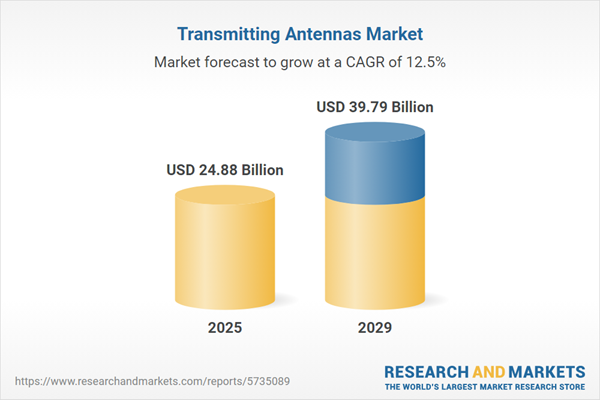

The transmitting antennas market size has grown rapidly in recent years. It will grow from $21.99 billion in 2024 to $24.88 billion in 2025 at a compound annual growth rate (CAGR) of 13.1%. The growth in the historic period can be attributed to television and radio broadcasting, telecommunications infrastructure, military and defense applications, satellite communications, wi-fi and wireless networking.

The transmitting antennas market size is expected to see rapid growth in the next few years. It will grow to $39.79 billion in 2029 at a compound annual growth rate (CAGR) of 12.5%. The growth in the forecast period can be attributed to 5g deployment, iot and smart devices, connected vehicles, aerospace and satellite communication. Major trends in the forecast period include beamforming technology, iot connectivity, smart antennas, 5g mmwave antennas.

The growing investment in autonomous vehicles is driving the demand for antennas, thereby boosting the market. Autonomous vehicles are equipped with various sensing technologies, such as cameras, light detection and ranging (LIDAR), laser-based sensors, global positioning systems, and radar transceivers, to navigate complex environments. For example, in September 2024, Alphabet Inc., a US-based multinational conglomerate, announced a $5 billion investment in its self-driving subsidiary, Waymo. This investment marks a significant step in expanding Waymo’s autonomous vehicle operations. Currently, Waymo operates in San Francisco, Phoenix, and Los Angeles, and has recently revealed plans to begin testing fully autonomous rides on the freeways of the San Francisco Bay Area. These increased investments in autonomous vehicles are fueling the growth of the transmitting antennas market.

The expansion of 5G networks is expected to propel the growth of the transmitting antennas market in the coming years. The global deployment of 5G networks necessitates a significant increase in transmitting antennas to support the higher data speeds and network capacity that 5G technology offers. For instance, according to 5G Americas, a US-based industry trade organization, the number of 5G wireless connections surged by 76% between the end of 2021 and the end of 2022, reaching a total of 1.05 billion connections. It is projected to reach 5.9 billion by the end of 2027, according to data from Omdia and 5G Americas. Consequently, the growing demand for 5G networks is expected to drive the transmitting antennas market.

Many companies are addressing the rising demand for military antennas by manufacturing specialized military-grade antennas. These military antennas provide enhanced surveillance, precise tracking, and address security concerns for various military applications, including aircraft, naval vessels, armored vehicles, and more. For example, TACo., a Canada-based company, specializes in manufacturing multiple military antennas for applications such as ground-air-ground, air traffic control, and various vehicular and base communications needs. The increasing need for advanced features in military antennas is contributing to market growth.

Major companies in the transmitting antennas market are innovating with new technologies such as the Light Antenna ONE, a LiFi module designed for integration into billions of devices, as showcased at MWC Barcelona. LiFi is a wireless data transmission system that utilizes light, rather than radio frequencies. The Light Antenna is an optoelectrical antenna designed to enable LiFi in connected devices and integrates seamlessly like conventional RF antennas. For instance, in February 2023, PureLiFi, a UK-based telecommunications equipment supplier, launched the Light Antenna Module at the Mobile World Congress (MWC) in Barcelona. This cutting-edge wireless communications antenna is smaller than a US dime and is prepared to enable LiFi in a wide range of connected devices and smartphones at scale, following the IEEE 802.11bb Light Communication standard, which is set to be ratified soon.

In June 2024, Kanders & Company Inc., a US-based investment firm, acquired specific antenna and test equipment businesses from L3Harris Technologies Inc. for around $200 million. Through this acquisition, Kanders & Company Inc. plans to integrate these businesses into a new platform company called Fisica, positioning itself as a major player in the defense technology sector. L3Harris Technologies Inc., a US-based aerospace and defense technology company, specializes in providing smart antenna solutions.

A transmitting antenna constitutes a fundamental component of radio technology. It comprises a conductor through which an electric current flows, oscillating with time, and thus transforms this current into radiofrequency radiation that propagates through the surrounding space.

The principal categories of transmitting antennas encompass smart antennas, mini-strip antennas, and other variations. Smart antennas are a type of digital antenna equipped with signal tracking and processing capabilities. These antenna configurations find widespread applications in fields such as signal processing, radar systems, and telecommunications. Transmitting antennas operate across a range of frequencies, including HF (High Frequency), VHF (Very High Frequency), and UHF (Ultra High Frequency), and are employed in various industries, including aerospace and defense, consumer electronics, healthcare, telecommunications, and other end-use sectors.

The transmitting antennas market research report is one of a series of new reports that provides transmitting antennas market statistics, including transmitting antennas industry global market size, regional shares, competitors with a transmitting antennas market share, detailed transmitting antennas market segments, market trends and opportunities, and any further data you may need to thrive in the transmitting antennas industry. The transmitting antennas market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the transmitting antennas market include Accel Networks, Honeywell International, Intel Corporation, Alcatel-Lucent International Holdings, Ruckus Wireles, Airgo Networks (Acquired by Qualcomm), Broadcom Corp, Linx Technologies, Samsung Electronics, Motorola, ArrayComm, Qualcomm, Comba Telecom, KATHREIN-Werke, Laird, Advanced RF Technologies (ADRF), Cobham Wireless, CommScope, Bird Technologies, Ericsson, Huawei Technologies, ZTE, Antennas Direct, VOXX Accessories Corp, Jasco Products (GE), Best Buy, Winegard, Mohu, Polaroid, Channel Master, Marathon.

North America was the largest region in the transmitting antennas market in 2024. Asia-Pacific is expected to be the fastest-growing region in the transmitting antennas market during the forecast period. The regions covered in the transmitting antennas market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the transmitting antennas market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The transmitting antennas market consists of sales of equipment, which allow wireless communication between a group of devices and their related networks. Antennas transform electrical energy from the transmitter into electromagnetic energy and radiate into the surrounding atmosphere. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Transmitting Antennas Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on transmitting antennas market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for transmitting antennas ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The transmitting antennas market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Smart Antenna; Mini-strip Antenna; Other Types2) By Frequency: HF; VHF; UHF

3) By End-User Industry: Aerospace and Defense; Consumer Electronics; Healthcare; Telecommunication; Other End-Use Industries

Subsegments:

1) By Smart Antenna: Adaptive Array Antennas; Multiple Input Multiple Output (MIMO) Antennas2) By Mini-strip Antenna: Microstrip Patch Antennas; Dual-band Mini-strip Antennas

3) By Other Types: Parabolic Reflector Antennas; Dipole Antennas; Loop Antennas

Key Companies Mentioned: Accel Networks; Honeywell International; Intel Corporation; Alcatel-Lucent International Holdings; Ruckus Wireles

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Transmitting Antennas market report include:- Accel Networks

- Honeywell International

- Intel Corporation

- Alcatel-Lucent International Holdings

- Ruckus Wireles

- Airgo Networks (Acquired by Qualcomm)

- Broadcom Corp

- Linx Technologies

- Samsung Electronics

- Motorola

- ArrayComm

- Qualcomm

- Comba Telecom

- KATHREIN-Werke

- Laird

- Advanced RF Technologies (ADRF)

- Cobham Wireless

- CommScope

- Bird Technologies

- Ericsson

- Huawei Technologies

- ZTE

- Antennas Direct

- VOXX Accessories Corp

- Jasco Products (GE)

- Best Buy

- Winegard

- Mohu

- Polaroid

- Channel Master

- Marathon

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 24.88 Billion |

| Forecasted Market Value ( USD | $ 39.79 Billion |

| Compound Annual Growth Rate | 12.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |