Global Multiplex Assays Market - Key Trends & Drivers Summarized

What Are Multiplex Assays and How Are They Used in Research and Diagnostics?

Multiplex assays are advanced diagnostic tools that allow the simultaneous detection and analysis of multiple biological markers (such as proteins, genes, or other molecules) in a single sample. These assays are widely used in research, clinical diagnostics, and drug development to analyze complex biological processes or detect diseases with higher accuracy and efficiency. Unlike traditional assays that measure one analyte at a time, multiplex assays provide a comprehensive overview by assessing multiple targets simultaneously, thus saving time, reducing costs, and increasing data throughput. These assays are essential in fields like oncology, immunology, and infectious diseases, where understanding multiple biomarkers can lead to more accurate diagnoses and personalized treatment strategies.What Technological Advances Are Shaping the Future of Multiplex Assays?

Advancements in biotechnology and molecular diagnostics are transforming multiplex assays, making them more sensitive, accurate, and scalable. The development of next-generation sequencing (NGS) technologies and microarray platforms has significantly enhanced the ability to analyze large volumes of genetic and protein data simultaneously. Furthermore, advances in fluorescent and chemiluminescent detection methods have improved the sensitivity and precision of multiplex assays, allowing for the detection of lower concentrations of biomarkers. Integration with artificial intelligence (AI) and machine learning is enabling more sophisticated data analysis, helping researchers and clinicians interpret complex assay results more effectively. These technological innovations are expanding the use of multiplex assays in areas such as companion diagnostics, biomarker discovery, and personalized medicine.How Is the Shift Toward Personalized Medicine Driving the Demand for Multiplex Assays?

The growing trend toward personalized medicine, which tailors treatments to individual patients based on their unique genetic, molecular, and environmental profiles, is significantly boosting the demand for multiplex assays. These assays enable healthcare providers to analyze multiple biomarkers at once, offering a more comprehensive understanding of a patient's health and disease status. In oncology, for example, multiplex assays are being used to identify specific mutations or gene expressions that can guide targeted therapies. The ability to detect and monitor several disease-related markers in a single test is also enhancing the efficiency of drug development and clinical trials, where multiple outcomes can be evaluated simultaneously. This push toward more personalized and precise healthcare is a major growth driver for the multiplex assays market.What Are the Key Growth Drivers in the Multiplex Assays Market?

The growth in the multiplex assays market is driven by several factors, including advancements in molecular diagnostics, the rising prevalence of chronic diseases, and the increasing demand for personalized medicine. Technological innovations, such as the development of high-throughput platforms and enhanced detection methods, are making multiplex assays more accurate and accessible for a wider range of applications. The growing incidence of cancer and other complex diseases is also pushing the adoption of these assays in research and clinical settings, where understanding multiple biomarkers is critical for diagnosis and treatment. Additionally, the expansion of companion diagnostics, where multiplex assays are used to match patients with specific therapies, is further driving demand. The increasing use of multiplex assays in pharmaceutical development, especially in the context of biomarker-driven drug trials, is another significant factor contributing to market growth.Report Scope

The report analyzes the Multiplex Assays market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Offering (Consumables, Instruments, Software & Services); Type (Protein Assays, Nucleic Acid Assays, Cell-Based Assays); End-Use (Pharma & Biotech Companies, Hospitals & Research Institutes, Reference Laboratories, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Multiplex Assays Consumables segment, which is expected to reach US$3.7 Billion by 2030 with a CAGR of 6.9%. The Multiplex Assays Instruments segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 9.6% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Multiplex Assays Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Multiplex Assays Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Multiplex Assays Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abcam PLC, Agilent Technologies, Inc., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Bio-Techne Coporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Multiplex Assays market report include:

- Abcam PLC

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bio-Techne Coporation

- Illumina, Inc.

- Luminex Corporation

- Merck KgaA

- Meso Scale Diagnostics, LLC.

- Olink

- Qiagen NV

- Quanterix Corporation

- Randox Laboratories Ltd.

- Seegene, Inc.

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abcam PLC

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bio-Techne Coporation

- Illumina, Inc.

- Luminex Corporation

- Merck KgaA

- Meso Scale Diagnostics, LLC.

- Olink

- Qiagen NV

- Quanterix Corporation

- Randox Laboratories Ltd.

- Seegene, Inc.

- Thermo Fisher Scientific, Inc.

Table Information

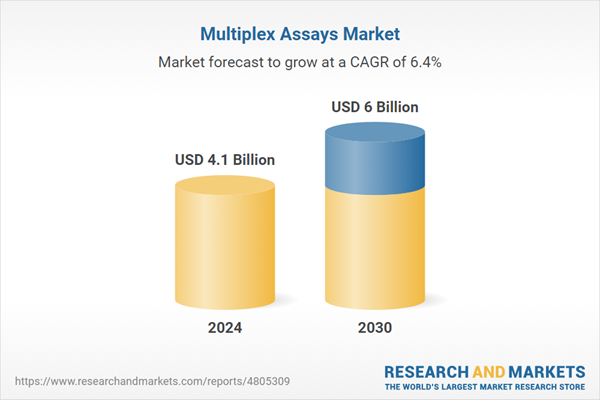

| Report Attribute | Details |

|---|---|

| No. of Pages | 158 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 6 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |