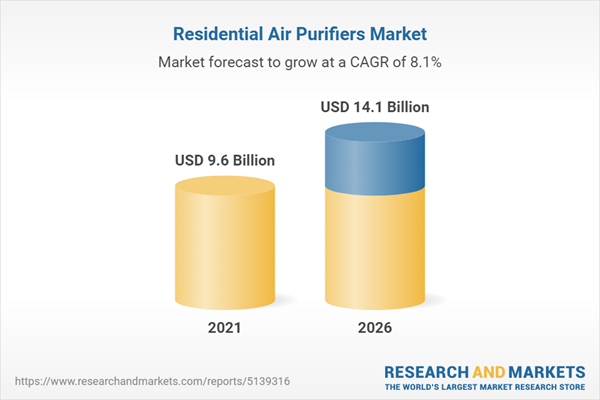

The global residential air purifiers market is expected to reach USD 14.1 billion in 2026 from USD 9.6 billion in 2021, at a CAGR of 8.1% during the forecast period. The residential air purifiers are the most effective devices to improve indoor air quality and to reduce or remove the sources of pollutants and to ventilate with clean air. They offer the advantages of higher efficacy, usability, and improved air quality for healthy breathing. Currently, with the surge in COVID-19 cases, there is an increased focus on personal health, coupled with the need to reduce the spread of infection. This is further expected to drive the market growth during the forecast period. However, the technical limitations pertaining to air quality monitoring products, along with their initial installation cost, are hindering the growth of this market to a certain extent.

Based on technology, the HEPA segment accounted for the largest share during the forecast period

Based on technology, the residential air purifiers market is segmented into HEPA filters (high-efficiency particulate arresting or high-efficiency particulate air) and other technologies. The HEPA segment accounted for the larger market share. The growing concern for environmental sustainability, increasing public awareness pertaining to the healthcare implications of air pollution, and the growing popularity of smart homes/ambient-assisted living has resulted in the increased adoption of the HEPA technology in the residential air purifiers market.

Based on type, the portable/stand-alone purifiers segment accounted for the largest share during the forecast period

Based on type, the residential air purifiers market is segmented into portable/stand-alone purifiers and in-duct purifiers. The portable/stand-alone purifiers accounted for the largest share of the residential air purifiers market in 2020. The large share of the portable/stand-alone purifiers segment can be attributed to the increasing public awareness pertaining to the healthcare implications of air pollution and the growing popularity of smart homes/ambient-assisted living.

Asia Pacific is expected to have the fastest growth in the residential air purifiers market during the forecast period

The Asia Pacific region is also expected to be the fastest-growing regional market at a CAGR during the forecast period. Factors such as the increasing investments by major players in the region, the presence of less stringent regulations for product approval, and growing demand for quality lifestyles are expected to drive the growth of this market during the forecast period.

Break of primary participants was as mentioned below:

- By Company Type - Tier 1-35%, Tier 2-45%, and Tier 3-20%

- By Designation - C-level-35%, Director-level-25%, Others-40%

- By Region - North America-45%, Europe-30%, Asia Pacific-20%, Latin America- 3%, Middle East and Africa-2%

Key players in the Residential Air Purifiers Market

The key players operating in the residential air purifiers market include Daikin Industries, Ltd. (Japan), Sharp Corporation (Japan), Honeywell International Inc. (US), Samsung Electronics Co., Ltd. (South Korea), LG Electronics Inc. (South Korea), Koninklijke Philips N.V. (Netherlands), Dyson (UK), Unilever Group (UK), Panasonic Corporation (Japan), Whirlpool Corporation (US), AllerAir Industries Inc. (US), IQAir (Switzerland), Winix Co., Ltd. (South Korea), Xiaomi Corporation (China), Camfil AB (Sweden), Airpura Industries Inc. (Canada), Airgle Corporation (US), Hunter Pure Air (US), Kent RO Systems Ltd. (India) and SHIL Limited (India).

Research Coverage:

The report analyzes the residential air purifiers market and aims at estimating the market size and future growth potential of this market based on various segments such as technology, type, and region. The report also includes a product portfolio matrix of various residential air purifier products available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn would help them, garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global residential air purifiers market. The report analyzes this market by technology and type.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the global residential air purifiers market

- Market Development: Comprehensive information on the lucrative emerging markets by technology and type.

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global residential air purifiers market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players in the global residential air purifiers market.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition & Scope

1.2.1 Inclusions & Exclusions of the Study

1.2.2 Market Segmentation

Figure 1 Residential Air Purifiers Market Segmentation

1.2.3 Years Considered for the Study

1.3 Currency

Table 1 Exchange Rates Utilized for Conversion to Usd

1.4 Stakeholders

1.5 Summary of Changes

2 Research Methodology

2.1 Research Approach

2.2 Research Methodology Design

Figure 2 Residential Air Purifiers Market: Research Design

2.2.1 Secondary Research

2.2.1.1 Key Data from Secondary Sources

2.2.2 Primary Data

Figure 3 Primary Sources

2.2.2.1 Key Data from Primary Sources

2.2.2.2 Insights from Primary Experts

Figure 4 Breakdown of Primary Interviews: Supply-Side and Other Participants

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, and Region

2.3 Market Size Estimation

Figure 6 Market Size Estimation: Revenue Share Analysis

Figure 7 Revenue Share Analysis Illustration

Figure 8 China Market Analysis Approach

Figure 9 CAGR Projections from the Analysis of Drivers, Restraints, Opportunities, and Challenges

Figure 10 CAGR Projections

Figure 11 Top-Down Approach

2.4 Data Triangulation Approach

Figure 12 Data Triangulation Methodology

2.5 Market Share Estimation

2.6 Assumptions for the Study

2.7 Limitations

2.7.1 Methodology-Related Limitations

2.7.2 Scope-Related Limitations

2.8 Risk Assessment

Table 2 Risk Assessment: Residential Air Purifiers Market

3 Executive Summary

Figure 13 Residential Air Purifiers Market, by Technology, 2021 Vs. 2026 (USD Million)

Figure 14 Residential Air Purifiers Market, by Type, 2021 Vs. 2026 (USD Million)

Figure 15 Geographic Analysis: Residential Air Purifiers Market

4 Premium Insights

4.1 Residential Air Purifiers: Market Overview

Figure 16 Rising Levels of Air Pollution and the Growing Trend for Smart Homes Are Expected to Drive the Growth of the Global Market

4.2 North America: Residential Air Purifiers Market, by Technology

Figure 17 Hepa Segment Accounted for the Largest Share of the North America Residential Air Purifiers Market in 2020

4.3 Residential Air Purifiers Market: Geographic Growth Opportunities

Figure 18 India is Expected to Project the Highest Growth Rate During the Forecast Period

4.4 Residential Air Purifiers Market, by Region (2019-2026)

Figure 19 Asia-Pacific to Dominate the Residential Air Purifiers Market Until 2026

4.5 Residential Air Purifiers Market: Developed Vs. Developing Markets

Figure 20 Developing Markets to Register a Higher Growth Rate During the Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Table 3 Market Dynamics: Residential Air Purifiers Market

5.2.1 Market Drivers

5.2.1.1 The Rising Prevalence of COVID-19

Table 4 Total Number of Confirmed COVID-19 Cases, by Region, (As of September 13, 2021)

5.2.1.2 Increasing Urbanization and Indoor Air Pollution Levels

5.2.1.3 Supportive Government Regulations for Effective Air Pollution Monitoring & Control

Table 5 Government Initiatives to Combat Air Pollution Across Regions

5.2.1.4 Increasing Public Awareness Pertaining to the Healthcare Implications of Air Pollution

Table 6 Awareness Program Initiatives

5.2.2 Market Restraints

5.2.2.1 High Product Costs

Table 7 Price Range of Air Purifiers with Advanced Technologies

5.2.2.2 Technical Limitations Associated with Air Quality Monitoring Products

5.2.3 Market Opportunities

5.2.3.1 Emerging Markets to Offer High Growth Opportunities

Table 8 Company Expansions in Emerging Markets

5.2.3.2 Rising Technological Advancements

5.2.4 Market Challenges

5.2.4.1 Complex Nature of Indoor Pollutants

5.2.4.2 High R&D Expenses for New Product Launches

5.3 Industry Trends

5.3.1 Multi-Functional/Smart Air Purifiers

Figure 21 Smart Air Purifier Market Insights

5.3.2 Growing Trend for Smart Homes

5.4 Regulatory Analysis

5.4.1 North America

5.4.2 Europe

5.4.3 Asia-Pacific

Table 9 Test Standards (And Rating Matrics) for Air Purification Technologies

Table 10 Key Regulations & Standards Governing Residential Air Purifiers Market

5.5 Porter's Five Forces Analysis

Table 11 Porters' Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

5.6 Technology Analysis

Table 12 Technology Innovation in Residential Air Purifiers

5.7 Pricing Analysis

Table 13 Average Price of Residential Air Purifiers, by Region (USD)

5.8 Ecosystem Analysis

5.8.1 Residential Air Purifiers Market: Ecosystem Analysis

5.9 Patent Analysis

5.9.1 Patent Publication Trends for Residential Air Purifiers

Figure 22 Patent Publication Trends (January 2011-September 2021)

5.9.2 Jurisdiction and Top Applicant Analysis

Figure 23 Top Applicants & Owners (Companies/Institutions) for Residential Air Purifiers Patents (January 2011-September 2021)

Figure 24 Top Applicant Countries/Regions for Residential Air Purifiers Patents (January 2011-September 2021)

Table 14 List of Patents/Patent Applications in the Residential Air Purifiers Market, 2020-2021

5.10 Impact of COVID-19 on the Residential Air Purifiers Market

6 Residential Air Purifiers Market, by Technology

6.1 Introduction

Table 15 Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

6.2 High-Efficiency Particulate Air (Hepa)

6.2.1 Hepa Technology is the Most Efficient Method for Air Purification, Thus Leading to Its Increased Adoption

Table 16 Residential Air Purifiers Market for Hepa, by Country, 2019-2026 (USD Million)

6.3 Other Technologies

Table 17 Residential Air Purifiers Market for Other Technologies, by Country, 2019-2026 (USD Million)

7 Residential Air Purifiers Market, by Type

7.1 Introduction

Table 18 Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

7.2 Portable/Stand-Alone Air Purifiers

7.2.1 Hepa Filters Are Most Commonly Used in Portable Air Purifier Systems

Table 19 Portable Air Cleaner Sizing for 80% Steady-State Particle Removal

Table 20 Portable/Stand-Alone Residential Air Purifiers Market, by Country, 2019-2026 (USD Million)

7.3 In-Duct Air Purifiers

7.3.1 Duct-Based Systems Require Forced-Air HVAC Systems for Efficient Air Purification

Table 21 In-Duct Residential Air Purifiers Market, by Country, 2019-2026 (USD Million)

8 Residential Air Purifiers Market, by Region

8.1 Introduction

Figure 25 Residential Air Purifiers Market: Geographic Snapshot (2020)

Table 22 Residential Air Purifiers Market, by Region, 2019-2026 (USD Million)

8.2 Impact of COVID-19 on the Residential Air Purifiers Market, by Country/Region

8.3 Asia-Pacific

Figure 26 Asia-Pacific: Residential Air Purifiers Market Snapshot

Table 23 Asia-Pacific: Residential Air Purifiers Market, by Country, 2019-2026 (USD Million)

Table 24 Asia-Pacific: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 25 Asia-Pacific: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.3.1 China

8.3.1.1 Increasing Efforts and Focus Towards Preventing and Minimizing Air Pollution to Drive the Market Growth in China

Table 26 China: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 27 China: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.3.2 Japan

8.3.2.1 Presence of Prominent Residential Air Purifier Market Players in the Region to Drive the Market Growth in Japan

Table 28 Japan: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 29 Japan: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.3.3 India

8.3.3.1 Increasing Awareness Programs by the Government to Curb Air Pollution to Drive the Adoption of Residential Air Purifiers in India

Table 30 India: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 31 India: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.3.4 South Korea

8.3.4.1 Growing Air Pollution Due to Fine Dust to Drive Market Growth

Table 32 South Korea: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 33 South Korea: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.3.5 Rest of Asia-Pacific (Roapac)

Table 34 Roapac: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 35 Roapac: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.4 North America

Figure 27 North America: Residential Air Purifiers Market Snapshot

Table 36 North America: Residential Air Purifiers Market, by Country, 2019-2026 (USD Million)

Table 37 North America: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 38 North America: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.4.1 US

8.4.1.1 Presence of Major Market Players and the Growing Demand for Smart Technologies in the US to Drive the Market Growth

Table 39 US: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 40 US: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.4.2 Canada

8.4.2.1 Increasing Government Investments in Technology and Infrastructure to Drive the Growth of the Market

Table 41 Canada Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 42 Canada: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.5 Europe

Table 43 Europe: Residential Air Purifiers Market, by Country, 2019-2026 (USD Million)

Table 44 Europe: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 45 Europe: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.5.1 Germany

8.5.1.1 Excessive Level of Air Pollution in Germany to Drive the Growth of the Market

Table 46 Germany: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 47 Germany: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.5.2 France

8.5.2.1 Focused Government Initiatives Towards Curbing Energy & Greenhouse Emissions to Drive the Market Growth in France

Table 48 France: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 49 France: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.5.3 UK

8.5.3.1 Government Initiatives Towards the Support of Energy-Efficient Products and Green Infrastructure to Drive the Market Growth

Table 50 UK: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 51 UK: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.5.4 Italy

8.5.4.1 Growing Focus on Curbing Air Pollution and Fine Dust Particle Levels to Drive the Growth of the Market

Table 52 Italy: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 53 Italy: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.5.5 Spain

8.5.5.1 Increasing Focus on Personal Health and the Growing Number of COVID-19 Cases to Support the Market Growth in Spain

Table 54 Spain: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 55 Spain: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.5.6 Rest of Europe

Table 56 RoE: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 57 RoE: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.6 Latin America

Table 58 Latin America: Residential Air Purifiers Market, by Country/Region, 2019-2026 (USD Million)

Table 59 Latin America: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 60 Latin America: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.6.1 Brazil

8.6.1.1 The Rising Concern Regarding Air Pollution in the Major Cities of Brazil to Support the Market Growth for Residential Air Purifiers

Table 61 Brazil: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 62 Brazil: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.6.2 Mexico

8.6.2.1 Green Building Initiatives and Rising Carbon Emissions to Drive the Market Growth for Air Purifiers in Mexico

Table 63 Mexico: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 64 Mexico: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.6.3 Rest of Latin America

Table 65 Rolatam: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 66 Rolatam: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

8.7 Middle East & Africa

8.7.1 Rising Concerns of Environmental Degradation Will Drive the Market Growth in the Coming Years

Table 67 Middle East & Africa: Residential Air Purifiers Market, by Technology, 2019-2026 (USD Million)

Table 68 Middle East & Africa: Residential Air Purifiers Market, by Type, 2019-2026 (USD Million)

9 Competitive Landscape

9.1 Overview

9.2 Key Player Strategies/Right to Win

9.2.1 Overview of Strategies Adopted by Players in the Residential Air Purifiers Market

9.3 Revenue Share Analysis of the Top Market Players

Figure 28 Revenue Analysis of Key Players in the Residential Air Purifiers Market

9.4 Market Share Analysis

Figure 29 Residential Air Purifiers Market Share, By Key Player, 2020

Table 69 Residential Air Purifiers Market: Degree of Competition

9.5 Competitive Benchmarking

Table 70 Footprint of Companies in the Residential Air Purifiers Market

Table 71 Product Footprint of Companies (20 Companies)

Table 72 Regional Footprint of Companies (20 Companies)

9.6 Competitive Leadership Mapping

9.6.1 Stars

9.6.2 Emerging Leaders

9.6.3 Pervasive Players

9.6.4 Participants

Figure 30 Residential Air Purifiers Market: Competitive Leadership Mapping (2020)

9.7 Competitive Leadership Mapping for Other Companies

9.7.1 Progressive Companies

9.7.2 Dynamic Companies

9.7.3 Starting Blocks

9.7.4 Responsive Companies

Figure 31 Residential Air Purifiers Market: Competitive Leadership Mapping for Other Companies (2020)

9.8 Competitive Scenario

9.8.1 Product/Approvals/Enhancements

Table 73 Product Approvals/Enhancements, 2018-2021

9.8.2 Deals

Table 74 Deals, 2018-2021

9.8.3 Other Developments

Table 75 Other Developments, 2018-2021

10 Company Profiles

10.1 Key Players

Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats)

10.1.1 Daikin Industries, Ltd.

Table 76 Daikin Industries, Ltd.: Business Overview

Figure 32 Daikin Industries, Ltd.: Company Snapshot (2020)

10.1.2 Sharp Corporation

Table 77 Sharp Corporation: Business Overview

Figure 33 Sharp Corporation: Company Snapshot (2020)

10.1.3 Honeywell International Inc.

Table 78 Honeywell International Inc.: Business Overview

Figure 34 Honeywell International Inc.: Company Snapshot (2020)

10.1.4 Panasonic Corporation

Table 79 Panasonic Corporation: Business Overview

Figure 35 Panasonic Corporation: Company Snapshot (2020)

10.1.5 Lg Electronics, Inc.

Table 80 Lg Electronics, Inc.: Business Overview

Figure 36 Lg Electronics, Inc.: Company Snapshot (2020)

10.1.6 Koninklijke Philips N.V

Table 81 Koninklijke Philips N.V.: Business Overview

Figure 37 Koninklijke Philips N.V: Company Snapshot (2020)

10.1.7 Dyson Ltd.

Table 82 Dyson Ltd.: Business Overview

10.1.8 Samsung Electronics Ltd.

Table 83 Samsung Electronics Ltd.: Business Overview

Figure 38 Samsung Electronics Ltd.: Company Snapshot (2020)

Table 84 Unilever Group: Business Overview

Figure 39 Unilever Group: Company Snapshot (2020)

10.1.10 Whirlpool Corporation

Table 85 Whirlpool Corporation: Business Overview

Figure 40 Whirlpool Corporation: Company Snapshot (2020)

10.1.11 Allerair Industries, Inc.

Table 86 Allerair Industries, Inc.: Business Overview

10.1.12 IQAir

Table 87 IQAir: Business Overview

10.1.13 Winix Co. Ltd.

Table 88 Winix Co. Ltd.: Business Overview

10.1.14 Xiaomi Corporation

Table 89 Xiaomi Corporation: Business Overview

Figure 41 Xiaomi Corporation: Company Snapshot (2020)

10.1.15 Camfil Ab

Table 90 Camfil Ab: Business Overview

10.1.16 Airpura Industries Inc.

Table 91 Airpura Industries Inc.: Business Overview

10.1.17 Airgle Corporation

Table 92 Airgle Corporation: Business Overview

10.1.18 Hunter Pure Air

Table 93 Hunter Pure Air: Business Overview

10.1.19 Kent Ro Systems Ltd.

Table 94 Kent Ro Systems Ltd.: Business Overview

10.1.20 Somany Home Innovation Limited (Wholly Owned Subsidiary of Hsil)

Table 95 Somany Home Innovation Limited: Business Overview

Figure 42 Somany Homeinnovation Limited: Company Snapshot (2020)

10.2 Other Players

10.2.1 Ideal Krug & Priester GmbH & Co. Kg: Company Overview

10.2.2 Havells India Ltd.: Company Overview

10.2.3 Molekule: Company Overview

10.2.4 Carrier Global: Company Overview

10.2.5 Coway Co. Ltd.: Company Overview

Details on Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies.

11 Appendix

11.1 Insights from Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

Companies Mentioned

- Airgle Corporation

- Airpura Industries Inc.

- Allerair Industries, Inc.

- Camfil Ab

- Carrier Global

- Coway Co. Ltd.: Company Overview

- Daikin Industries, Ltd.

- Dyson Ltd.

- Havells India Ltd.

- Honeywell International Inc.

- Hunter Pure Air

- Ideal Krug & Priester GmbH & Co. Kg

- IQAir

- Kent Ro Systems Ltd.

- Koninklijke Philips N.V

- LG Electronics, Inc.

- Molekule

- Panasonic Corporation

- Samsung Electronics Ltd.

- Sharp Corporation

- Somany Home Innovation Limited (Wholly Owned Subsidiary of Hsil)

- Whirlpool Corporation

- Winix Co. Ltd.

- Xiaomi Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | October 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 9.6 Billion |

| Forecasted Market Value ( USD | $ 14.1 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |