Several factors are propelling the market for South Korean animal feed such as increased production and demand for animal-related meat products. For example, the demand for pork meat has increased from 28.8 kg/capita in 2022 to 29.9 kg/capita in 2024.

Further, key developments within the country propitiate the market growth. For instance, in March 2023, BASF and Cargill expanded their partnership, adding South Korea, the first Asian nation, to their existing feed enzymes development and distribution agreement. The companies are committed to bringing enzyme-based solutions to the market.

Moreover, in 2025, Korea's chicken production is projected to be around 945,000 MT. This is an increase of 1% from the previous year's 935,000 MT, driven by an increase in broiler inventory throughout 2024 and steady growth in chicken demand. Chicken consumption will also rise by 0.9 per cent (10,000 MT) in 2025. These factors will propel the demand for the poultry in the country.

South Korea Animal Feed Market Drivers

Increasing demand for meat is contributing to the South Korean animal Feed market expansion.One of the key factors pushing the market for animal feed in South Korea is the increased demand for meat. This is possibly due to demographic factors and shifting consumption patterns in the country.

According to the data provided by OECD countries, meat consumption in the country has increased subsequently in a few years. The per capita consumption of beef and veal in kilograms was 11.4 in 2021, increased to 12 in 2022, and reached 12.1 in 2023. This increased demand for meat propels the need for animal feed to ensure proper growth and nutrition.

An increase in research and development activities, followed by a rise in government initiatives, is also expected to drive South Korea Animal Feed market growth.

Governments may invest in research for alternative feed sources and their alternatives, reducing environmental impact while promoting animal welfare through improved living conditions. This could increase demand for high-quality, nutritious feed. Additionally, subsidies could be offered to support domestic South Korean animal Feed production, reducing import reliance and potentially lowering farmers' costs. Further, the growth of livestock production has subsequently assisted the rise in the demand for highly nutritious South Korean animal Feed items, which is anticipated to upgrade the South Korean animal Feed demand.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The South Korea Animal Feed market is segmented and analyzed as follows:

By Type

- Fodder & Forage

- Compound Feed

By Livestock

- Pork

- Aquatic animal

- Cattle

- Poultry

- Others

By Raw Materials

- Soy

- Corn

- Rendered Meal

- Others

Table of Contents

Companies Mentioned

- Cargill

- Kemin Industries, Inc.

- BASF SE

- Archer Daniels Midland Company

- Royal DSM N.V.

- Alltech

- SUNJIN Co., Ltd.

- CJ Feed&Care Corporation

- Hanil Feed Co., Ltd

- NongHyup Feed Inc.

- Jeil Feed

- Daesang Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | December 2024 |

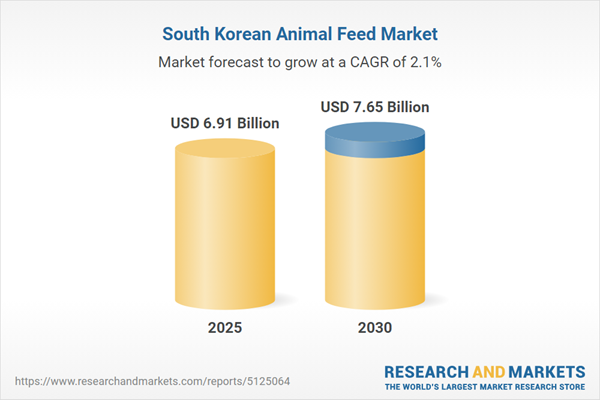

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 6.91 Billion |

| Forecasted Market Value ( USD | $ 7.65 Billion |

| Compound Annual Growth Rate | 2.0% |

| Regions Covered | South Korea |

| No. of Companies Mentioned | 12 |