Global Vertical Farming Market - Key Trends & Drivers Summarized

Vertical farming is a revolutionary approach to agriculture that utilizes vertically stacked layers to grow crops in a controlled indoor environment. This method addresses the growing concerns of land scarcity and food security in an increasingly urbanized world. By leveraging advanced technologies such as hydroponics, aeroponics, and aquaponics, vertical farming allows for the cultivation of a wide range of crops, including leafy greens, herbs, and even some fruits, without the need for soil. These systems typically operate in specially designed facilities with precise control over light, temperature, humidity, and nutrients, resulting in higher yields and reduced water usage compared to traditional farming. The implementation of LED lighting and automation further enhances the efficiency and scalability of these farms, making it possible to produce food in urban areas, closer to consumers.The environmental benefits of vertical farming are significant, as it drastically reduces the carbon footprint associated with food transportation and minimizes the use of pesticides and herbicides. Additionally, the closed-loop systems used in vertical farming can recycle water and nutrients, making it a sustainable option in regions facing water scarcity. Urban areas benefit from the repurposing of unused buildings into productive agricultural spaces, contributing to local economies and creating jobs. Furthermore, the ability to grow food year-round, regardless of external weather conditions, provides a consistent supply of fresh produce. This consistency not only meets consumer demand for fresh, locally sourced food but also helps stabilize food prices by mitigating the impacts of climate-related disruptions on crop production.

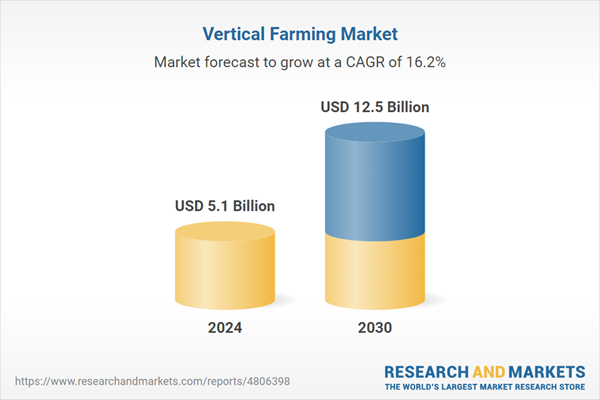

The growth in the vertical farming market is driven by several factors, including advancements in agricultural technology, increasing consumer preference for locally grown and organic produce, and the rising need for sustainable agricultural practices. Expanding global population and the rising demand for a variety of foods and crops is necessitating focus on alternative farming conditions as supplements to traditional cultivation. Declining availability of arable land worldwide and the rising need for food security are fueling growth in the vertical farming market. Innovations in sensor technology, artificial intelligence, and data analytics allow for real-time monitoring and optimization of crop growth conditions, leading to higher productivity and efficiency. The trend towards urbanization and the accompanying reduction in arable land push the demand for alternative farming methods that can thrive in limited spaces. Additionally, government initiatives and investments in sustainable farming projects, coupled with the private sector's interest in innovative agribusiness models, are fueling the market's expansion. Changing consumer behavior, with a growing awareness of health and environmental issues, also plays a crucial role, as more people seek fresh, pesticide-free produce. Overall, the vertical farming market is set to grow robustly, supported by technological advancements, market demand, and sustainability imperatives.

Report Scope

The report analyzes the Vertical Farming market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Lighting, Hydroponic Components, Climate Control, Sensors, Software & Services); Growth Mechanism (Hydroponics, Aeroponics, Aquaponics); Structure (Shipping Container, Building-based).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Lighting Component segment, which is expected to reach US$4 Billion by 2030 with a CAGR of 16%. The Hydroponic Components segment is also set to grow at 15.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 18.1% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Vertical Farming Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Vertical Farming Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Vertical Farming Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 4D Bios Inc., Aerofarms LLC, AEssense Grows, AFFINOR Growers, AgEye Technologies and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 70 companies featured in this Vertical Farming market report include:

- 4D Bios Inc.

- Aerofarms LLC

- AEssense Grows

- AFFINOR Growers

- AgEye Technologies

- Agrilution GmbH

- Agrinamics Corporation

- Agritecture

- Alesca Life Technologies Limited

- Algae International Berhad (AIB)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 4D Bios Inc.

- Aerofarms LLC

- AEssense Grows

- AFFINOR Growers

- AgEye Technologies

- Agrilution GmbH

- Agrinamics Corporation

- Agritecture

- Alesca Life Technologies Limited

- Algae International Berhad (AIB)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 311 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 12.5 Billion |

| Compound Annual Growth Rate | 16.2% |

| Regions Covered | Global |