Global Corporate Wellness Market - Key Trends & Drivers Summarized

Corporate wellness programs are comprehensive initiatives designed to promote the overall health and well-being of employees within an organization. These programs typically encompass a wide range of activities and services, including physical fitness classes, mental health support, nutrition counseling, smoking cessation programs, and stress management workshops. The primary goal of corporate wellness programs is to create a healthier, more productive workforce by addressing both physical and mental health issues. By fostering a supportive environment, companies aim to reduce healthcare costs, decrease absenteeism, and improve employee morale and engagement. In recent years, there has been a significant shift towards holistic wellness, recognizing the importance of balancing work and personal life to achieve long-term health benefits.The implementation of corporate wellness programs has evolved with advancements in technology and a growing understanding of employee needs. Modern programs often leverage digital tools and platforms to provide personalized wellness plans, track progress, and offer virtual consultations with health professionals. Wearable devices and mobile apps have become integral components, enabling employees to monitor their physical activity, sleep patterns, and dietary habits. Additionally, companies are increasingly incorporating mental health resources, such as access to counseling services and mindfulness training, to address the rising concern of workplace stress and burnout. These programs are designed to be inclusive, catering to diverse workforces by offering flexible options that can be tailored to individual preferences and schedules. Employers are also recognizing the importance of creating a culture of wellness, where health initiatives are supported and encouraged at all levels of the organization.

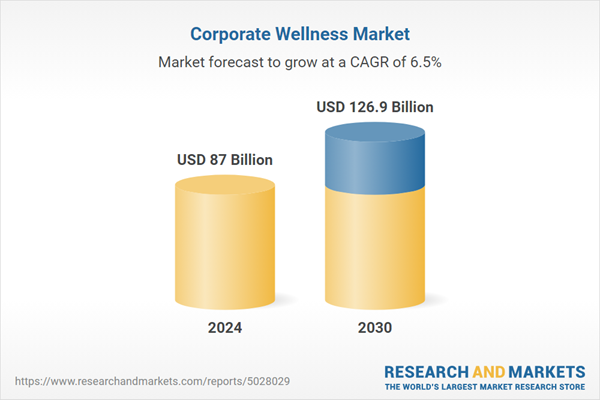

The growth in the corporate wellness market is driven by several factors, including the increasing awareness of the benefits of employee health and well-being, the rising prevalence of chronic diseases, and the growing demand for work-life balance. As organizations recognize the direct correlation between employee health and productivity, they are investing more in comprehensive wellness programs to attract and retain talent. Technological advancements have also played a crucial role, making it easier for companies to implement and manage wellness initiatives effectively. The COVID-19 pandemic has further accelerated the adoption of corporate wellness programs, as remote work has highlighted the need for mental health support and flexible health resources. Additionally, government regulations and incentives promoting workplace health initiatives are encouraging more companies to adopt wellness programs. As a result, the corporate wellness market is expected to continue expanding, driven by the ongoing emphasis on creating healthier, more engaged, and resilient workforces.

Report Scope

The report analyzes the Corporate Wellness market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Service (Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition & Weight Management, Stress Management, Other Services); Organization Size (Small, Medium, Large).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Health Risk Assessment Service segment, which is expected to reach US$27.9 Billion by 2030 with a CAGR of 6.4%. The Fitness Service segment is also set to grow at 5.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $31.5 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $8.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Corporate Wellness Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Corporate Wellness Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Corporate Wellness Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cerner Corporation, Ceridian HCM, Inc., Castlight Health, Inc., ComPsych Corporation, Ebix, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 164 companies featured in this Corporate Wellness market report include:

- Cerner Corporation

- Ceridian HCM, Inc.

- Castlight Health, Inc.

- ComPsych Corporation

- Ebix, Inc.

- CXA Group Pte. Ltd.

- Aanya Wellness

- Applied Health Analytics, LLC

- CoreHealth Technologies, Inc.

- Aduro, Inc.

- Beacon Health Options

- Cigna Corporation

- Catalyst Sante Inc.

- Bristlecone Health, Inc.

- Fitbit Health Solutions

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cerner Corporation

- Ceridian HCM, Inc.

- Castlight Health, Inc.

- ComPsych Corporation

- Ebix, Inc.

- CXA Group Pte. Ltd.

- Aanya Wellness

- Applied Health Analytics, LLC

- CoreHealth Technologies, Inc.

- Aduro, Inc.

- Beacon Health Options

- Cigna Corporation

- Catalyst Sante Inc.

- Bristlecone Health, Inc.

- Fitbit Health Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 461 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 87 Billion |

| Forecasted Market Value ( USD | $ 126.9 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |