Speak directly to the analyst to clarify any post sales queries you may have.

A concise orientation to underfill materials highlighting their evolving importance for mechanical integrity, thermal management, manufacturability, and product longevity

Underfill materials sit at the intersection of materials science and advanced electronic packaging, providing critical mechanical support, thermal conductivity pathways, and long-term reliability for modern semiconductor assemblies. As packaging densities increase and thermal budgets tighten, underfills have transitioned from a secondary consideration to a primary enabler of performance and longevity. This introduction sets the stage for a focused examination of formulation innovation, application diversity, and strategic considerations shaping procurement and design decisions.

The industry has evolved from a narrow set of epoxy solutions toward a broader palette that includes acrylics, polyurethanes, silicones, and increasingly sophisticated epoxy systems available in single- and two-component architectures. These materials respond to varied process flows and end-use performance criteria, including reworkability, capillary compatibility, cure kinetics, and thermo-mechanical stress mitigation. Consequently, packaging engineers and materials scientists must balance process throughput with long-term reliability targets when selecting underfill chemistries.

Moreover, underfills are now integral to packaging strategies across ball grid array, flip chip, and chip scale formats, each imposing distinct dispensing, cure, and interfacial adhesion challenges. As such, early collaboration between substrate designers, assembly houses, and materials suppliers has become essential to minimize integration risk. This introduction frames the broader discussion by emphasizing functional priorities-mechanical integrity, thermal management, manufacturability, and lifecycle serviceability-that drive stakeholder choices throughout the product development and production cycle.

How advances in packaging architectures, materials engineering, and supply strategies are rapidly reshaping underfill material selection and integration practices

The landscape for underfill materials is undergoing transformative shifts driven by parallel advances in packaging architectures, materials science, and manufacturing strategies. Device miniaturization and finer interconnect pitches have accelerated adoption of capillary and no-flow underfills tailored for dense flip chip and advanced ball grid array formats, while molded and preform underfills are gaining traction where throughput and precision are required. At the same time, formulators are optimizing viscosity ranges to match automated dispensing, capillary flow rates, and preform handling, yielding specialized high, medium, and low viscosity offerings that better align with specific assembly processes.

Concurrently, end-use demands from automotive electronics and telecommunications are pushing durability and thermal cycling performance higher, prompting broader use of epoxy resin systems including single-component and two-component options that can be tuned for cure profiles and modulus control. Consumer electronics continue to demand thin, low-stress solutions for smartphones, wearables, and tablets, encouraging the refinement of silicone- and polyurethane-based chemistries that deliver compliance without sacrificing adhesion.

Supply chain resilience and regional manufacturing trends are reshaping procurement strategies. Companies are diversifying sourcing to mitigate raw material volatility, while strategic partnerships between material developers and packaging service providers are shortening design cycles and accelerating qualification. In summary, these shifts reflect a convergence of technical innovation and operational adaptation that is redefining how underfills are selected, qualified, and integrated into modern electronic systems.

Assessing the broader operational and strategic consequences of 2025 tariff actions on supply chain resilience, sourcing strategies, and formulation adaptability

The imposition of tariffs and trade measures in 2025 introduced a new layer of complexity into supply chain and procurement decisions for underfill materials, particularly for organizations reliant on cross-border sourcing of specialty chemistries and precursors. Tariff-driven cost differentials have prompted procurement teams to re-evaluate supplier portfolios, consider alternative raw material suppliers, and accelerate qualification of regional substitutes to maintain continuity of supply. As a practical consequence, manufacturers are placing greater emphasis on supplier redundancy and long-lead inventory strategies to insulate production from sudden policy shifts.

Beyond immediate procurement adjustments, tariff pressures have influenced where downstream assembly and packaging operations are located. Some firms have restructured their footprint to align closer to raw material sources or final markets, thereby reducing exposure to import duties while also lowering logistics lead times. This geographic realignment often requires parallel investments in local qualification and process transfer efforts to maintain product reliability standards, with materials engineers and process technologists collaborating closely to replicate cure profiles and adhesion performance in new manufacturing environments.

Finally, tariffs have catalyzed increased investment in material substitution and formulation flexibility. Developers are prioritizing chemistries that can be produced from a broader set of precursors and are implementing modular formulation strategies that allow rapid tweaking of viscosity, cure behavior, and mechanical properties without full requalification. In effect, the tariff landscape has accelerated strategic resilience planning across the underfill value chain, encouraging firms to embed flexibility into sourcing, R&D, and production processes.

In-depth segmentation insights revealing how material classes, application formats, industry-specific needs, processing technologies, and physical forms collectively determine underfill strategy

A nuanced segmentation analysis clarifies how underfill selection and implementation vary across material classes, application types, end-use sectors, processing technologies, physical forms, and viscosity requirements. Material-wise, acrylic-based, epoxy resin-based, polyurethane-based, and silicone-based chemistries offer distinct trade-offs: acrylics for rapid cure and flow, epoxies for structural stiffness and thermal reliability available in single-component and two-component systems, polyurethanes for flexibility, and silicones for high-temperature compliance. Each material class maps differently to performance targets and process constraints.

Application segmentation further refines selection criteria across ball grid array packaging, chip scale packaging, and flip chip packaging. Within ball grid array formats, fine pitch and standard pitch variants impose different dispensing resolution and cure uniformity demands, while flip chip applications, including FC-BGA and FC-CSP subtypes, emphasize capillary flow control and underfill wetting characteristics. Chip scale packaging presents its own set of scale-driven handling and cure considerations.

From an end-use perspective, automotive electronics require high-reliability materials suitable for advanced driver assistance systems and infotainment platforms, whereas consumer electronics prioritize low profile, fast cure solutions tailored for smartphones, tablets, and wearables. Healthcare devices and industrial and telecommunications equipment impose additional constraints related to biocompatibility, long-term thermal stability, and electromagnetic performance. Technology-driven segmentation distinguishes capillary underfill, molded underfill, no-flow underfill, and reworkable underfill, each matching different assembly workflows and serviceability expectations. Form and viscosity segmentation-liquid underfill, molded underfill form, preform underfill, and high, medium, and low viscosity grades-complete the picture by linking handling characteristics to equipment automation levels and cure strategies. Together, these layered segments provide a decision-making framework that aligns materials, processes, and end-market requirements.

How regional manufacturing profiles, regulatory environments, and end-market demands shape underfill choices and qualification strategies across global markets

Regional dynamics play a pivotal role in underfill materials strategy, influencing sourcing, qualification timelines, and preferred chemistries. In the Americas, strong automotive and industrial electronics demand drives interest in high-reliability epoxy systems and reworkable formulations that support field serviceability. North American and South American manufacturing hubs each face distinct supply chain and regulatory conditions, prompting firms to adopt localized qualification approaches and tighter collaboration between materials suppliers and contract manufacturers.

Europe, Middle East & Africa exhibit a diverse set of requirements shaped by stringent automotive and industrial standards, as well as growing demand in telecommunications infrastructure. This region emphasizes materials that meet rigorous regulatory and environmental standards, prompting formulators to offer low-emission cure agents and compliance-friendly additives. Cross-border trade within the region and between neighboring markets necessitates harmonized qualification protocols to accelerate deployment across multiple production sites.

Asia-Pacific remains a central node for advanced packaging scale and rapid consumer electronics product cycles, leading to strong uptake of low-viscosity capillary underfills and preform solutions that favor high-throughput assembly. The region's dense ecosystem of materials producers, assembly houses, and OEMs facilitates rapid iteration, but it also demands robust supply chain oversight to manage raw material variability and lead-time sensitivity. In sum, regional characteristics shape not only the preferred chemistries and forms but also the organizational processes required to qualify and sustain high-volume production.

Observations on industry competitive dynamics, strategic partnerships, and capability-based differentiation among underfill material providers and integrators

The competitive landscape among companies engaged with underfill materials reflects diversification across formulation expertise, application support services, and integration partnerships with packaging houses and OEMs. Leading developers invest heavily in materials science capabilities to fine-tune cure kinetics, modulus profiles, and thermal performance, while others differentiate through specialized dispensing solutions, preform processing, or localized manufacturing footprints that reduce lead times and logistical complexity.

Partnership models are increasingly prominent, with materials suppliers embedding application engineering teams within assembly partners to accelerate qualification and trouble-shoot process transfers. Service differentiation also includes extended testing suites-thermal cycling, moisture sensitivity, and mechanical shock-that align with specific end-use requirements such as automotive and healthcare. Additionally, some firms offer modularized product families that allow customers to select a base chemistry and then tailor viscosity, filler loading, and cure profile without full requalification, thereby reducing time-to-deployment for derivative products.

Supply chain management and raw material sourcing are additional axes of competitive advantage. Companies that have secured diversified precursor sources and established regional compounding capabilities are better positioned to meet just-in-time demands and adapt to trade policy shifts. Finally, intellectual property around proprietary additives, surface treatments, and preform manufacturing methods continues to be a differentiator, enabling firms to command premium pricing for validated performance in demanding applications.

Concrete steps for manufacturers and suppliers to strengthen resilience, accelerate qualification cycles, and align formulations with evolving application demands

Industry leaders should adopt a multifaceted strategy that combines materials R&D, process integration, and supply chain resilience to capture value and reduce risk. First, prioritize formulation roadmaps that enable modular adjustments to viscosity, cure kinetics, and filler content so products can be rapidly adapted for diverse application classes and regional supply constraints. Coupling this with robust application engineering support will reduce qualification cycles and increase adoption by packaging partners.

Second, invest in supply chain diversification and nearshoring options where regulatory or tariff uncertainty creates exposure. Establishing regional compounding or preform manufacturing hubs and securing multiple precursor suppliers will improve continuity and enable faster response to customer needs. Parallel to this, implement formal process-transfer protocols and knowledge repositories to accelerate replication of cure profiles and adhesion performance across manufacturing sites.

Third, deepen collaboration with end-users in automotive, telecommunications, and consumer electronics to co-develop materials that meet specific reliability and serviceability requirements. Incorporate accelerated life testing, field feedback loops, and application-specific test matrices into product development so that new formulations can be validated against realistic stressors. Lastly, strengthen post-sale service offerings such as field failure analysis, rework recommendations, and training programs to reduce installation risk and reinforce customer relationships. These combined actions will position firms to respond to evolving technical demands while maintaining operational flexibility.

A transparent and technically grounded research approach combining expert interviews, literature analysis, and laboratory-aligned evaluation frameworks to ensure actionable insights

The research underpinning this report integrates primary and secondary methods to ensure technical rigor and practical relevance. Primary data collection included structured interviews with packaging engineers, materials scientists, procurement leaders, and manufacturing operations managers across diverse end-use industries. These conversations informed problem definitions, validated failure modes, and clarified the operational constraints that drive material selection and process architecture decisions.

Secondary research comprised a comprehensive review of peer-reviewed journals, patent filings, standards documents, and publicly available technical white papers focused on polymer chemistry, thermal-mechanical modeling, and electronic assembly processes. Laboratory-based evaluation protocols were incorporated where possible, including standard thermal cycling, moisture sensitivity, and shear adhesion tests, to contextualize material behavior under representative stressors. Where direct laboratory testing was not feasible, validated comparative frameworks were used to assess relative performance indicators.

Analytical techniques combined qualitative thematic synthesis with structured comparative matrices to map material properties to application and regional requirements. Sensitivity analyses were performed to examine how variations in viscosity, cure profile, and filler loading influence process compatibility and long-term reliability. Throughout, findings were triangulated across multiple sources to minimize bias and ensure that recommendations reflect both technological realities and commercial constraints.

Final synthesis underscoring the strategic role of underfill materials and the integrated actions required to secure performance and supply resilience

Underfill materials are a foundational enabler for modern electronic packaging, bridging the gap between mechanical protection and electrical performance as devices become more compact and functionally complex. The collective examination presented here highlights that material selection is not an isolated decision but a systems-level choice influenced by application format, end-use reliability demands, regional supply dynamics, and evolving processing technologies. Companies that integrate formulation flexibility, application engineering, and supply chain diversification will be better positioned to navigate technical and policy headwinds.

Moving forward, the interplay between novel packaging architectures and tailored underfill chemistries will continue to accelerate, particularly in segments with stringent reliability requirements such as automotive and telecommunications. At the same time, assembly process innovation will create opportunities for new underfill forms-such as advanced preforms and optimized no-flow systems-that reduce cycle time without compromising long-term performance. Therefore, organizations should treat underfill strategy as a strategic capability that requires cross-functional alignment among R&D, manufacturing, and procurement.

In closing, the path to sustainable advantage lies in marrying deep materials expertise with pragmatic operational practices. Firms that invest in modular chemistry platforms, regional manufacturing resilience, and close collaboration with end-users will not only reduce risk but also unlock new performance outcomes that support next-generation electronic systems.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Underfill Materials Market

Companies Mentioned

The key companies profiled in this Underfill Materials market report include:- AI Technology, Inc.

- AIM Metals & Alloys LP

- Bondline Electronic Adhesives, Inc.

- CAPLINQ Corporation

- Chemtronics International Ltd

- Dycotec Materials Ltd

- Epoxy Technology Inc

- Essemtec AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hitachi Chemical Company

- Indium Corporation

- MacDermid Alpha Electronics Solutions

- Master Bond, Inc.

- NAGASE (EUROPA) GmbH

- Namics Corporation

- Nordson Corporation

- Panasonic Corporation

- Parker Hannifin Corporation

- Shenzhen Cooteck Electronic Material Technology Co., Ltd

- SOMAR Corporation

- Sumitomo Bakelite Co., Ltd.

- Won Chemical Co.,Ltd.

- YINCAE Advanced Materials, LLC

- Zymet, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

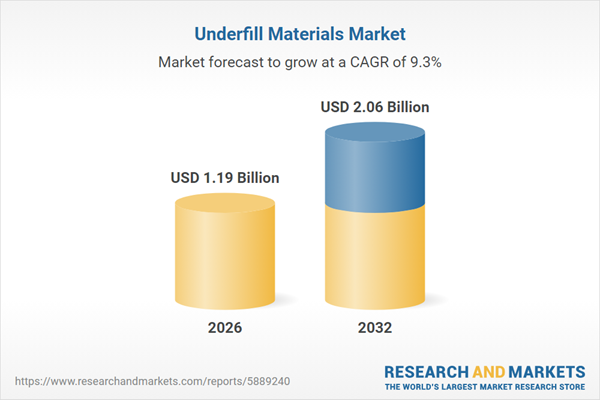

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.19 Billion |

| Forecasted Market Value ( USD | $ 2.06 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |