After the COVID-19 pandemic, due to the work-from-home culture for almost a year, people started developing health issues. Increase in weight and diseases like high blood pressure, cholesterol, and diabetes are increasing among people. Due to these reasons, people have become aware of the benefits of fitness, and countries have increased participation in sports and activities. After the pandemic, trekking and hiking trips also increased around the world, which, in turn, has increased demand for athletic shoes, thereby driving the growth of the athletic footwear market. According to the Outdoor Participation Trends report 2022, 58.7 million people went hiking in the United States in 2021.

The market is being driven by rising awareness about the importance of fitness. Consumer buying behavior transformed substantially in recent years, primarily due to an increase in disposable income and increased spending on products for self-enhancement. A rise in the number of specialty and franchised footwear stores, as well as tie-ups between footwear makers and various retail chains, has boosted demand for athletic footwear. Various emerging trends in different locations are expected to have a favorable impact on the sports footwear industry in the coming years. Furthermore, product development advancements, such as smart footwear that calculates calories burned, from market players may have an impact on the athletic footwear industry.

Athletic Footwear Market Trends

Growing Sports Participation and Influence of Athleisure

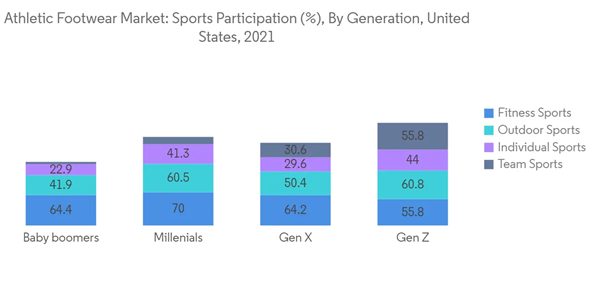

Consumers increasingly prefer designer athletic shoes that incorporate elements of sports design in accordance with the athleisure trend. Furthermore, the global demand for running and cycling footwear is driven by the continued shift toward more active lifestyles. With the rise in popularity of sports and fitness activities, such as aerobics, swimming, jogging, and yoga, as well as the number of women participating in fitness and sports activities, attractive and comfortable sports footwear ideal for daily sports activities is becoming extremely popular. Consumers, particularly women, are buying more athletic footwear as a result of this. In addition, athleisure has become increasingly widespread, influencing millennial parents' sports footwear choices. Athletic footwear is famous among all age groups, as baby boomers, Generation X, Generation Z, and millennials are also participating in sports activities.South America is the Fastest-growing Market for Athletic Footwear

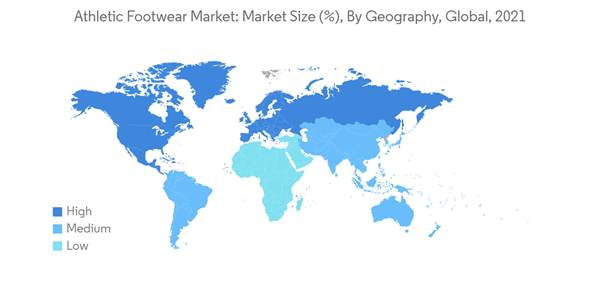

Brazil has a well-developed sporting culture. Sports are not only widely played and popular among large segments of the population, but they are also diverse in nature. As a result, Brazil is one of the world's major athletic footwear marketplaces, driving athletic footwear sales in South America. Furthermore, in recent years, in South America, rising health consciousness, changing lifestyles, increasing desire for comfortable footwear, the growing need for creative footwear designs, and expanding disposable income levels have pushed consumer preference for athletic footwear. Athletic footwear international companies and brands are significantly expanding in Brazil, contributing to the athletic footwear market in South America. Brazil offers exciting investment opportunities for the sports industry across multiple sports sectors. The target audience for companies is the high and middle-income population.Athletic Footwear Industry Overview

The athletic footwear market is competitive, with the presence of various regional and global players. To achieve a competitive advantage in the market, firms compete on a variety of variables such as product offerings, price, material quality, and marketing efforts. Companies are utilizing digital and social media marketing to notify people about new product launches. The e-commerce channel has been growing majorly over recent years, and it is one of the preferred channels for the major players operating in the market. Adidas AG, Nike Inc., and Puma SE are some of the major players operating in the market studied.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adidas AG

- Nike Inc.

- Under Armour Inc.

- Puma SE

- SKECHERS USA Inc.

- Asics Corporation

- Wolverine World Wide Inc.

- VF Corporation

- Fila

- New Balance Athletics Inc.