Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

International travel is also on the rise, fueled by India's growing global connectivity and the rise of digital platforms making travel planning easier. The market includes segments like hospitality, transportation, and tour operators, with technology playing a key role in shaping the future of the sector. Post-pandemic recovery further strengthens the outlook.

In February 2023, the highest percentage share of Foreign Tourist Arrivals (FTAs) in India came from Bangladesh, accounting for 20.3%, followed by the USA at 16.4%, and the UK at 11.1%. Other notable source countries included Canada (5.8%), Australia (3.7%), Malaysia (3.0%), Sri Lanka (2.8%), Russian Federation (2.7%), Germany (2.5%), and France (2.4%). Additionally, Nepal contributed 1.9%, Thailand 1.7%, Singapore 1.5%, Italy 1.2%, and Japan 1.2% to the total FTAs. These figures highlight the diverse origins of international tourists visiting India.

Key Market Drivers

Rising Disposable Incomes

As the Indian economy continues to grow, disposable incomes across the country are also on the rise. This is particularly true for the urban population, where increased wages and better employment opportunities have created more financial freedom for spending on travel. With more people able to afford leisure and business trips, the demand for both domestic and international travel is increasing. The Ministry of Tourism compiles monthly Foreign Tourist Arrivals (FTAs) based on data from the Bureau of Immigration (BOI). In February 2023, FTAs reached 865,779, compared to 240,896 in February 2022 and 1,090,516 in February 2019, reflecting a growth of 259.4% compared to 2022 and a decline of 20.6% compared to 2019. The rising number of FTAs is a key factor driving the growth of the market.Higher disposable income also leads to an improved standard of living, which often translates into an increased willingness to spend on experiences such as luxury hotels, fine dining, and high-end transportation. This has led to a boom in the premium segment of the travel industry, particularly in areas such as premium tours, luxury hotels, and high-end transport services like flights and trains.

Rise of Experiential and Sustainable Tourism

The growth of experiential and sustainable tourism in India is driven by the expanding middle class, with a clear shift from traditional tourism to more personalized and immersive travel experiences. Travelers are increasingly seeking authentic interactions with local cultures, traditions, and lifestyles, fueling the popularity of adventure, wellness, rural, and cultural tourism. This trend is particularly strong among younger generations and those keen to explore India’s diverse heritage and natural landscapes.Additionally, growing eco-consciousness is steering travelers toward sustainable choices, with increased demand for eco-friendly accommodations, nature-based activities, and responsible tourism practices, particularly in ecologically sensitive areas. Government initiatives like the "Responsible Tourism Mission" further promote sustainable tourism practices, encouraging both tourists and businesses to prioritize environmental preservation.

Government Initiatives and Infrastructure Development

The Indian government has played a pivotal role in driving the growth of the travel and tourism market through a variety of initiatives. Programs such as “Incredible India” have been instrumental in positioning India as a prominent destination for international tourists. The campaign has successfully showcased India’s rich culture, diverse heritage, and natural beauty, attracting tourists from across the globe.In addition to promotional campaigns, the Indian government has also focused on improving tourism infrastructure. Investments in transportation networks, including the expansion of airports, highways, and railways, have made travel within the country easier and more convenient. The government's push towards upgrading airports in major cities like Delhi, Mumbai, and Bengaluru has significantly improved the international travel experience.

Key Market Challenges

Safety and Security Concerns

Safety and security remain one of the biggest concerns for both domestic and international tourists visiting India. Issues such as theft, harassment, and crimes targeting tourists can discourage people from traveling to the country. According to various reports, incidents of violence against women, particularly in tourist-heavy areas, have created negative perceptions about the safety of travelers in India. These concerns, if not addressed, can lead to a decline in tourist arrivals, particularly from international markets.Furthermore, natural disasters such as floods, earthquakes, and landslides, which occur periodically in certain regions of the country, can disrupt travel plans and make destinations less attractive. In some cases, the lack of effective emergency management systems in these areas means tourists may not feel confident about their safety during such events.

Environmental Sustainability Issues

The rapid growth of India’s travel & tourism market has come with significant environmental costs. Unregulated tourism, particularly in ecologically sensitive areas, has led to environmental degradation. Popular tourist destinations such as the Himalayan region, Kerala's backwaters, and the coastal areas are under pressure due to rising waste generation, pollution, deforestation, and over-exploitation of resources.Mass tourism in destinations like Goa, Kerala, and Rajasthan has led to overcrowding, increased pollution, and depletion of natural resources like water. The construction of new hotels, resorts, and other tourist facilities has often been done without sufficient environmental impact assessments, leading to unsustainable practices that harm local ecosystems.

Key Market Trends

Digitalization and Technology Integration

Technology is transforming the way people plan, book, and experience their travel. The rise of smartphones, mobile apps, and digital platforms has made it easier for travelers to access information, make bookings, and plan trips. Online Travel Agencies (OTAs) like MakeMyTrip, Yatra, and Cleartrip have revolutionized the booking process, allowing users to compare prices, book flights, hotels, and transportation with a few clicks. The integration of artificial intelligence (AI), machine learning (ML), and big data analytics is enabling personalized recommendations and enhancing the overall customer experience.Mobile apps have also made it easier for travelers to book hotels, tours, and activities while on the go. The availability of real-time information, such as traffic updates, flight statuses, and restaurant reviews, enhances convenience and helps travelers make informed decisions. The use of digital payment platforms like Google Pay and Paytm has further streamlined the booking process, making it quicker and safer.

Rise of Medical and Wellness Tourism

India is rapidly emerging as a global hub for medical tourism, with increasing numbers of international travelers coming to India for affordable, high-quality healthcare services. India’s healthcare sector offers advanced medical procedures and treatments at a fraction of the cost compared to Western countries, making it an attractive destination for medical tourists. Popular medical treatments sought by international travelers include surgeries, dental procedures, fertility treatments, and cosmetic surgery.The growth of wellness tourism is another key trend in the India Travel & Tourism market. India has long been associated with traditional wellness practices, such as Ayurveda, yoga, and meditation, which are gaining global recognition. Tourists are increasingly seeking wellness experiences that focus on holistic health, relaxation, and rejuvenation. Many resorts, particularly in destinations like Kerala, Rishikesh, and Goa, are now offering specialized wellness retreats that combine yoga, meditation, and Ayurveda treatments, catering to the growing demand for health-focused travel experiences.

Segmental Insights

Type Insights

Domestic tourism was the dominating segment in India’s Travel & Tourism market, driven by rising disposable incomes, increasing urbanization, and a growing preference for local travel experiences. Post-pandemic, there has been a significant shift toward exploring domestic destinations, as travel restrictions made international tourism less feasible. Popular destinations like Goa, Kerala, Rajasthan, and the Himalayan regions attract millions of Indian tourists annually. Additionally, improving infrastructure, better road connectivity, and government campaigns like "Dekho Apna Desh" have further fueled the growth of domestic tourism, making it the backbone of India’s overall travel and tourism sector.Regional Insights

The North region of India dominated the travel and tourism market, driven by its rich cultural heritage, historical landmarks, and diverse tourism offerings. Key destinations like Delhi, Agra, and Jaipur attract both domestic and international tourists, with iconic attractions such as the Taj Mahal and Jaipur’s palaces drawing significant attention. The region’s well-developed infrastructure, including major international airports and train networks, further supports its dominance. Additionally, states like Himachal Pradesh, Uttarakhand, and Jammu & Kashmir are popular for their natural beauty, adventure tourism, and spiritual retreats, reinforcing the North’s central role in India's tourism industry.Key Market Players

- Thomas Cook (India) Ltd.

- Country Holidays Inn and Suites Pvt. Ltd

- Yatra Online Limited

- Riya Travel and Tours Pvt. Ltd.

- Cox & Kings Limited

- Cleartrip Private Limited

- Indian Railway Catering and Tourism Corporation Ltd.

- Makemytrip (India) Private Limited

- Le Travenues Technology Limited (“ixigo”)

- SOTC Travel Limited

Report Scope:

In this report, the India Travel & Tourism Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Travel & Tourism Market, By Type:

- Domestic

- Inbound

- Outbound

India Travel & Tourism Market, By Service Offering:

- Ticket Reservation

- Hotel Booking

- Holiday/Tour Packages

- Others

India Travel & Tourism Market, By Purpose of Visit:

- Business

- Leisure & Recreation

- Education

- Medical

- Social Activity

- Others

India Travel & Tourism Market, By Booking Type:

- Travel Companies

- Travel Agencies

- Online

- Others

India Travel & Tourism Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Travel & Tourism Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Thomas Cook (India) Ltd.

- Country Holidays Inn and Suites Pvt. Ltd

- Yatra Online Limited

- Riya Travel and Tours Pvt. Ltd.

- Cox & Kings Limited

- Cleartrip Private Limited

- Indian Railway Catering and Tourism Corporation Ltd.

- Makemytrip (India) Private Limited

- Le Travenues Technology Limited (“ixigo”)

- SOTC Travel Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | February 2025 |

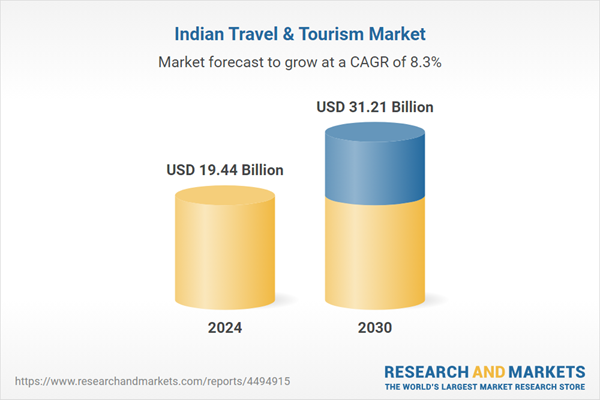

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.44 Billion |

| Forecasted Market Value ( USD | $ 31.21 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |