Global Tractor Rental Market - Key Trends & Drivers Summarized

What Is Tractor Rental, and Why Is It Beneficial for Farmers and Businesses?

Tractor rental services provide farmers, agricultural contractors, and businesses with temporary access to tractors without the need for long-term ownership. Renting tractors is a cost-effective solution for farmers, especially smallholders or those with seasonal needs, as it eliminates the high upfront costs associated with purchasing equipment. Renting also reduces the maintenance expenses, storage requirements, and depreciation risks that come with owning a tractor. Instead of investing capital in buying machinery, farmers and contractors can allocate their resources to other operational needs, making tractor rentals an attractive option for managing agricultural expenses and cash flow.Tractor rentals are particularly beneficial in peak farming seasons, when the demand for equipment is high, or for specialized tasks that require specific attachments or horsepower not available on the farmer's regular machinery. Additionally, rental services offer flexibility, allowing users to choose different types of tractors and equipment based on the task, soil type, or crop requirement. This adaptability enables farmers to scale operations efficiently, improve productivity, and access modern equipment with the latest technology, even if they operate on a limited budget. As a result, tractor rental services provide a practical, economical, and flexible solution to meet the varied demands of the agricultural sector.

How Are Technological Advancements Impacting the Tractor Rental Market?

Technological advancements are transforming the tractor rental market by making rental processes more efficient, accessible, and user-friendly. The integration of digital platforms and mobile apps allows farmers to easily search for, compare, and book tractors and equipment from their smartphones, streamlining the rental process. Many rental platforms now feature transparent pricing, availability tracking, and even real-time equipment location, enabling users to select the best options for their needs and budget. Digital records and remote tracking of equipment have also improved asset management for rental companies, ensuring that equipment is maintained and repaired promptly, reducing downtime for end-users.Another technological advancement is the increased availability of high-tech, GPS-enabled tractors with precision agriculture capabilities on rental platforms. These advanced tractors use GPS, sensors, and machine learning to optimize farming tasks such as planting, fertilizing, and harvesting, maximizing crop yield and resource efficiency. For small-scale farmers, renting high-tech tractors allows them access to technology that would otherwise be too expensive to purchase outright. In addition, telematics systems enable rental companies to monitor equipment health remotely, alerting them to potential issues and optimizing maintenance schedules. These technological innovations enhance the value and efficiency of tractor rental services, providing farmers with access to modern equipment and capabilities that improve productivity and reduce costs.

What Types of Tractors Are Available for Rental, and How Are They Used?

The tractor rental market offers a range of tractor types, each suited to specific agricultural tasks, land sizes, and crop requirements. Compact tractors, typically under 40 horsepower, are commonly rented for light-duty tasks on small farms, such as tilling, mowing, or light landscaping. These tractors are popular among small-scale farmers, gardeners, and landscapers who need affordable equipment for basic maintenance tasks. Row crop tractors, with higher horsepower and versatility, are well-suited for larger farms and more intensive agricultural tasks, such as planting, spraying, and fertilizing row crops. These tractors often come with multiple attachment options, making them adaptable to various farming needs.Another popular type is the utility tractor, which ranges from medium to heavy-duty models and is ideal for tasks such as plowing, hauling, and lifting. These versatile tractors are designed for both agricultural and non-agricultural applications, making them a favorite among larger farms and contractors working on varied terrains. Specialty tractors, such as orchard and vineyard tractors, are also available for rental, catering to farms that require narrow and maneuverable machinery for precise navigation through tight rows. High-tech precision agriculture tractors equipped with GPS and automation features are increasingly being offered by rental companies, appealing to progressive farmers looking to optimize planting and harvesting efficiency. The variety of tractor types available for rental allows farmers to select the exact model and specifications suited to their operational needs, enhancing flexibility and productivity.

What Is Driving Growth in the Tractor Rental Market?

The growth in the tractor rental market is driven by several factors, including rising agricultural equipment costs, fluctuating farm incomes, and the increasing adoption of technology in farming. As agricultural machinery prices continue to rise, many small to medium-scale farmers are finding it more financially feasible to rent equipment instead of purchasing it outright. This shift is especially prominent in regions with unpredictable weather patterns and fluctuating crop yields, where income variability makes large capital investments in equipment risky. Tractor rentals allow farmers to access necessary machinery without incurring long-term financial burdens, enabling them to maintain profitability despite challenging economic conditions.Another key growth driver is the widespread adoption of mechanized farming and precision agriculture, even among smaller farms. As farmers recognize the productivity gains that modern tractors and precision equipment can provide, demand for rentals has increased, as rentals offer an affordable way to access this technology. Government subsidies and programs in many countries encourage mechanization, further supporting the adoption of rental services, particularly in developing regions where capital-intensive equipment is out of reach for most farmers. Additionally, the rise of digital platforms and mobile apps that simplify equipment access and scheduling has expanded the tractor rental market's reach, making it accessible to a larger audience. This convergence of economic, technological, and logistical factors is driving robust growth in the tractor rental market, positioning it as a practical solution for modernizing agricultural practices in a cost-effective way.

Report Scope

The report analyzes the Tractor Rental market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Below 40 HP Tractor, 40 HP - 120 HP Tractor, 121 HP - 180 HP Tractor, Above 180 HP Tractor).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Below 40 HP Tractor segment, which is expected to reach US$14.7 Billion by 2030 with a CAGR of a 6.4%. The 40 HP - 120 HP Tractor segment is also set to grow at 7.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.8 Billion in 2024, and China, forecasted to grow at an impressive 6.6% CAGR to reach $9.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Tractor Rental Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Tractor Rental Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Tractor Rental Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Deere & Company, Flaman, Friesen Sales & Rentals, Garton Tractor, Inc., JFarm Services and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Tractor Rental market report include:

- Deere & Company

- Flaman

- Friesen Sales & Rentals

- Garton Tractor, Inc.

- JFarm Services

- Kubota Tractor Corporation

- Kwipped Inc.

- Mahindra Construction Equipments

- Meade Tractor

- Messicks Farm Equipment

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Deere & Company

- Flaman

- Friesen Sales & Rentals

- Garton Tractor, Inc.

- JFarm Services

- Kubota Tractor Corporation

- Kwipped Inc.

- Mahindra Construction Equipments

- Meade Tractor

- Messicks Farm Equipment

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

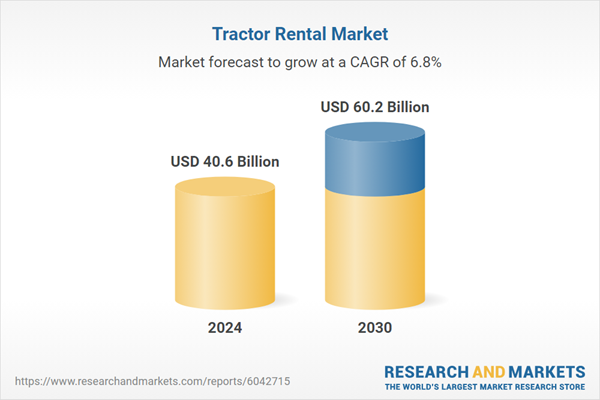

| Estimated Market Value ( USD | $ 40.6 Billion |

| Forecasted Market Value ( USD | $ 60.2 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |