Global Airport Security Equipment Market - Key Trends & Drivers Summarized

What Are The Emerging Technological Innovations Transforming Airport Security Equipment?

The evolution of airport security equipment has accelerated dramatically over recent years, driven by sophisticated technological advancements that are redefining how safety and efficiency are achieved at air travel hubs worldwide. Cutting-edge biometric systems, such as facial recognition and fingerprint scanners, are being integrated into screening processes, providing faster and more accurate identification of passengers. Advanced X-ray and computed tomography (CT) scanning systems have revolutionized baggage screening by offering 3D imaging capabilities that reveal concealed threats with unprecedented clarity. The integration of artificial intelligence and machine learning algorithms in these systems enables real-time threat analysis and automated decision-making, ensuring that potential security breaches are flagged immediately. High-resolution video surveillance and smart sensors, connected through the Internet of Things (IoT), allow for continuous monitoring of restricted zones, enabling proactive incident management and rapid response. Digital transformation in security control centers has led to the development of centralized platforms that aggregate data from multiple sensors, providing a comprehensive view of airport security operations. Enhanced encryption and cybersecurity protocols are being implemented to protect the vast amounts of sensitive data generated, while robust data analytics tools are used to predict trends and streamline operations. Furthermore, modular design approaches in equipment construction facilitate easier upgrades and system integrations, ensuring that airports can quickly adapt to evolving threats. The convergence of advanced hardware, sophisticated software, and integrated network systems is driving significant improvements in operational efficiency, reducing human error, and boosting overall safety. Manufacturers are now investing in R&D to push the boundaries of sensor resolution, throughput speed, and detection accuracy, while also addressing environmental challenges such as low-light performance and adverse weather conditions. The rapid adoption of these advanced technologies is not only reshaping security protocols but also redefining the passenger experience by minimizing delays and enhancing privacy. With increasing demand for interoperability among various security systems, standardization efforts are underway to create unified platforms that simplify maintenance and integration. As the sector embraces digital innovation, ongoing improvements in thermal imaging, radar-based detection, and wireless communications are expanding the capability and reliability of security systems at airports. These enhancements support a robust security posture that is adaptable to both traditional and emerging threats, ensuring that airport operations remain resilient in the face of global challenges. The continuous technological evolution in airport security equipment is setting new industry benchmarks, driving both cost efficiency and operational excellence in an era of heightened global travel.How Are End-Use Trends and Consumer Behaviors Shaping Airport Security Strategies?

Airports around the world are increasingly re-evaluating their security strategies in response to shifting end-use trends and evolving consumer expectations. As passenger volumes surge due to global travel recovery and the rise of low-cost carriers, airports are under immense pressure to maintain high levels of safety without compromising on operational speed or customer experience. Security systems are being designed to minimize wait times and streamline the screening process, ensuring that travelers are processed quickly and efficiently. Enhanced customer-centric solutions, such as self-service kiosks and mobile integration for pre-screening, are gaining prominence and driving demand for user-friendly, digital-first security solutions. Additionally, the integration of behavioral analytics into security protocols is enabling airports to identify suspicious activity without intrusive manual checks, thereby enhancing both security and passenger comfort. Consumer demand for transparency and accountability in data handling has spurred airports to adopt systems that not only protect physical assets but also secure personal information through advanced encryption and robust cybersecurity measures. The growing expectation for seamless connectivity has led to the deployment of integrated, networked security platforms that provide real-time updates to passengers via mobile apps and digital signage. These systems are designed to communicate clearly and effectively during security delays or alerts, thus reducing passenger anxiety and building trust. Moreover, airport security equipment is evolving to support flexible, scalable solutions that can adapt to fluctuating passenger traffic and varying threat levels, ensuring that resource allocation is optimized during peak travel times. The increasing emphasis on environmental sustainability has also influenced equipment design, with manufacturers now prioritizing energy efficiency and the use of recyclable materials. Enhanced operational protocols, supported by continuous staff training and digital simulation exercises, are improving the human-machine interface within security ecosystems. The integration of remote monitoring systems and predictive maintenance tools ensures that the equipment remains in optimal condition, reducing downtime and operational disruptions. These consumer-centric and end-use driven trends are reshaping the landscape of airport security, compelling stakeholders to adopt solutions that balance stringent safety standards with a superior travel experience.What Role Do Digital Transformation and Integrated Networks Play in Modern Airport Security Equipment?

Digital transformation is at the core of modern airport security, with the integration of advanced networking and data analytics solutions driving significant improvements in system performance and operational resilience. The convergence of IoT devices, high-speed communications, and cloud-based analytics has led to the development of integrated security platforms that consolidate data from disparate sources into a unified command center. This centralization of information not only enhances situational awareness but also allows for the rapid identification and neutralization of threats. Automated video analytics and real-time facial recognition systems are being deployed to support proactive threat detection, ensuring that anomalies are detected and addressed promptly. Furthermore, the deployment of edge computing devices reduces latency and enables localized processing of critical security data, resulting in quicker response times. The use of big data analytics, supported by machine learning algorithms, is transforming how security trends are forecasted and operational strategies are formulated. By continuously analyzing streams of data from sensors, cameras, and access control systems, airport security managers can optimize resource allocation and fine-tune protocols to match current threat landscapes. The integration of mobile technologies and wearable devices further extends the reach of security operations, enabling staff to receive real-time alerts and coordinate responses seamlessly. Enhanced connectivity through 5G networks is accelerating data transfer rates and ensuring uninterrupted communication across vast airport complexes, a critical factor in maintaining robust security measures. These technological integrations have also streamlined compliance with international security standards and regulatory requirements, making audits and certifications more efficient. As security systems become more interconnected, there is a growing emphasis on cybersecurity measures that protect against data breaches and unauthorized access, ensuring that sensitive information remains secure. The interoperability of systems from multiple vendors is being enhanced through standardization efforts, creating a more cohesive security infrastructure that is both scalable and resilient. Collaborative platforms that enable data sharing among different airports and security agencies are also fostering a more coordinated approach to threat management, reinforcing the overall security framework across regions.The growth in the airport security equipment market is driven by several factors…

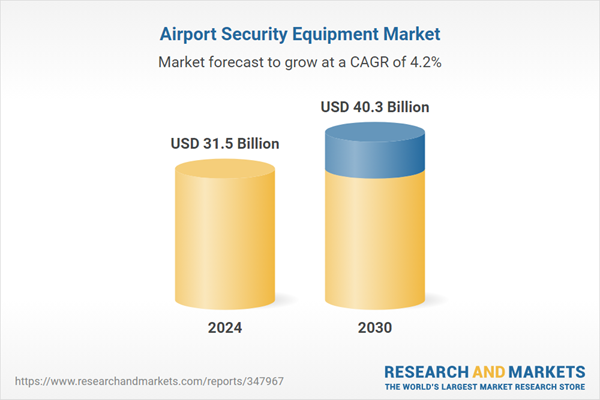

The growth in the airport security equipment market is driven by several factors, including transformative digital innovations, end-use advancements, and evolving consumer behavior that collectively redefine the safety and operational efficiency of modern airports. Technological breakthroughs such as high-definition imaging, AI-based analytics, and advanced sensor integration have propelled the adoption of intelligent, networked security systems that offer real-time monitoring and threat detection with unparalleled precision. The expansion of integrated security networks - enabled by IoT connectivity, cloud computing, and edge processing - facilitates seamless communication between disparate systems, thereby enhancing situational awareness and operational coordination. End-use trends, such as the surge in passenger volumes and the diversification of travel modalities, are compelling airports to invest in scalable, automated solutions that reduce screening times and improve overall travel experience. Furthermore, the increasing emphasis on data security and privacy, driven by consumer demand for transparency, has accelerated the implementation of robust encryption and cybersecurity protocols. The convergence of smart technologies with traditional security systems is resulting in platforms that are not only highly efficient but also adaptive to evolving threat landscapes. Regulatory reforms and international security mandates are further reinforcing market demand by establishing stringent performance benchmarks that drive continuous innovation in equipment design and deployment. Strategic collaborations among technology providers, airport authorities, and government agencies are fostering an environment of rapid technological adoption and process optimization. Continuous investments in research and development, combined with digital transformation initiatives, are enabling more efficient asset management and predictive maintenance across security systems. These factors, in tandem with growing global travel and heightened security awareness, create a robust ecosystem that propels the future expansion of airport security equipment, ensuring that modern airports remain resilient, efficient, and secure.Report Scope

The report analyzes the Airport Security Equipment market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Explosives Detection, X-Ray & Infrared Equipment, Perimeter & Access Control, Video Surveillance, Biometrics Equipment, Metal Detectors, Other Types).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Explosives Detection Equipment segment, which is expected to reach US$13.5 Billion by 2030 with a CAGR of a 4.8%. The X-Ray & Infrared Equipment segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.5 Billion in 2024, and China, forecasted to grow at an impressive 3.9% CAGR to reach $6.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Airport Security Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Airport Security Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Airport Security Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Analogic Corporation, Autoclear, LLC, Axis Communications AB., Ayonix Corporation, Bertel O. Steen Airport Solutions AS and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 82 companies featured in this Airport Security Equipment market report include:

- Analogic Corporation

- Autoclear, LLC

- Axis Communications AB.

- Ayonix Corporation

- Bertel O. Steen Airport Solutions AS

- Brijot Imaging Systems

- C.E.I.A. S.p.A.

- Gilardoni S.p.A.

- Honeywell International, Inc.

- IDEMIA

- Johnson Controls International PLC

- L3 Security & Detection Systems

- Mistral Security Inc.

- Nuctech Company Limited

- OSI Systems, Inc.

- OSSI

- RedXDefense

- RESA AIRPORT DATA SYSTEMS

- Robert Bosch LLC

- Rockwell Collins

- Siemens AG

- SITA

- Smiths Detection Watford Ltd.

- Thruvision Ltd.

- Vanderlande Industries B.V.

- Westminster International Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Analogic Corporation

- Autoclear, LLC

- Axis Communications AB.

- Ayonix Corporation

- Bertel O. Steen Airport Solutions AS

- Brijot Imaging Systems

- C.E.I.A. S.p.A.

- Gilardoni S.p.A.

- Honeywell International, Inc.

- IDEMIA

- Johnson Controls International PLC

- L3 Security & Detection Systems

- Mistral Security Inc.

- Nuctech Company Limited

- OSI Systems, Inc.

- OSSI

- RedXDefense

- RESA AIRPORT DATA SYSTEMS

- Robert Bosch LLC

- Rockwell Collins

- Siemens AG

- SITA

- Smiths Detection Watford Ltd.

- Thruvision Ltd.

- Vanderlande Industries B.V.

- Westminster International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31.5 Billion |

| Forecasted Market Value ( USD | $ 40.3 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |