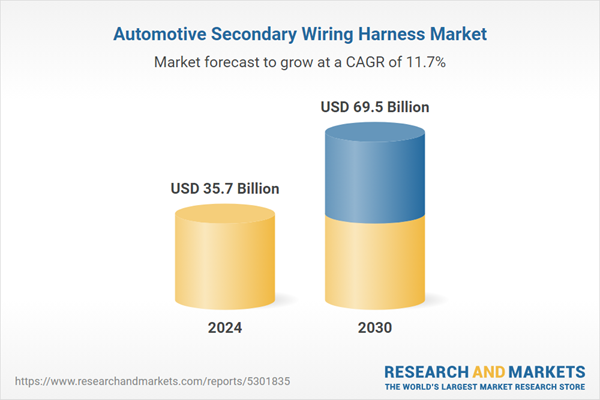

Global Automotive Secondary Wiring Harness Market - Key Trends and Drivers Summarized

Why Are Secondary Wiring Harnesses Vital in Automotive Systems?

Secondary wiring harnesses play a crucial role in modern vehicles, ensuring the efficient routing of electrical signals and power to non-essential yet critical systems, such as lighting, infotainment, sensors, and accessory connections. Unlike primary wiring harnesses, which handle high-voltage power for essential functions like engine ignition and battery connection, secondary wiring harnesses are designed to manage and distribute lower-voltage connections across a wide array of auxiliary systems. In today's vehicles, where comfort, safety, and connectivity features are more sophisticated than ever, secondary wiring harnesses ensure that these systems function smoothly, without interference or overload. Their design contributes to overall vehicle safety by isolating secondary systems from the primary power routes, reducing the risk of electrical shorts and overheating. In addition, secondary wiring harnesses help automakers achieve more organized and accessible vehicle interiors, allowing for streamlined designs and more efficient maintenance. With the increasing complexity of automotive electrical systems, secondary wiring harnesses are indispensable for the seamless operation of auxiliary features, enabling automakers to add value and functionality to modern vehicles.What Are the Key Components and Configurations of Secondary Wiring Harnesses?

Automotive secondary wiring harnesses consist of a variety of components that support the transmission of power and data to different vehicle systems. These components include wires, connectors, terminals, and protective sheaths, all meticulously organized and engineered to withstand the vibrations, heat, and moisture commonly encountered in automotive environments. The wires within these harnesses are typically color-coded and insulated to prevent interference and ensure precise routing, while connectors and terminals are carefully designed to match the specific requirements of each connected system, from audio and visual devices to safety sensors and lighting. Protective sheaths, such as plastic tubing or corrugated loom, shield the harness from potential damage, extending its lifespan and reducing the need for repairs. Secondary wiring harnesses are also highly customizable to fit the unique configuration of each vehicle model, as they often need to navigate complex interiors without intruding on space or functionality. This modular and adaptable design makes it easier for manufacturers to integrate advanced features in vehicles while ensuring that all auxiliary systems receive reliable power and connectivity. The configurations of secondary wiring harnesses, therefore, play a key role in supporting both the design flexibility and functionality demanded in modern automotive interiors.How Are Technological Advancements Improving Secondary Wiring Harness Performance?

Technological advancements in materials and manufacturing processes are significantly enhancing the performance and durability of automotive secondary wiring harnesses. Innovations in lightweight, high-strength materials like advanced polymers and aluminum wiring have made harnesses more resistant to wear, corrosion, and temperature fluctuations while contributing to overall vehicle weight reduction. For instance, replacing traditional copper with aluminum wiring in secondary harnesses offers a lighter, corrosion-resistant alternative that meets the vehicle industry's demands for fuel efficiency and lower emissions. Digital manufacturing technologies, such as 3D modeling and virtual prototyping, allow engineers to design custom harness configurations with precision, optimizing the routing and layout of wiring for improved space utilization and minimal electromagnetic interference. Additionally, automated assembly techniques have improved harness production speed and consistency, reducing production costs while ensuring quality standards. New insulation materials with enhanced heat and chemical resistance further protect the wires from damage, increasing the durability of the harness. As vehicles become more connected and feature-rich, these technological advancements ensure that secondary wiring harnesses can reliably support a growing number of low-voltage systems without compromising performance or safety.What Are the Key Drivers of Growth in the Automotive Secondary Wiring Harness Market?

The growth in the automotive secondary wiring harness market is driven by multiple factors, all linked to the increasing demand for enhanced safety, comfort, and connectivity in modern vehicles. A primary driver is the rise in electronic and auxiliary systems within vehicles, from advanced infotainment systems and driver-assistance technologies to various sensor networks for parking, collision detection, and climate control. Each of these systems requires a stable and organized network of secondary wiring to function properly, fueling the demand for sophisticated harness solutions. The shift toward electric vehicles (EVs) is another significant growth factor, as EVs rely heavily on intricate wiring harness systems to power auxiliary functions without overloading the primary battery system. Technological trends like the Internet of Things (IoT) and vehicle-to-everything (V2X) communication also increase the need for secondary wiring harnesses, as connected vehicles require reliable data transmission for seamless interaction with external systems and infrastructure. Furthermore, regulatory mandates for safety features such as rearview cameras, parking sensors, and blind-spot detection systems in new vehicles necessitate additional wiring networks, directly boosting demand for secondary wiring harnesses. Lastly, the industry's push for lightweight, fuel-efficient designs is driving innovation in harness materials and layouts, as automakers seek harness solutions that contribute to both efficiency and sustainability. These combined factors underscore the expanding role of secondary wiring harnesses in the automotive market, reflecting the evolving expectations for vehicle connectivity, safety, and performance.Report Scope

The report analyzes the Automotive Secondary Wiring Harness market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Electric Vehicle (HEV, BEV, PHEV); Application (Cabin (Interior), Engine Harness, Door Harness, Airbag Harness, Other Applications); End-Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the HEV segment, which is expected to reach US$36.6 Billion by 2030 with a CAGR of a 11.4%. The BEV segment is also set to grow at 11.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.2 Billion in 2024, and China, forecasted to grow at an impressive 15.3% CAGR to reach $16.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Secondary Wiring Harness Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Secondary Wiring Harness Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Secondary Wiring Harness Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Furukawa Electric Co., Ltd., Lear Corporation., Leoni AG, Nexans, Samvardhana Motherson Group. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Automotive Secondary Wiring Harness market report include:

- Furukawa Electric Co., Ltd.

- Lear Corporation.

- Leoni AG

- Nexans

- Samvardhana Motherson Group.

- Spark Minda, Ashok Minda Group

- Sumitomo Electric Industries, Ltd.

- THB Group

- Yazaki Corporation

- Dhoot Transmission Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Furukawa Electric Co., Ltd.

- Lear Corporation.

- Leoni AG

- Nexans

- Samvardhana Motherson Group.

- Spark Minda, Ashok Minda Group

- Sumitomo Electric Industries, Ltd.

- THB Group

- Yazaki Corporation

- Dhoot Transmission Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 35.7 Billion |

| Forecasted Market Value ( USD | $ 69.5 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | Global |