes due to their gel-like structure, proven efficiency, easy-to-clean formula, and higher compatibility with condoms and sex toys are acting as another growth-inducing factor.In line with this, the advent of premium medicated lubricants in diverse types and flavors, such as k-y jelly and Replens, and their availability across online and offline drug and grocery stores are propelling the market growth. Such products help deal with excess dryness and vaginal tears that might cause STIs. Apart from this, the escalating consumer awareness regarding the diverse usability of the product and favorable initiatives undertaken by governments and non-governmental organizations (NGOs) to offer proper sex education in educational settings to sensitize younger demographics are creating a positive outlook for the market.

Key Market Segmentation:

The research provides an analysis of the key trends in each sub-segment of the global personal lubricant market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on type, gender, and distribution channel.Breakup by Type:

- Water-based

- Silicone-based

- Oil-base.

Breakup by Gender:

- Male

- Femal.

Breakup by Distribution Channel:

- E-Commerce

- Drug Stores

- Other.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being BioFilm IP LLC, Church & Dwight Co. Inc., Cupid Limited, Karex Berhad, LifeStyles Healthcare Pte Ltd, Lovehoney Group Limited, Reckitt Benckiser Group PLC, Sliquid LLC, The Yes Yes Company Ltd. and Trigg Laboratories Inc.Key Questions Answered in This Report:

- How has the global personal lubricant market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global personal lubricant market?

- What are the key regional markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the gender?

- What is the breakup of the market based on the distribution channel?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global personal lubricant market and who are the key players?

- What is the degree of competition in the industry?

Table of Contents

Companies Mentioned

- BioFilm IP LLC

- Church & Dwight Co. Inc.

- Cupid Limited

- Karex Berhad

- LifeStyles Healthcare Pte Ltd

- Lovehoney Group Limited

- Reckitt Benckiser Group PLC

- Sliquid LLC

- The Yes Yes Company Ltd.

- Trigg Laboratories Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | June 2025 |

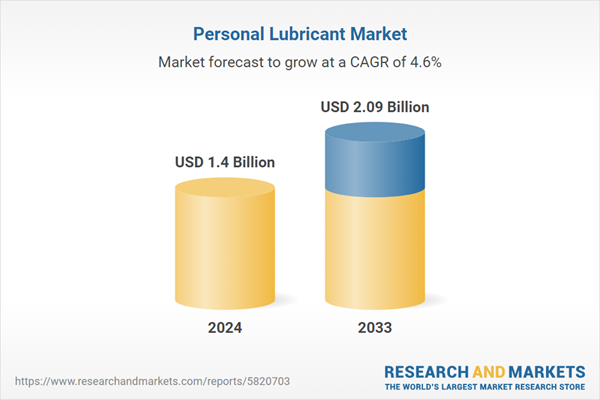

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2.09 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |