Global Automotive Wiring Harness Market - Key Trends and Drivers Summarized

What Makes Automotive Wiring Harnesses the Nervous System of Modern Vehicles?

Automotive wiring harnesses are often referred to as the nervous system of vehicles, connecting various components and ensuring that power and signals are transmitted efficiently throughout the vehicle. These complex assemblies of wires, connectors, and terminals are integral to the functioning of virtually every automotive system, from basic lighting and engine control to advanced infotainment and driver assistance systems. As vehicles become more technologically advanced, the role of the wiring harness has evolved from simple power transmission to managing the vast array of electronic functions that modern vehicles rely on. This evolution has increased the complexity of wiring harnesses, making them critical to vehicle safety, performance, and reliability. Given their central role, any failure in the wiring harness can lead to significant issues, highlighting the importance of quality and durability in their design and manufacturing.How Are Technological Advancements Shaping Automotive Wiring Harness Development?

The automotive wiring harness industry is undergoing significant changes, driven by rapid advancements in vehicle technology. With the rise of electric vehicles (EVs), hybrid vehicles, and autonomous driving technologies, the demand for more sophisticated wiring harnesses has surged. These advancements require wiring harnesses that can handle higher voltages and currents, integrate seamlessly with advanced electronic control units (ECUs), and support complex communication protocols such as CAN, LIN, and FlexRay. Moreover, the trend towards lighter vehicles to improve fuel efficiency has pushed manufacturers to develop lightweight wiring harnesses using advanced materials such as aluminum instead of traditional copper. Additionally, the integration of smart technologies and IoT in vehicles is leading to the development of intelligent wiring harnesses that can monitor their own condition and communicate data to the vehicle's onboard diagnostics systems, paving the way for predictive maintenance and enhanced safety features.What Are The Challenges And Opportunities In The Automotive Wiring Harness Market?

Despite the opportunities presented by technological advancements, the automotive wiring harness market faces several challenges. One of the most significant is the complexity and customization required for each vehicle model, as each harness must be precisely tailored to fit the specific design and functionality of the vehicle. This complexity increases manufacturing costs and time, making the process more labor-intensive. Additionally, the push for more compact and efficient wiring harnesses must be balanced with the need for reliability and durability, as these systems are often exposed to harsh environmental conditions, such as extreme temperatures, vibration, and moisture. However, these challenges also present opportunities for innovation, as manufacturers invest in automated manufacturing processes, advanced simulation tools, and new materials to improve efficiency and reduce costs. The ongoing trend towards electric and autonomous vehicles continues to drive demand for advanced wiring harnesses, creating a dynamic and competitive market environment.What Factors Are Driving Growth in the Automotive Wiring Harness Market?

The growth in the automotive wiring harness market is driven by several factors, including the increasing adoption of electric and hybrid vehicles, the rising demand for advanced driver assistance systems (ADAS), and the ongoing shift towards vehicle electrification. As electric vehicles become more prevalent, the need for high-voltage wiring harnesses that can safely and efficiently handle the power requirements of these vehicles is growing rapidly. Additionally, the proliferation of ADAS and other smart vehicle technologies is driving demand for wiring harnesses that can support the complex electronic systems necessary for autonomous and semi-autonomous driving. Consumer expectations for enhanced vehicle connectivity and infotainment systems are also contributing to the growth of the market, as these features require robust and reliable wiring solutions. Furthermore, the trend towards lightweighting in vehicle design is pushing manufacturers to develop innovative wiring harness solutions that reduce weight without compromising performance, further fueling market expansion. As the automotive industry continues to evolve, the demand for advanced, high-quality wiring harnesses is expected to remain strong, driven by the need for safer, more efficient, and technologically advanced vehicles.Report Scope

The report analyzes the Automotive Wiring Harness market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Terminals, Connectors, Wires, Other Components); Application (Dashboard / Cabin, Engine, Body & Lighting, Battery, HVAC, Airbag, Other Applications); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dashboard / Cabin Application segment, which is expected to reach US$44.5 Billion by 2030 with a CAGR of 5.1%. The Engine Application segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $32.2 Billion in 2024, and China, forecasted to grow at an impressive 7% CAGR to reach $34.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Wiring Harness Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Wiring Harness Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Wiring Harness Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amphenol Global Interconnect Systems, Aptiv PLC, Casco Manufacturing Co., Chenfei Tech (Polaris), Chia Soon Electronics Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Automotive Wiring Harness market report include:

- Amphenol Global Interconnect Systems

- Aptiv PLC

- Casco Manufacturing Co.

- Chenfei Tech (Polaris)

- Chia Soon Electronics Co., Ltd.

- Commercial Vehicle Group, Inc.

- Consolidated Electronic Wire & Cable

- Cypress Industries

- Dongguan Yuqiu Electronics Company Limited

- Elcom International Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amphenol Global Interconnect Systems

- Aptiv PLC

- Casco Manufacturing Co.

- Chenfei Tech (Polaris)

- Chia Soon Electronics Co., Ltd.

- Commercial Vehicle Group, Inc.

- Consolidated Electronic Wire & Cable

- Cypress Industries

- Dongguan Yuqiu Electronics Company Limited

- Elcom International Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 229 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

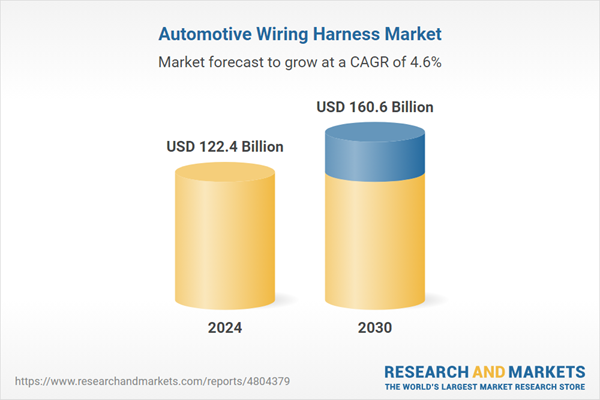

| Estimated Market Value ( USD | $ 122.4 Billion |

| Forecasted Market Value ( USD | $ 160.6 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |