Global CMOS Image Sensors Market - Key Trends and Drivers Summarized

How Are CMOS Image Sensors Revolutionizing Modern Imaging Technologies?

CMOS (Complementary Metal-Oxide-Semiconductor) image sensors are at the forefront of modern imaging technologies, transforming how we capture and process visual information across a wide range of applications. These sensors have largely replaced traditional CCD (Charge-Coupled Device) sensors due to their superior performance in terms of power efficiency, speed, and integration capabilities. CMOS image sensors are embedded in a wide array of devices, from smartphones and digital cameras to automotive systems, medical imaging devices, and industrial equipment. Their ability to convert light into electronic signals with high precision while consuming less power makes them ideal for battery-operated devices and applications requiring high-speed image processing. One of the key advantages of CMOS image sensors is their ability to integrate additional functions such as signal processing, image correction, and noise reduction directly on the chip, enabling real-time enhancements and faster image capture. This versatility and scalability have made CMOS sensors the go-to solution for industries that require high-quality imaging, whether it's for consumer electronics, security systems, or advanced scientific research.What Technological Innovations Are Shaping the Evolution of CMOS Image Sensors?

The evolution of CMOS image sensors has been shaped by numerous technological innovations that have drastically improved their performance and expanded their potential applications. One major breakthrough is the development of backside illumination (BSI) technology, which enhances the sensor's ability to capture light by placing the wiring behind the photodiodes, resulting in improved image quality, especially in low-light conditions. This advancement has been pivotal for smartphone cameras and other compact devices, where space is limited but high-quality imaging is essential. Additionally, the ongoing reduction in pixel size has allowed manufacturers to produce sensors with higher resolutions without increasing the overall sensor size, making it possible to pack more pixels into smaller devices. Global shutter technology is another critical advancement in CMOS image sensors, particularly for applications like machine vision, robotics, and high-speed imaging. Unlike traditional rolling shutters, which can cause distortion when capturing fast-moving objects, global shutters capture the entire image at once, eliminating motion artifacts and ensuring accurate image reproduction in dynamic environments. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into CMOS image sensors is enabling real-time image processing features such as facial recognition, object tracking, and scene optimization. These AI-driven capabilities are particularly prominent in the smartphone industry, where features like computational photography and augmented reality (AR) are pushing the boundaries of what mobile cameras can achieve. Innovations in 3D imaging, such as time-of-flight (ToF) sensors, have also added depth-sensing capabilities to CMOS sensors, enabling applications in AR, VR, and autonomous systems, further broadening the scope of their use.How Are Different Industries Adopting CMOS Image Sensors?

CMOS image sensors are being adopted across a wide range of industries, each harnessing the technology to meet unique imaging and processing needs. In consumer electronics, smartphones are at the forefront of this revolution, with manufacturers integrating multiple CMOS sensors to provide ultra-wide, telephoto, and macro capabilities, all while maintaining high image quality even in challenging lighting conditions. Beyond consumer devices, the automotive industry is increasingly reliant on CMOS image sensors for applications in advanced driver-assistance systems (ADAS) and autonomous vehicles. These sensors are essential for lane detection, obstacle recognition, and 360-degree surround-view systems, providing high-speed, high-resolution imaging that enhances vehicle safety and autonomy. In the medical field, CMOS image sensors are being used in diagnostic imaging devices such as endoscopes and microscopes, where their small size and high resolution make them ideal for capturing detailed medical imagery in minimally invasive procedures. Industrial automation and robotics also rely heavily on CMOS sensors for machine vision systems, which are used for inspecting products, guiding robotic arms, and performing quality control in manufacturing environments. Additionally, CMOS sensors are playing a crucial role in the security and surveillance sector, where they are embedded in IP cameras and facial recognition systems, offering high-resolution video capture and real-time image analysis for enhanced security solutions. These diverse applications demonstrate the flexibility and scalability of CMOS image sensors, making them indispensable across industries that require precise, real-time imaging.What Is Driving the Growth in CMOS Image Sensors?

The growth in the CMOS image sensor market is driven by several key factors. One of the primary drivers is the booming demand for high-resolution cameras in smartphones, which has spurred significant innovation in CMOS sensor technology. Consumers are increasingly seeking better image quality, enhanced low-light performance, and advanced features like optical zoom, which have pushed manufacturers to develop more sophisticated CMOS sensors with higher pixel counts and improved sensitivity. Additionally, the growing use of multi-camera setups in mobile devices, enabling features such as portrait mode and ultra-wide-angle photography, has further increased the demand for CMOS image sensors. Another major growth factor is the rapid expansion of the automotive industry's reliance on imaging technology. With the rise of autonomous driving systems and ADAS, high-performance CMOS sensors are essential for providing the real-time imaging required for vehicle safety, navigation, and object detection. The proliferation of smart security systems is also contributing to market growth, as CMOS sensors are increasingly used in surveillance cameras and facial recognition systems to deliver clear, detailed images in various lighting conditions. Industrial automation and machine vision systems are experiencing heightened demand for CMOS image sensors as well. Furthermore, the integration of AI into CMOS sensors is expanding their applications across industries, allowing for more intelligent and autonomous imaging systems that can adapt to real-time conditions. Finally, advancements in 3D imaging and depth-sensing technologies, such as ToF and structured light, are opening up new applications for CMOS sensors in areas like AR, VR, and biometric authentication. These factors are collectively driving the strong growth of the CMOS image sensor market, making it a crucial component of modern imaging technologies across both consumer and industrial sectors.Report Scope

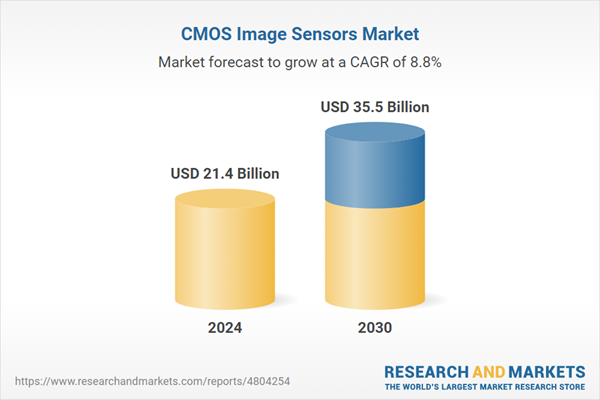

The report analyzes the CMOS Image Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (CMOS, Other Technologies); Application (Consumer Electronics, Medical, Industrial, Surveillance, Automotive, Defense & Aerospace, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the CMOS Technology segment, which is expected to reach US$27.1 Billion by 2030 with a CAGR of 8%. The Other Technologies segment is also set to grow at 11.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.7 Billion in 2024, and China, forecasted to grow at an impressive 13.7% CAGR to reach $8.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global CMOS Image Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global CMOS Image Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global CMOS Image Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as e2v technologies PLC, GalaxyCore Inc., OmniVision Technologies, Inc., ON Semiconductor Corporation, Panasonic Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 28 companies featured in this CMOS Image Sensors market report include:

- e2v technologies PLC

- GalaxyCore Inc.

- OmniVision Technologies, Inc.

- ON Semiconductor Corporation

- Panasonic Corporation

- Pixart Imaging Inc.

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- SK Hynix, Inc.

- Sony Corporation

- STMicroelectronics NV

- Taiwan Semiconductor Manufacturing Co., Ltd.

- Teledyne Technologies Inc.

- Toshiba Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- e2v technologies PLC

- GalaxyCore Inc.

- OmniVision Technologies, Inc.

- ON Semiconductor Corporation

- Panasonic Corporation

- Pixart Imaging Inc.

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- SK Hynix, Inc.

- Sony Corporation

- STMicroelectronics NV

- Taiwan Semiconductor Manufacturing Co., Ltd.

- Teledyne Technologies Inc.

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 237 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.4 Billion |

| Forecasted Market Value ( USD | $ 35.5 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |