Global Student Accommodation Market - Key Trends & Drivers Summarized

How Is the Internationalization of Education Reshaping Student Housing Demand?

The global student accommodation market is undergoing a seismic transformation, driven by the rapid internationalization of higher education. As more students travel across borders for tertiary studies, particularly to countries like the United States, United Kingdom, Australia, Canada, and increasingly parts of Europe and Asia-Pacific, demand for specialized, safe, and well-equipped student living spaces has skyrocketed. According to UNESCO, international student mobility is expected to cross 8 million by 2030, up from just 5.3 million in 2020, and this surge is fueling an equally robust demand for purpose-built student accommodation (PBSA). This accommodation trend is not just about a roof over the head - it encapsulates fully integrated living and learning environments with access to Wi-Fi, study lounges, security services, and communal engagement, mirroring university values. Institutional investors are increasingly drawn to this asset class due to its resilience and counter-cyclical nature, especially when compared to commercial or retail real estate. Public-private partnerships are also fostering the development of state-of-the-art student facilities, reducing the burden on universities and governments while ensuring quality infrastructure.Can Sustainability and Smart Tech Really Influence Where Students Live?

Environmental sustainability and technology integration have emerged as two compelling differentiators in modern student accommodation choices. Today's Gen Z and Gen Alpha cohorts are highly environmentally conscious, favoring accommodations with green certifications, energy-efficient systems, and reduced carbon footprints. Developers are responding with eco-friendly construction materials, solar panels, rainwater harvesting systems, and even zero-waste operational models. Moreover, smart technology is revolutionizing how student accommodations function - features like digital key access, smart thermostats, app-controlled laundry, and AI-powered maintenance requests are quickly becoming industry norms rather than luxury add-ons. These technological enhancements not only improve operational efficiency but also appeal strongly to students seeking comfort, connectivity, and control over their living environment. As cybersecurity concerns rise, robust digital safety infrastructures are being incorporated to protect personal data, adding yet another layer of trust and appeal to technologically forward student residences.What Role Do Urban Migration Patterns and City Planning Play?

Urbanization trends and evolving city planning policies are significantly influencing the student accommodation landscape. As major cities grapple with housing shortages and escalating rent prices, dedicated student housing emerges as a vital strategy to relieve pressure on urban residential markets. In cities like London, Berlin, Melbourne, and Toronto, local governments are actively integrating student housing provisions into zoning regulations and development frameworks to ensure that the surge in student populations doesn't destabilize general housing affordability. Transit-oriented development (TOD) models, which prioritize building accommodation near public transportation hubs and universities, are increasingly common, aligning housing with student commuting needs. Additionally, micro-living spaces are gaining popularity in urban centers where land scarcity drives creative and compact design solutions without compromising on quality. These evolving spatial dynamics are not only helping students access affordable housing closer to educational institutions but are also ensuring that cities remain inclusive and functional amidst demographic shifts.Why Is This Market Surging? What's Really Driving the Boom?

The growth in the student accommodation market is driven by several factors tied to evolving educational, technological, and demographic dynamics. Firstly, the consistent rise in tertiary enrollment rates globally, particularly in emerging economies like India, China, and Nigeria, is creating demand for more organized and scalable student living arrangements. Secondly, changing consumer behavior is notable - students and parents alike are increasingly prioritizing quality of life, community engagement, and academic support when selecting accommodations, pushing providers to innovate beyond basic lodging. Third, the rise of hybrid learning models and extended academic calendars is influencing demand for year-round housing options rather than just term-based rentals. Technological adoption is another powerful enabler, allowing developers and managers to personalize student experiences, reduce operational costs, and gain competitive differentiation. Investment capital is flowing steadily into the sector, particularly from pension funds and real estate investment trusts (REITs), encouraged by stable rental yields and low vacancy rates. Lastly, socio-political factors, such as visa policy liberalization and expanded international recruitment strategies by universities, are increasing the diversity and volume of student inflow, further energizing demand for structured accommodation solutions across both developed and emerging markets.Report Scope

The report analyzes the Student Accommodation market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Accommodation Type (Purpose-Built Student Accommodation, University-Managed Accommodation, Private Rental Accommodation, Others); Education Grade (Undergraduate Students, Postgraduate Students, Professional & Continuing Education Students).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Purpose-Built Student Accommodation segment, which is expected to reach US$6.8 Billion by 2030 with a CAGR of a 4.8%. The University-Managed Accommodation segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.2 Billion in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $3.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Student Accommodation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Student Accommodation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Student Accommodation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as All-Pro Fasteners, Inc., Bossard Group, Cheng Hao Enterprise Co., Ltd., Dresselhaus GmbH & Co. KG, EJOT Holding GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Student Accommodation market report include:

- Amber Student

- American Campus Communities (ACC)

- Aparto

- Asset Living

- BaseCamp Student

- Campus Living Villages

- CLV USA

- Collegiate AC

- CRM Students

- Downing Students

- Fresh Student Living

- Global Student Accommodation Group (GSA)

- Greystar

- Harrison Street

- Homes for Students

- Homversity

- Housr

- Nexo Residencias

- Scape

- Stanza Living

- Student Roost

- Student.com

- The Scion Group

- The Social Hub

- UniAcco

- Unite Students

- University Living

- Urbanest

- Vita Student

- Yugo

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amber Student

- American Campus Communities (ACC)

- Aparto

- Asset Living

- BaseCamp Student

- Campus Living Villages

- CLV USA

- Collegiate AC

- CRM Students

- Downing Students

- Fresh Student Living

- Global Student Accommodation Group (GSA)

- Greystar

- Harrison Street

- Homes for Students

- Homversity

- Housr

- Nexo Residencias

- Scape

- Stanza Living

- Student Roost

- Student.com

- The Scion Group

- The Social Hub

- UniAcco

- Unite Students

- University Living

- Urbanest

- Vita Student

- Yugo

Table Information

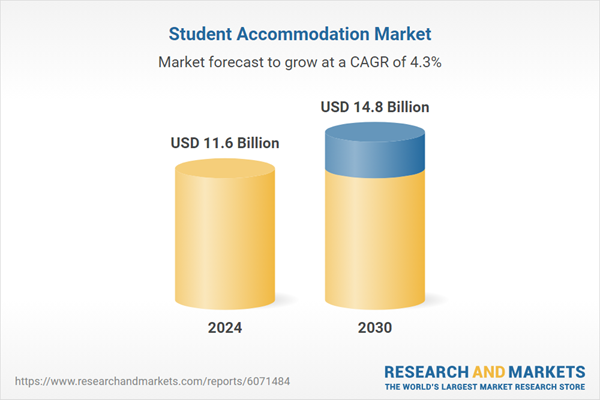

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.6 Billion |

| Forecasted Market Value ( USD | $ 14.8 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |